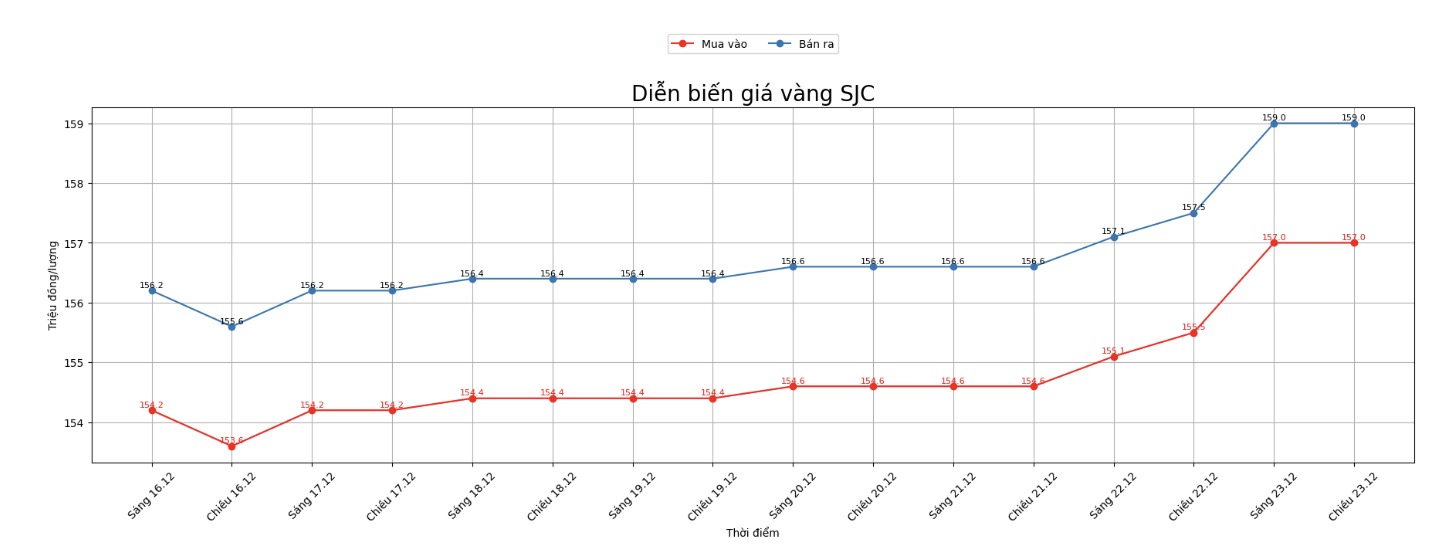

SJC gold bar price

As of 6:00 a.m. on December 24, the price of SJC gold bars was listed by DOJI Group at 157-159 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 157-159 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156-159 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

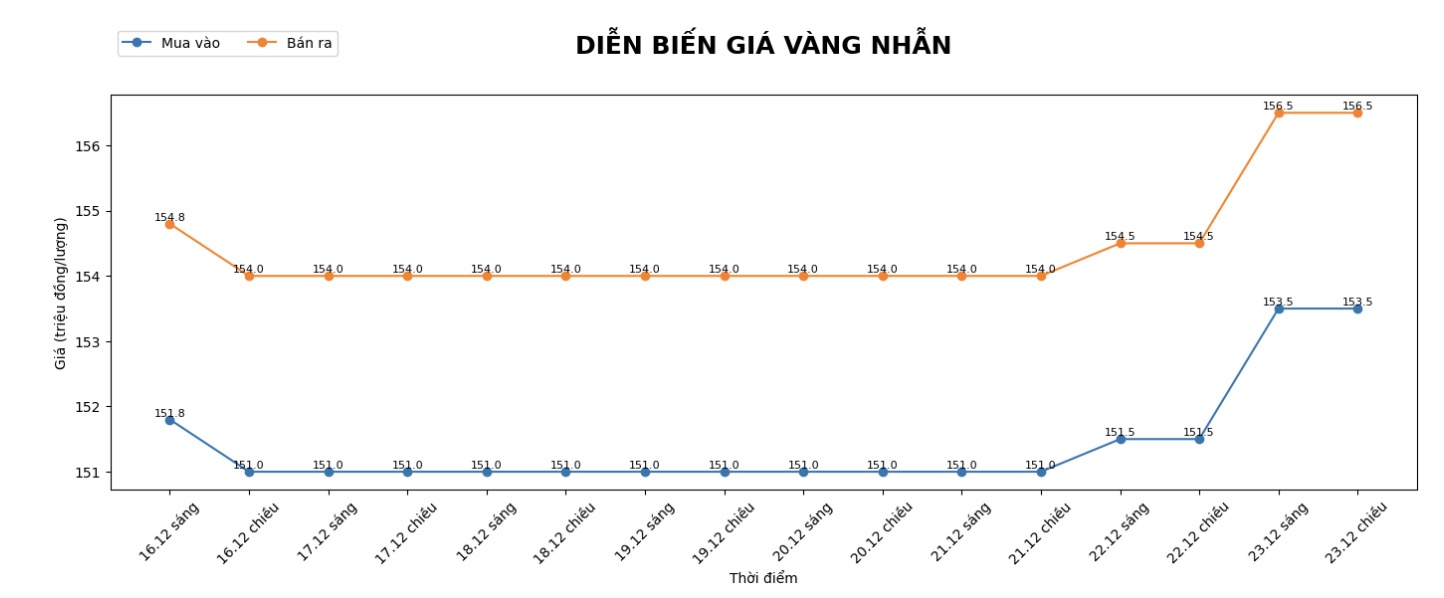

9999 gold ring price

As of 6:00 a.m. on December 24, DOJI Group listed the price of gold rings at 153.5-156.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.5-157.5 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 153.8-156.8 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

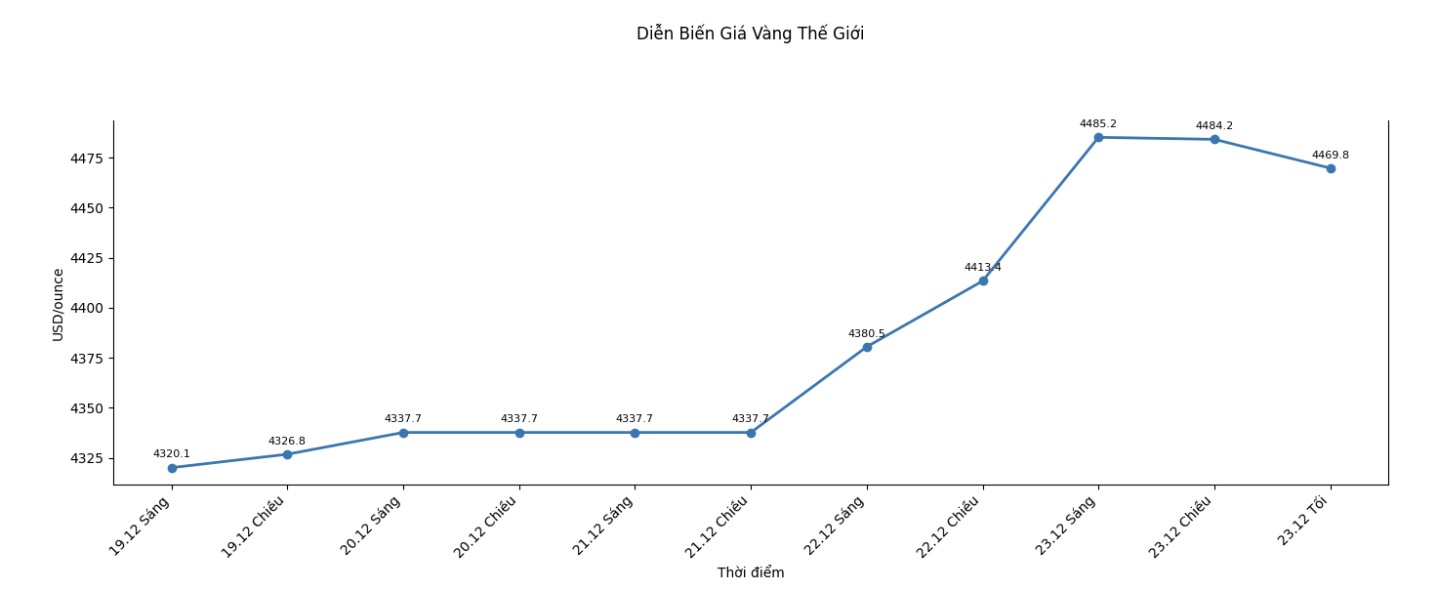

World gold price

The world gold price listed at 9:12 p.m. on December 23 was at 4,469.8 USD/ounce, up 27.2 USD/ounce compared to a day ago.

Gold price forecast

Gold and silver prices continued to record a solid increase and simultaneously set a new record in the early trading session in the US on Tuesday. Safety shelter demand increased during the shortened trading week due to the holiday, in the context of the international market still facing many potential uncertainties.

February gold contract increased by 48.5 USD, to 4,518.1 USD/ounce. March delivery silver price increased by 1.12 USD, reaching 69.685 USD/ounce.

In the overnight trading session, gold prices continued to climb to a new record high of 4,530.8 USD/ounce, calculated according to the Comex gold contract issued in February. Comex silver price for delivery in March also set a historical peak at 70.155 USD/ounce.

Since the beginning of the year, gold has had 50 record sessions, up about 70%, towards the strongest increase of the year since 1979. Silver prices have risen even more strongly, with an increase of over 130% compared to the beginning of the year.

In the international market, prolonged tensions in some regions continue to cause investors to seek safe-haven assets such as gold and silver. This contributes to maintaining the price increase of the precious metal in recent times.

Technically, with the February gold contract, the next upside target for buyers is to close above the strong resistance level of 4,600.00 USD/ounce. On the other hand, the short-term target for the bears is to push prices below the support zone of 4,300 USD/ounce.

The most recent resistance level was at a record peak of 4,530.8 USD/ounce, followed by 4,550 USD/ounce. The near support zones were identified at $4,479.80/ounce and $4,450/ounce.

In outside markets, the USD index decreased slightly. Crude oil prices are almost flat, trading around 58.00 USD/barrel. The yield on the 10-year US government bond is currently around 4.15%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...