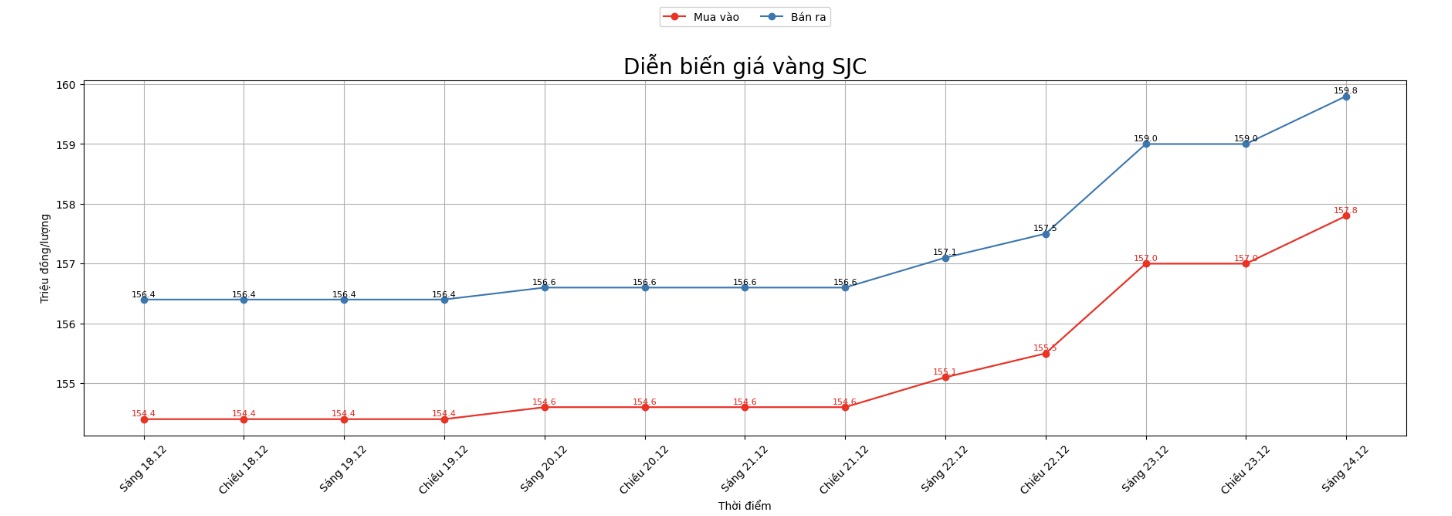

Updated SJC gold price

As of 9:05, the price of SJC gold bars was listed by DOJI Group at 157.8-159.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156.8-159.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 157.8-159.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

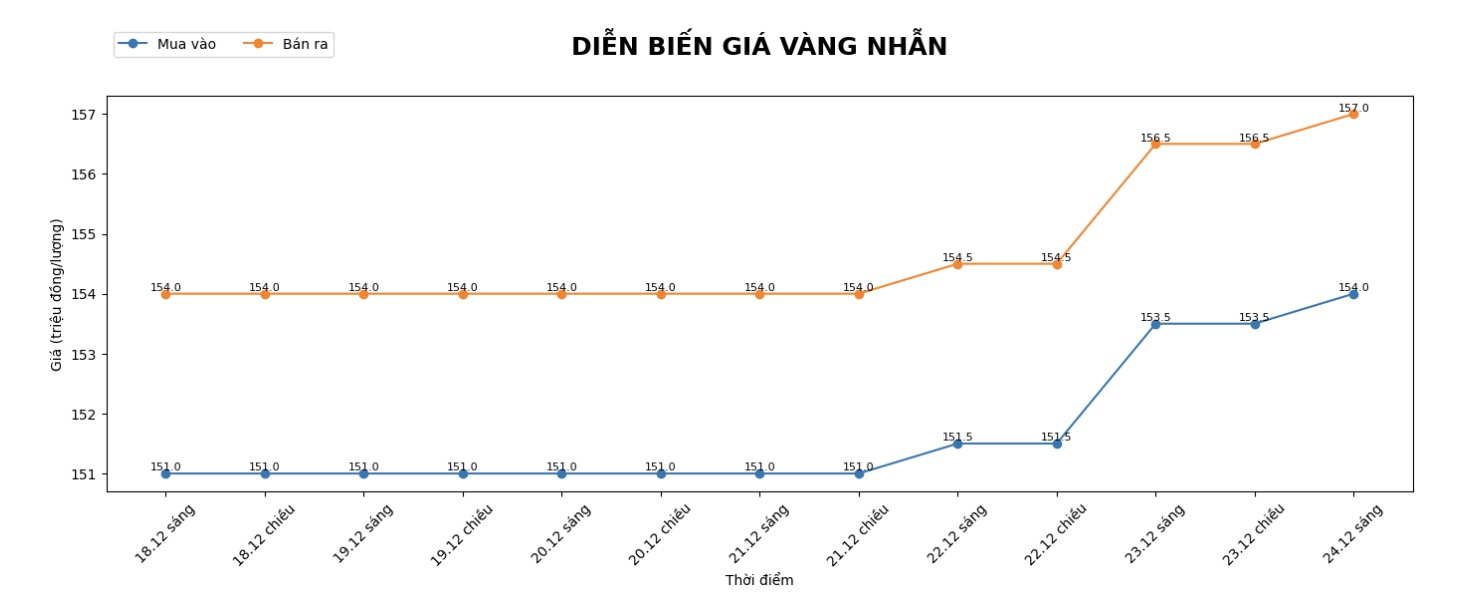

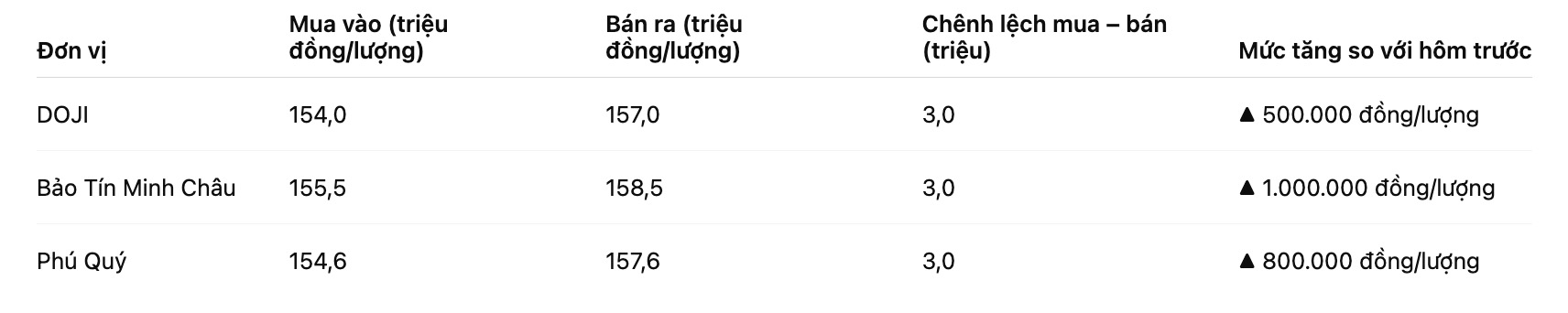

9999 round gold ring price

As of 9:05, DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 154.6-157.6 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

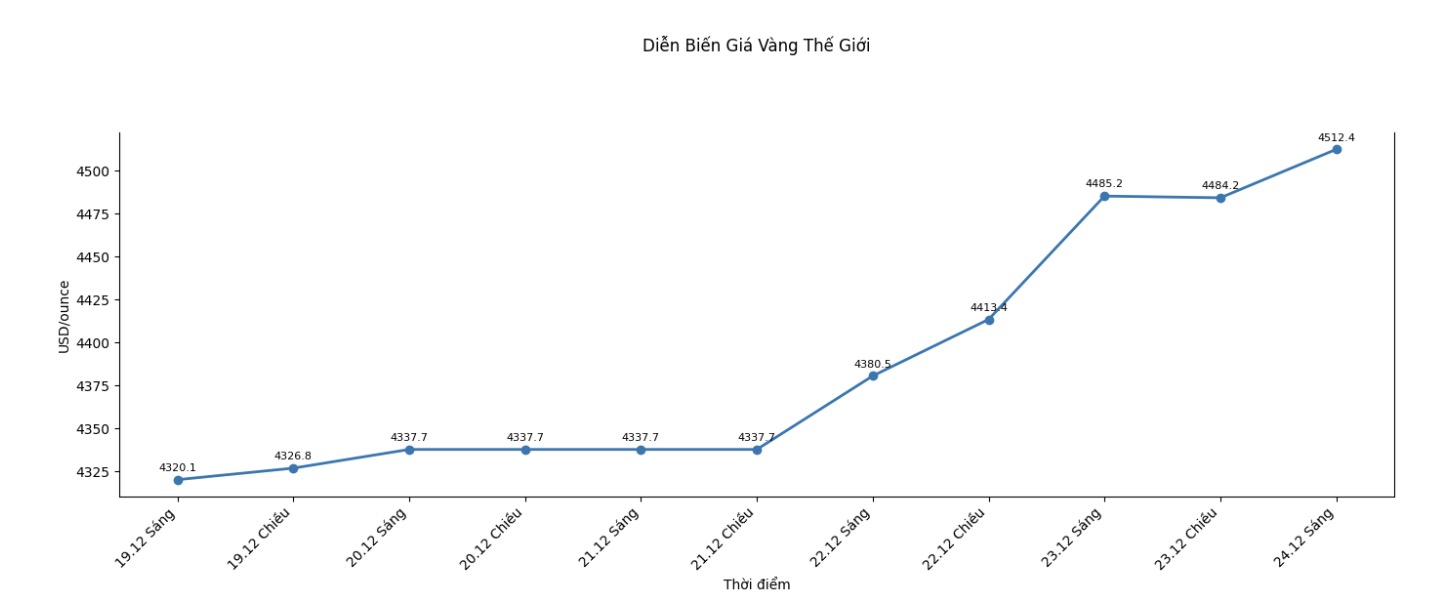

World gold price

At 9:08, the world gold price was listed around 4,512.4 USD/ounce, up 27.2 USD compared to a day ago.

Gold price forecast

World gold prices skyrocketed, surpassing the threshold of 4,500 USD/ounce in the context of the US economy showing surprising strength.

The BEA released initial estimates of Gross Domestic Product (GDP) in the third quarter on Tuesday, saying the economy grew 4.3% compared to the previous quarter, higher than the 3.8% in the second quarter. This figure far exceeded economists' expectations, with the consensus forecast at only 3.3%.

The increase in real GDP in the third quarter reflects the increase in consumer, export and government spending, partly offset by a decline in investment. Imports a deducted factor in GDP calculation have decreased.

Compared to the second quarter, the acceleration of real GDP in the third quarter reflects a smaller investment decrease, faster consumer spending growth, along with a recovery in exports and government spending. Imports decreased less in the third quarter, the report said.

Gold prices have risen about 70% this year, driven by geopolitical tensions, US interest rate cuts, strong central bank buying and abundant investment demand.

"We continue to see the long-term trend of central bank foreign exchange reserves diversification as the main driver for gold prices through the end of the decade," analysts at SP Angel said in a report. "We expect gold prices to rise to around $5,000/ounce next year," the report added.

The US dollar continues to slide for the second consecutive session and is heading for its biggest decline of the year since 2017 an even more attractive factor for gold as a defensive channel.

According to Swissquote's Carlo Alberto De Casa, expectations of a dovish US Federal Reserve (Fed) are moderate, declining confidence in the greenback, geopolitical tensions and central bank buying power have created great attraction for gold.

Technically, with the February gold contract, the next upside target for buyers is to close above the strong resistance level of $4,600/ounce. On the other hand, the short-term target for the bears is to push prices below the support zone of 4,300 USD/ounce.

The most recent resistance level was at a record peak of 4,530.8 USD/ounce, followed by 4,550 USD/ounce. The near-support zones were identified at $4,479.8/ounce and $4,450/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...