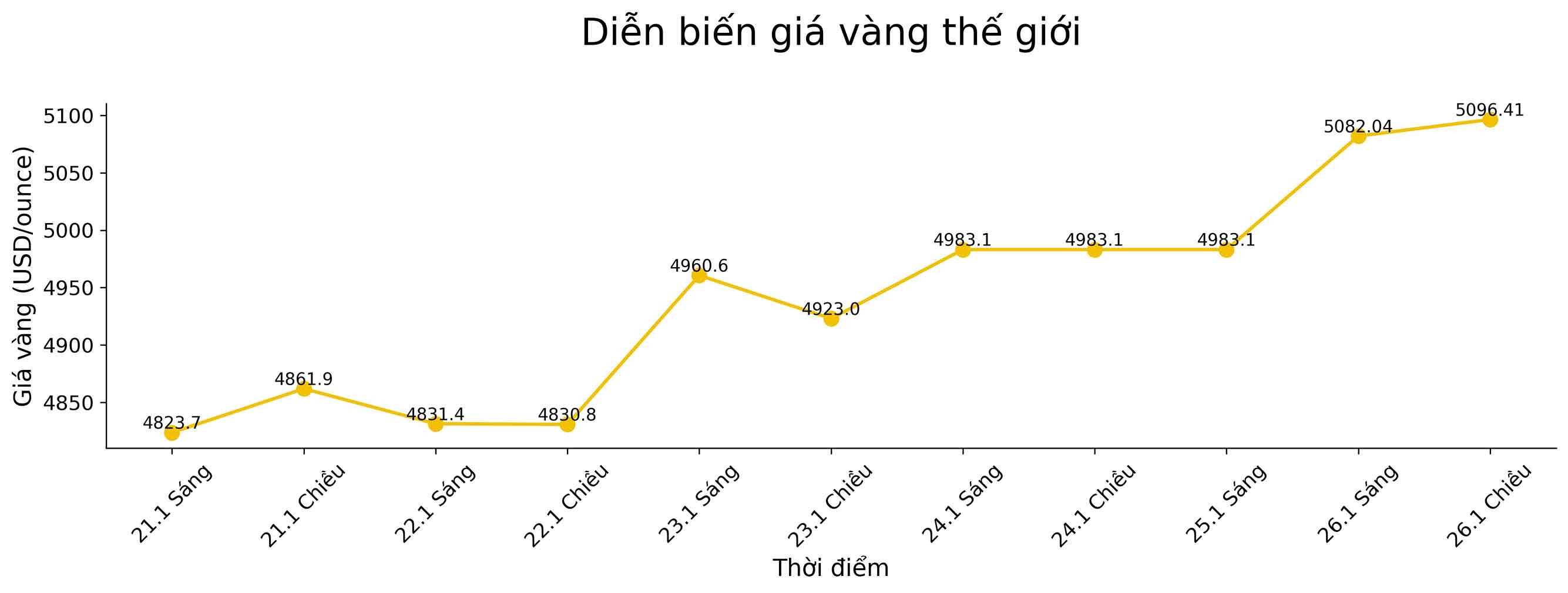

Gold prices soared to a new record near the threshold of 5,100 USD/ounce in the trading session on January 22, continuing to expand the historical escalation momentum as investors poured into shelter assets amid rising geopolitical instability.

Spot gold prices rose 2.2%, to $5,095.67/ounce in this afternoon's trading session, after hitting an all-time high of $5,110.50. Gold futures for February delivery in the US also rose to $5,086.30/ounce.

In 2025, gold rose 64% - the strongest increase since 1979 thanks to increased shelter demand, loose monetary policy in the US, solid buying power from central banks (including China's 14th consecutive month of increased reserves in December), and record capital inflows into ETF funds. In just the past week, the precious metal has continuously set new peaks and has increased by more than 18% since the beginning of the year.

According to Kyle Rodda, senior analyst at Capital.com, the latest driving force for the upward momentum stems from "the crisis of confidence in the US government and assets, after the unusual decisions of the Trump administration last week".

President Donald Trump last week unexpectedly withdrew the threat of imposing taxes on European allies to put pressure on the Greenland issue. Last weekend, he said he would impose 100% tariffs on Canada if this country pursues a trade agreement with China. He also threatened to impose a 200% tariff on French wine and champagne to put pressure on President Emmanuel Macron to join the Board of Peace initiative. Some opinions fear that this initiative could weaken the role of the United Nations in resolving conflicts, although Mr. Trump affirmed that he would cooperate with this organization.

The Trump administration has created a prolonged break in traditional operations, making gold almost the only defensive option," Rodda said.

In the opposite direction, the appreciation of the Yen in the session on January 22 caused the USD to fall widely, as the market closely monitored the possibility of intervention to support the yen and investors cut off the USD position before the Fed meeting this week. The weakening USD makes gold – which is valued in the greenback – more attractive to those holding other currencies.