Goldman Sachs (a multinational investment and financial service banking group of the US) is forecasting very positively about gold price prospects. The reason given by this unit is the trend of diversifying reserves to gold of the private sector and central banks in emerging markets.

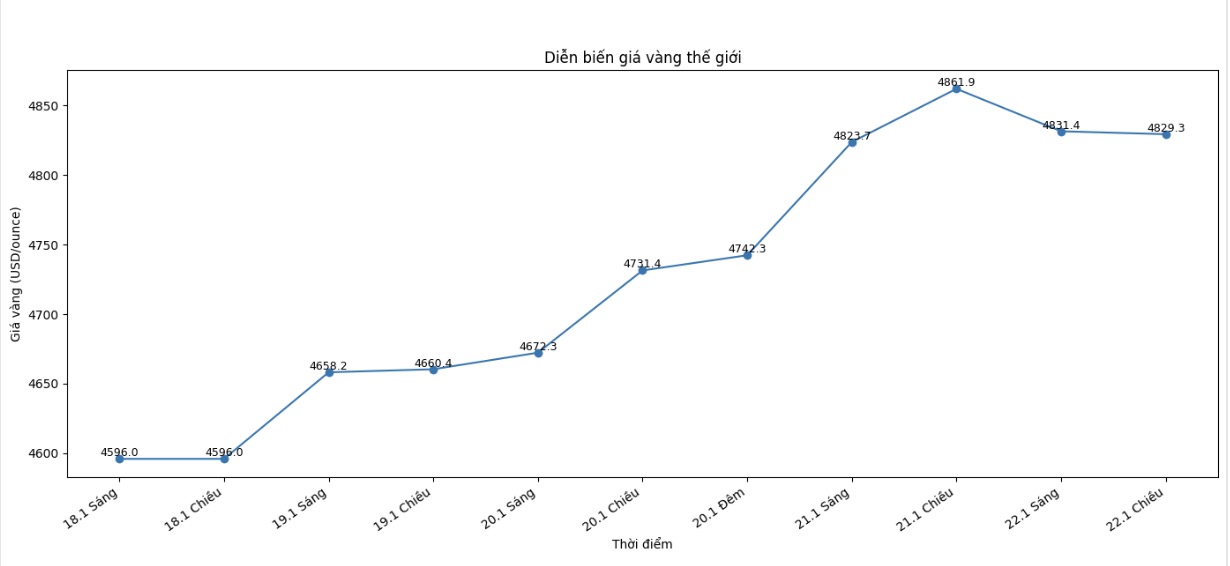

Spot gold prices climbed to a peak of 4,887.82 USD/ounce in Wednesday's trading session. Since the beginning of 2026, this safe-haven precious metal has increased by more than 11%, following a very strong 64% increase last year.

In a report released on Wednesday, Goldman Sachs said: "We assume that diversified investors in the private sector – who buy gold to hedge against global policy risks and are the driving force for our price forecasts to continuously be adjusted upwards – will not sell off their gold holdings in 2026. This increases the starting level for our gold price forecasts.

The bank also forecasts that gold holdings through ETF funds in the West will increase, as the US Federal Reserve (Fed) is likely to cut interest rates by 50 basis points in 2026.

In addition, Goldman Sachs expects central banks to buy an average of about 60 tons of gold in 2026, as emerging economies continue their strategy of diversifying foreign exchange reserves into gold.

However, according to Goldman Sachs, the risk of falling gold prices may appear if awareness of long-term risks to global monetary policy decreases sharply, thereby causing investors to liquidate macroeconomic policy risk hedging positions.

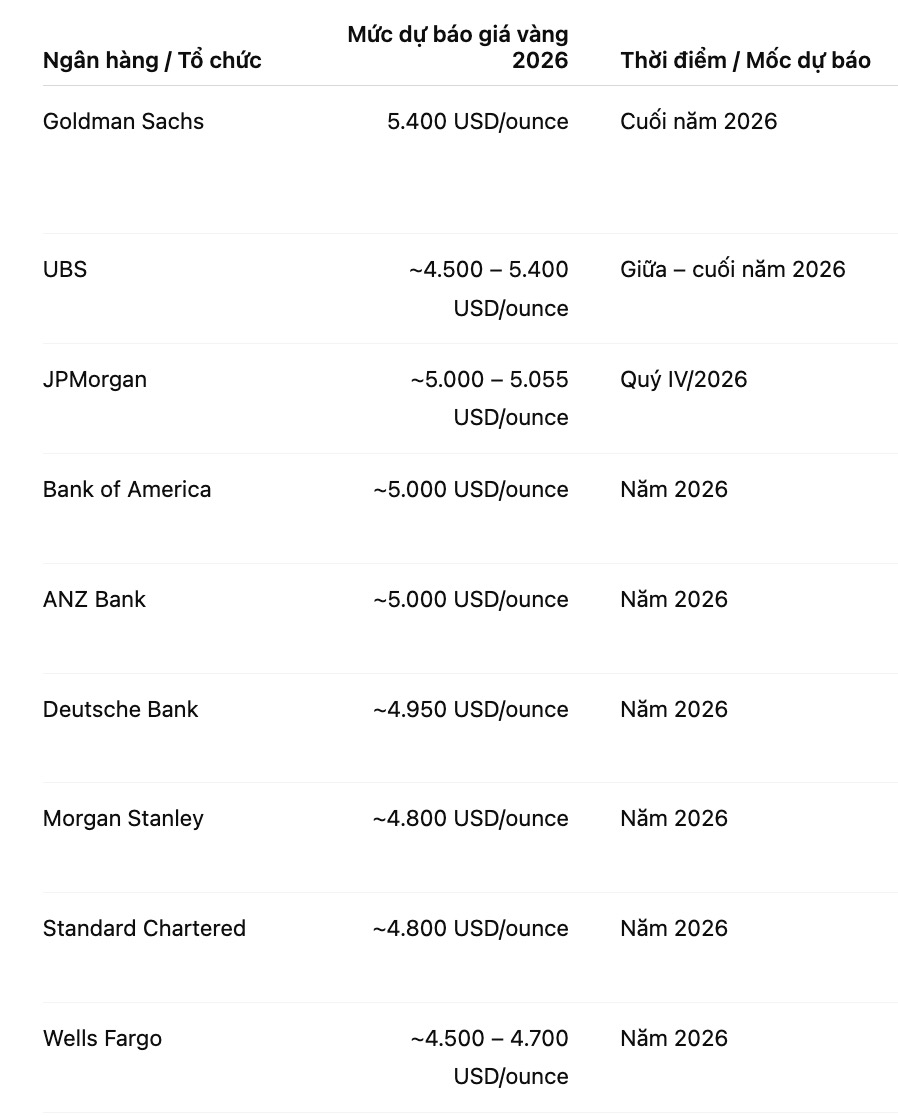

In addition to Goldman Sachs, many major banks and financial institutions in the world also made very positive forecasts about gold price prospects in 2026. Some institutions such as JPMorgan, Bank of America, ANZ, Deutsche Bank... all lean towards the scenario that gold maintains its upward momentum, with a common forecast range around 4,800 – 5,400 USD/ounce.

Reports suggest that gold continues to be supported by the need for safe havens, the trend of diversifying reserves of central banks, and expectations of a cooling interest rate environment in the near future. Meanwhile, some organizations are even more optimistic, saying that if macroeconomic and geopolitical risks persist, gold prices could reach higher levels.

See more news related to gold prices HERE...