Gold prices first surpassed the 5,000 USD/ounce mark, extending an unprecedented acceleration driven by changes in US President Donald Trump's foreign policy and the wave of capital withdrawal from government bonds as well as major currencies.

The precious metal has climbed to around 5,090 USD, after increasing by more than 8% last week thanks to escalating geopolitical risks and the weakening USD. The greenback strength index recorded its strongest weekly decline since May, helping the precious metal become cheaper for most buyers. Silver also continued to climb to a new record level, after surpassing the 100 USD/ounce mark in the previous session.

The spectacular increase in gold has more than doubled in just two years, once again affirming its historical role as a "dance of fear" in the market. After the strongest year of increase since 1979, gold has increased by more than 15% since the beginning of this year, mainly thanks to the "avoid depreciation" trend, when investors abandoned currency and Treasury bonds. The large sell-off on the Japanese bond market last week was the latest example of turning a blind eye to aggressive fiscal spending.

In recent weeks, a series of moves by the Trump administration from attacking the independence of the Federal Reserve (Fed), threatening to annex Greenland, to military intervention in Venezuela have continued to increase instability. For investors who want to direct cash flow in a volatile environment, the attractiveness of gold has never been so clear.

Gold is the reverse of confidence" - Max Belmont, Portfolio Manager at First Eagle Investment Management, said. "It is a defensive fence against unexpected inflation, unexpected market declines, or geopolitical hotspots.

Besides geopolitical factors, the large public debt in developed economies has also become an important pillar of the price increase momentum. Many long-term investors believe that inflation will become the only way for the government to maintain debt repayment capacity, so they are pouring into gold to preserve purchasing power.

In the past three years, people have become much more concerned about the long-term debt trajectory" - John Reade - Chief Strategy Officer of the World Gold Council said - "Where I see arguments about devaluation and debt most clearly expressed is in family asset management offices. They think about protecting assets through generations, not just a few years.

This "avoiding depreciation" trend peaked at the end of 2025 when famous investors such as Citadel Securities CEO Ken Griffin or Bridgewater founder Ray Dalio considered gold's upward momentum a warning sign.

The market is currently awaiting Mr. Trump's decision on the Fed Chairman position after he announced that he has completed the interview and has someone in mind. A softer Chairman may raise expectations of further interest rate cuts this year – a positive factor for gold, which is a non-profit asset after three consecutive previous cuts.

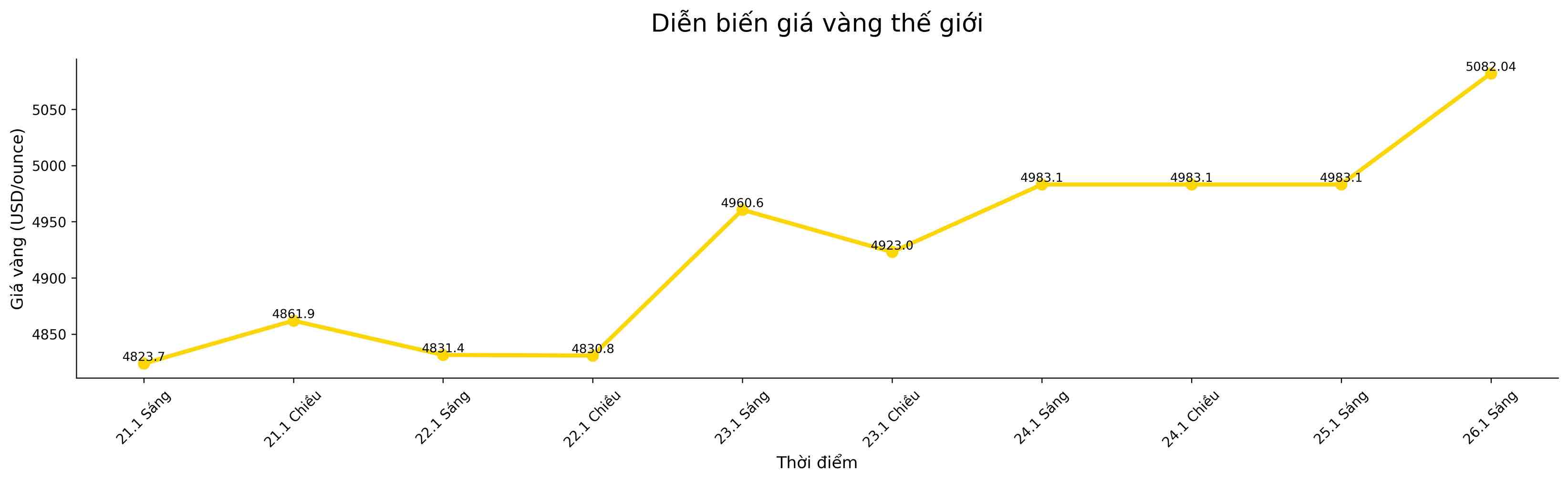

In this morning's trading session, gold prices rose 1.5% to 5,082.04 USD/ounce at 8:12 am; silver rose 2.2% to 105.50 USD. Platinum fell slightly after hitting a new peak, while palladium rose. Bloomberg Dollar Spot fell 0.2% after losing 1.6% last week.