Gold and silver prices simultaneously increased in Wednesday's trading session, as the USD and US Treasury bond yields weakened after data showed December retail sales nearly stalled, raising concerns that the economy is slowing down before the important jobs report is released.

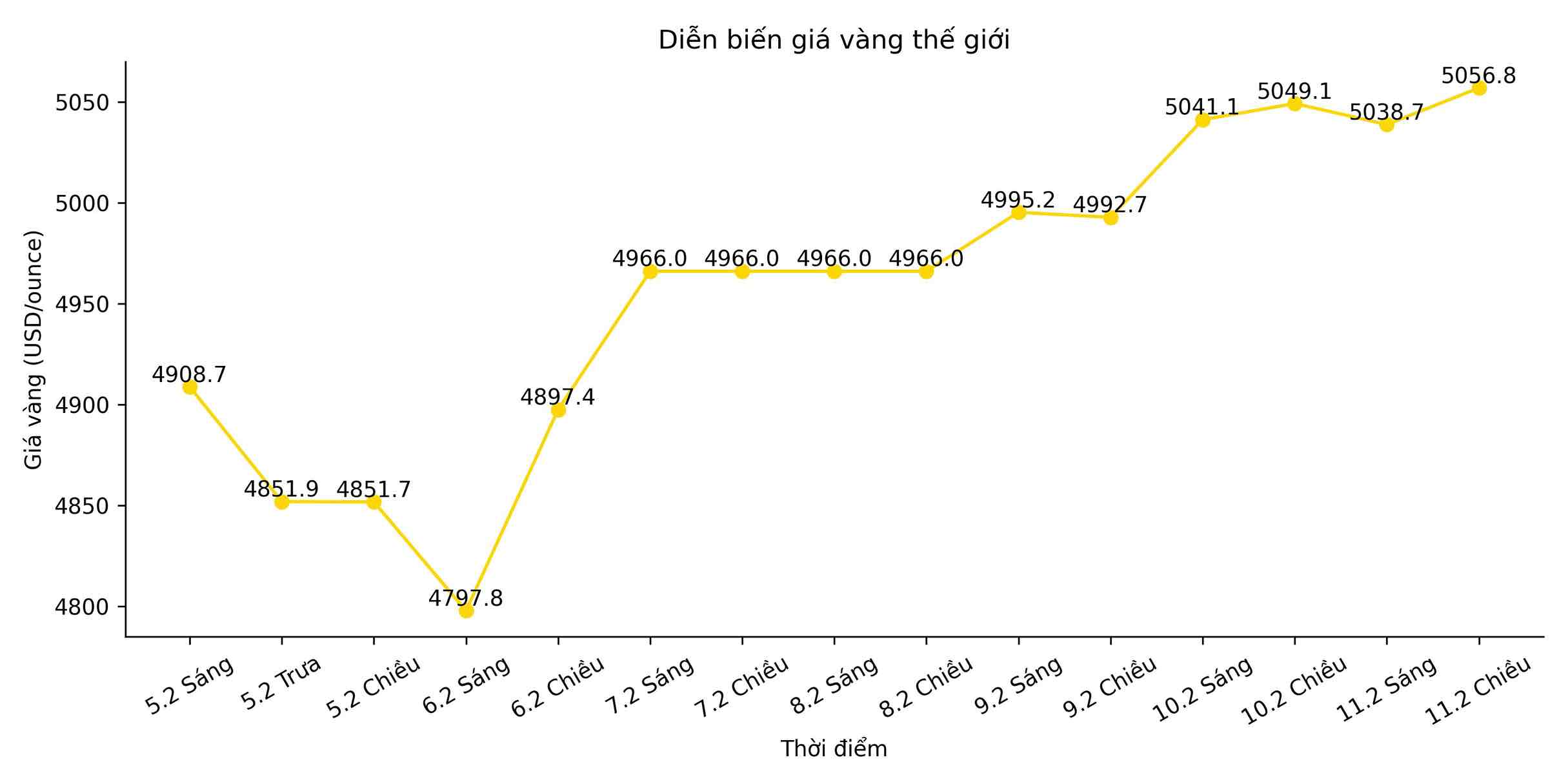

In this afternoon's trading session, spot gold rose 0.7% to 5,056.82 USD/ounce. Gold futures for April delivery in the US rose 1% to 5,080.90 USD/ounce. Spot silver prices jumped 2.2% to 82.44 USD/ounce, after falling more than 3% in the previous session.

According to Mr. Kyle Rodda, senior market analyst at Capital. com, the decrease in yields is a clear supporting factor for gold prices. "After weak retail data, the market expects the US Federal Reserve (Fed) may need to cut interest rates sooner and more strongly than previously expected" - he said.

US bond yields have fallen to near their lowest level in a month after a series of data shows that the economy shows signs of weakening, creating room for the Fed to ease monetary policy. Low yields reduce the opportunity cost of holding non-performing assets like gold.

Currently, investors expect at least two waves of interest rate cuts, each of 25 basis points in 2026, with the first of which may take place in June. The market is waiting for the January non-farm payroll (NFP) report to be released later in the day. A Reuters survey shows that the number of new jobs may increase by 70,000 last month, after increasing by 50,000 in December.

Mr. Tim Waterer, chief analyst at KCM Trade, said that stronger fluctuations of gold or USD may only appear after the NFP report is released. "If job data weakens, it could support gold's recovery momentum," he said.

The USD (.DXY) index fell to near a two-week low, making greenback-valued metals cheaper for international buyers.

In other precious metal groups, platinum increased by 1.4% to $2,116.25/ounce, while palladium increased by 1.3% to $1,730.50/ounce.