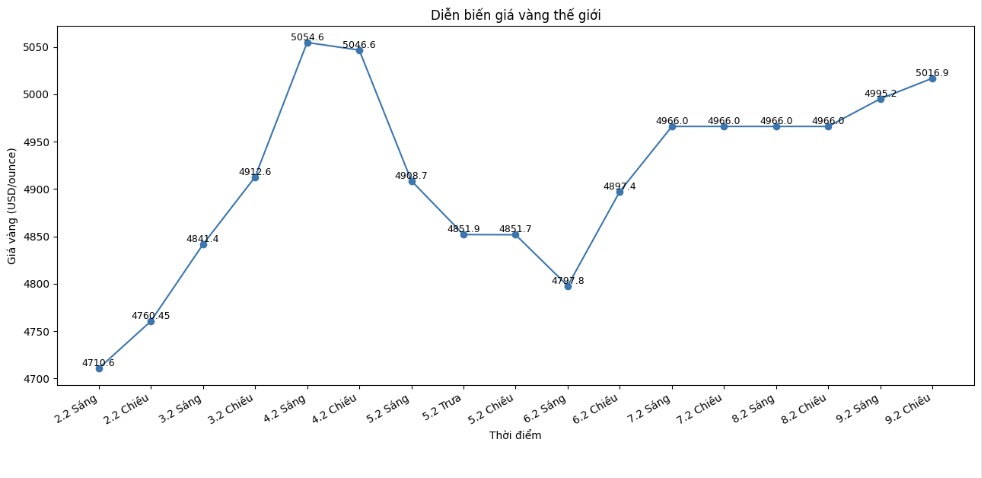

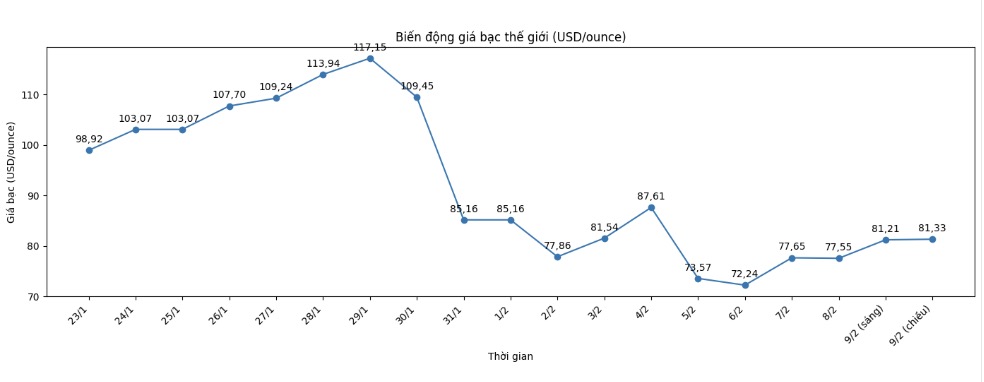

As of 3:15 PM on February 9 (Vietnam time), spot gold prices increased to 5,016.9 USD/ounce, after jumping up about 4% in the last session of last week. At the same time, spot silver prices also increased to 81.33 USD/ounce after increasing by nearly 10% in the previous session. Silver once set a historic peak of 121.64 USD/ounce on January 29.

Mr. Kelvin Wong - senior market analyst at OANDA - said: "This could be a very short-term daily correlation between the USD and silver and gold, thereby pushing up the prices of precious metals.

The USD is currently at its lowest level since February 4, making greenback-valued metals cheaper for foreign buyers. The Japanese Yen appreciated after Japanese Prime Minister Sanae Takaichi won overwhelmingly in Sunday's election.

KCM's chief analyst, Mr. Tim Waterer - commented: "The hunt for cheap goods is also contributing to bringing gold prices back above the 5,000 USD/ounce mark.

This week, investors are waiting for monthly reports on the US labor market and consumer price index. The market expects the US Federal Reserve (Fed) to have at least two interest rate cuts, each of 0.25 percentage points in 2026, with the first expected in June. Gold - a non-performing asset - usually benefits in a low interest rate environment.

Any signs of weakening from job data could support the recovery momentum of gold prices. We do not expect the Fed to cut interest rates until mid-year, unless job data worsens significantly," Mr. Waterer said.

Earlier, the Chairman of the San Francisco Fed, Mary Daly, said on Friday that she believes it may take another or two waves of interest rate cuts to cope with the weakening of the labor market.

Mr. Kelvin Wong commented: "If silver prices cannot surpass the important resistance level of 92.24 USD/ounce, I don't really believe in the possibility of forming a medium-term uptrend.

Spot platinum fell 0.7% to $2,081.23/ounce, while palladium lost 0.3% to $1,707.31/ounce.

The world gold and silver market operates through two main pricing mechanisms. The first is the spot market, which quotes prices for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.