Analysts at UBS (a Swiss multinational financial and banking group, one of the largest in the world) believe that the continued reduction in US real interest rates will support investment demand in gold ETF funds, as it reduces the opportunity cost of holding this non-rotating metal. In addition, central banks are forecast to continue to increase gold reserves.

Gold prices have been under pressure for most of last week" - analysts wrote in a report released on Monday. "Even after recovering, the precious metal is still about 7% lower than its historical peak.

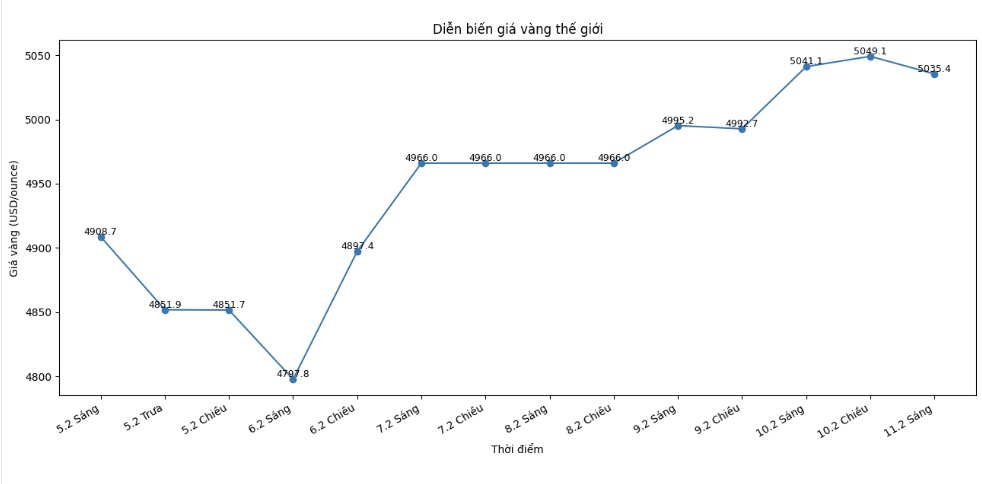

According to UBS, the gold market has witnessed very strong fluctuations recently, with recent weeks recording the strongest intraday decline since 2013, and also the strongest increase since 2008.

The direct catalyst for these fluctuations is the nomination of Kevin Warsh to the position of Chairman of the US Federal Reserve (Fed) at the end of January, thereby easing concerns that the appointment of a more moderate candidate could accelerate the recent weakening trend of the USD. Previously, gold had benefited from concerns surrounding the value of the greenback" - the report stated.

UBS said that the recent volatility has made some investors doubt the role of gold as a hedging channel against geopolitical and market fluctuations, but the bank's view remains unchanged.

We believe that these concerns are excessive and the upward momentum of gold prices will soon return" - analysts said. "Despite recent fluctuations, gold prices have still increased by about 16% since the beginning of the year and are one of the assets that have benefited greatly from geopolitical instability, which we believe will continue. We also do not think that the Fed's policy will end the upward momentum of gold, as has happened in some historical periods.

UBS noted that although Kevin Warsh supports narrowing the Fed's balance sheet, he has called for interest rate cuts in the past. “This will support gold prices, even as long-term concerns about the value of the USD somewhat subside.

The fact that US real interest rates are likely to continue to fall will help maintain investment demand in gold ETF funds, as it reduces the opportunity cost of holding non-performance assets. Finally, other drivers of gold price increases remain intact, including strong buying demand from central banks" - the report said.

UBS analysts currently forecast that gold prices will end the year around $5,900/ounce. “This is consistent with our overall positive view of the commodity market.

We believe that the strong upward momentum of both industrial metals and precious metals has room to continue, and commodities will play an increasingly important role in the investment portfolio in 2026, with yields driven by supply-demand imbalances, geopolitical risks and long-term trends," they wrote.

For investors who are holding a large proportion of gold and have not made significant profits, expanding to other commodities such as copper, aluminum and agricultural products can help diversify profit sources in the future and contribute to stabilizing the investment portfolio.

In the opening session of the North American market, spot gold prices at one point jumped to a session high of 5,078.74 USD/ounce, but then turned down to near the 5,000 USD mark in the first hours of trading.