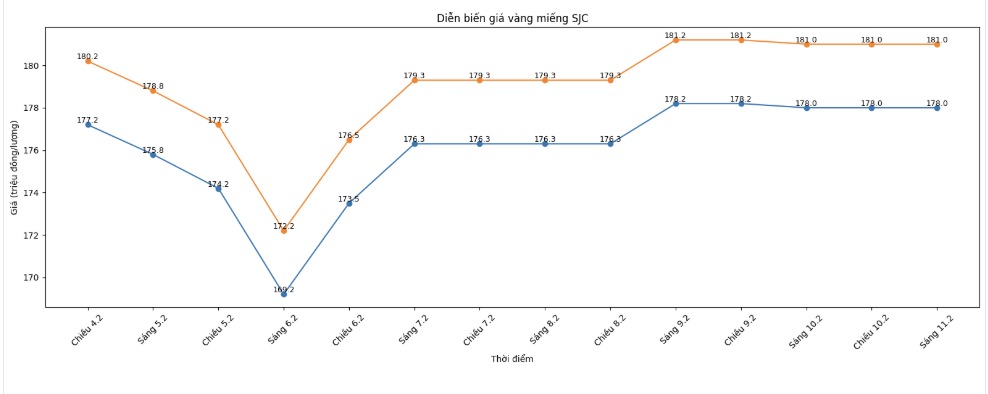

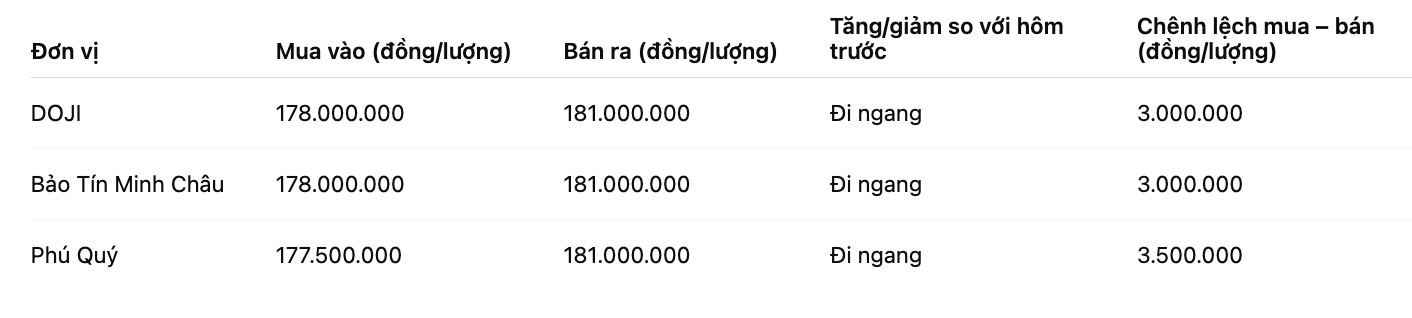

SJC gold bar price

As of 9:05 am, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed SJC gold bar prices at the threshold of 177.5-181 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 3.5 million VND/tael.

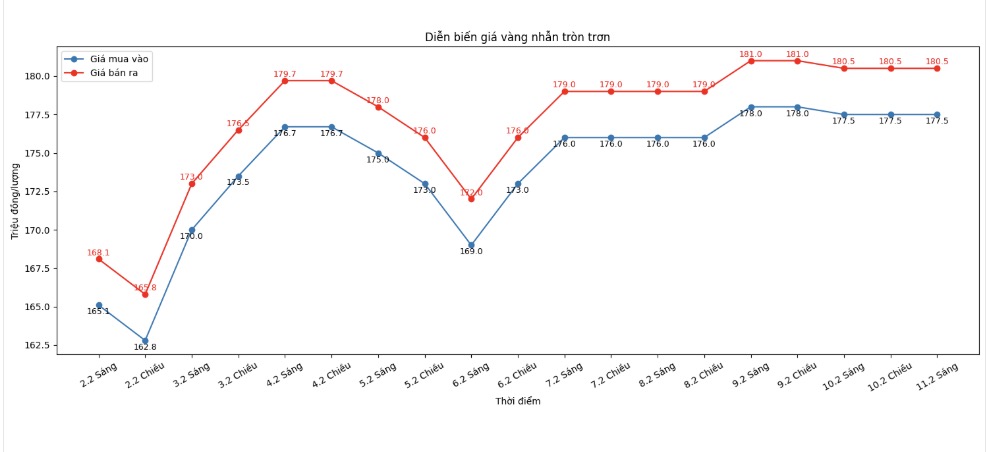

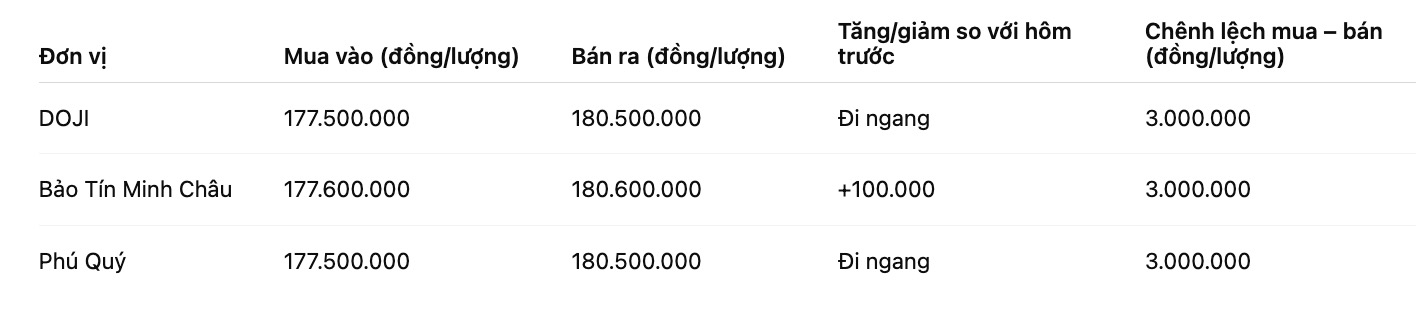

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 177.6-80.6 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 to 3.5 million VND/tael, posing a risk of losses for investors.

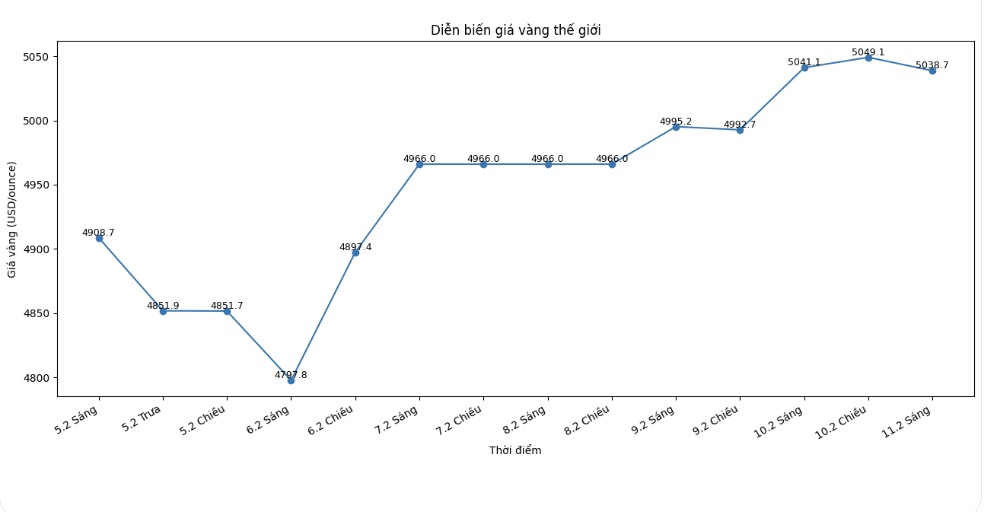

World gold price

At 9:10 am, world gold prices were listed around the threshold of 5,038.7 USD/ounce, down 2.4 USD compared to the previous day.

Gold price forecast

World gold prices are maintaining a state of fluctuation around the 5,000 USD/ounce mark amid US economic signals sending mixed messages. Newly released data shows that consumer spending in the US is clearly weakening, thereby strengthening the safe haven role of gold, but short-term correction pressure has not completely disappeared.

According to the US Department of Commerce, retail sales in December were almost flat, significantly lower than market expectations. Notably, the controlled sales group - a direct component of GDP - also recorded a slight decrease. These figures reflect that the demand of the world's largest economy is slowing down, as the consumer bad debt ratio climbed to its highest level in nearly a decade.

Some analysts believe that negative economic data may make the US Federal Reserve (FED) more cautious in its monetary policy management roadmap.

Neils Christensen - Kitco News analyst - said that the gold market has not reacted strongly immediately, but fundamental factors are silently supporting the price of precious metals. According to him, as the labor and consumer markets both show signs of cooling down, interest rates may be adjusted in a direction favorable for gold in the medium term.

From a longer-term perspective, Christopher Gannatti - Global Research Director at WisdomTree believes that recent deep drops in gold prices are technical correction and position rebalancing, rather than reflecting the weakening of gold's strategic role.

He emphasized that strong sell-offs often appear when the market enters a period of high volatility, cash flow is compressed in a short time, and speculative sentiment increases. History shows that these shocking declines usually do not last long and do not mean long-term trend reversal.

In the short term, gold prices are forecast to continue to fluctuate strongly in a wide range, as investors closely monitor new signals from US monetary policy and the developments of the USD. However, in the medium and long term, the differentiated global economic context, potential financial risks and the need to diversify assets are still key factors supporting gold prices.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...