Prices of precious metals simultaneously adjusted in the last trading session of 2025, but the entire market is still heading towards a rare breakthrough year, with the focus on silver – the metal recording the strongest increase in history and gold with the highest increase in more than 40 years.

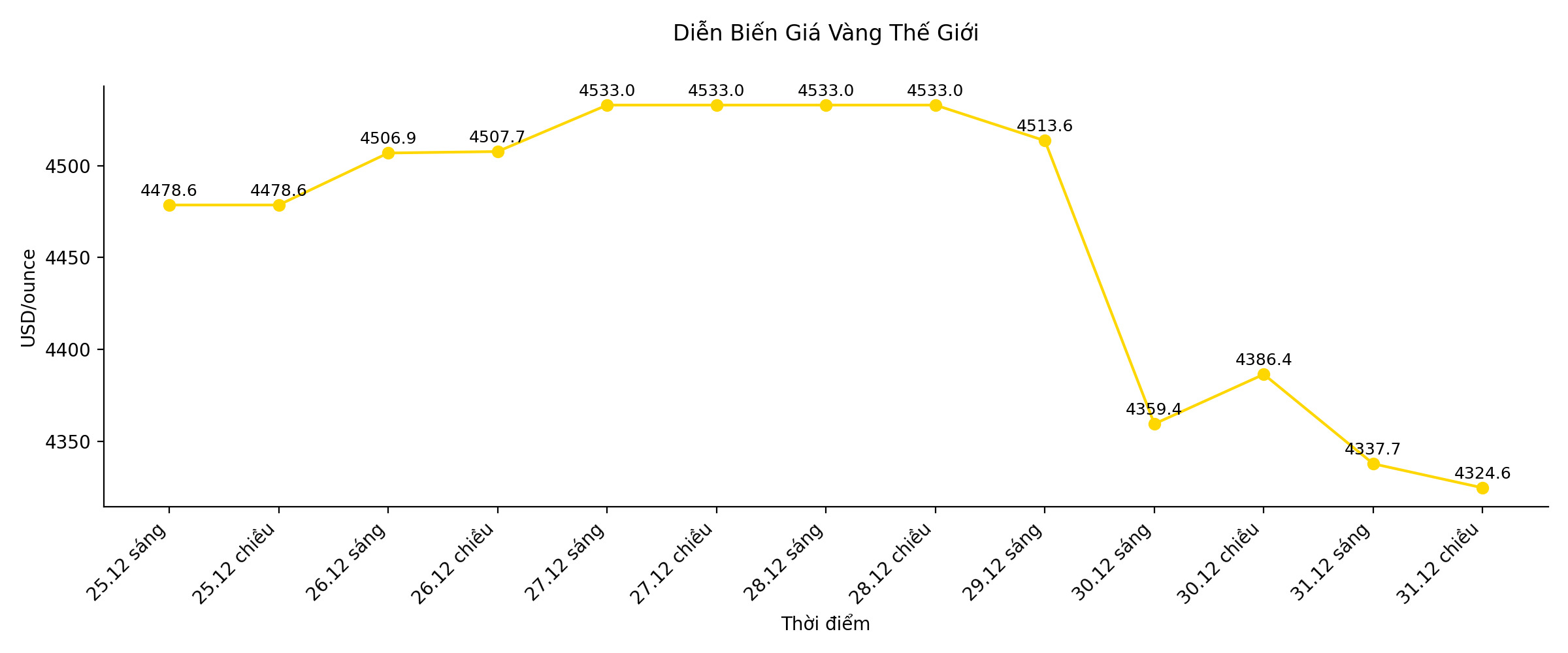

As of the afternoon trading session of December 31, 2025, spot gold prices fell 1.4% to 4,286.89 USD/ounce, falling to the lowest level in more than two weeks, after setting a record high of 4,549.71 USD/ounce in the last session of last week. US gold futures for February delivery also fell 2%, to 4,298.60 USD/ounce.

Despite short-term corrections, gold still increased by more than 60% in 2025 - the strongest increase since 1979, when precious metal prices broke through due to geopolitical instability related to the Iranian Revolution.

The upward momentum of gold this year is driven by expectations that the US Federal Reserve (Fed) will continue to ease monetary policy, prolonged geopolitical tensions, strong buying demand from central banks and capital flows into gold ETF funds.

Mr. Ilya Spivak, Head of Global Macro Division at Tastylive, commented: "It is likely that by the end of the first quarter of 2026, gold prices will test the milestone of 5,000 USD/ounce. The driving forces that supported gold throughout the past year are gradually becoming self-maintenance trends.

Meanwhile, silver fell sharply 7.1% to 71.02 USD/ounce after setting a historic peak of 83.62 USD/ounce at the beginning of the week. Despite the adjustment, silver still increased by more than 140% from the beginning of the year, far exceeding gold and recording the strongest year of price increase ever.

The increase in silver is supported by being classified by the US as a strategic mineral group, tighter supply, low inventories, and stronger industrial-investment demand.

The recovery of the USD to its highest level in more than a week also added pressure to precious metal prices. According to Mr. Jigar Trivedi, senior analyst at Reliance Securities (India), the strengthening greenback and year-end profit-taking activities are the main reasons for metal prices to adjust.

In other metals, platinum fell 12% to $1,935.35/ounce, after hitting a historic peak of $2,478.50/ounce earlier this week. However, this metal still increased by more than 110% in 2025 - the strongest increase ever.

Palladium also fell 8.2% to $1,478/ounce, but still recorded an increase of 66% in the year, marking the best year of growth in 15 years.