In the 2026 Commodity Outlook report, strategists at the world's leading bank Goldman Sachs affirmed: "Gold is still our most preferred long-term buy position in the entire commodity market.

This bank forecasts that gold prices could reach the $4,900/ounce mark in the fourth quarter of 2026, in the base scenario. Notably, Goldman believes that this level is still not the absolute ceiling if cash flow from individual investors accelerates along with the central bank's buying demand.

Short-term bottom before strong increase

According to the roadmap built by Goldman Sachs, gold prices in 2026 will not go up in a straight line. In the first quarter of 2026, this precious metal may adjust to a low of 4,200 USD/ounce, as the market absorbs short-term factors such as monetary policy developments and profit-taking after a period of hot increases.

In the second quarter, gold prices are forecast to return to the above 4,400 USD/ounce zone, before setting a new peak of about 4,630 USD in the third quarter.

By the end of Q4/2026, Goldman Sachs set a target of 4,900 USD/ounce - a new record high for precious metals.

Why is Goldman Sachs optimistic about gold prices?

US banks believe that the global macroeconomic context continues to support gold. Goldman Sachs' basic scenario includes solid global GDP growth and the US Federal Reserve (Fed) reducing interest rates by a total of 50 basis points in 2026.

History shows that gold often benefits in a declining interest rate environment, when the opportunity cost of holding non-profitable assets is narrowed.

From a long-term structural perspective, Goldman Sachs points out two major drivers.

First, geopolitical, technological and AI competition between the US and China is pushing goods - especially gold - back to the central position in the economic security strategy.

Second, the high concentration of geographical goods supply increases the risk of disruption, thereby highlighting the "security" role of gold in the investment portfolio.

The central bank continues to be a pillar

One of the most important reasons behind the positive forecast for gold prices is the persistent buying demand of central banks.

Goldman Sachs estimates that the bloc's gold purchase volume in 2026 averaged about 70 tons/month - about 4 times higher than the pre-2022 average.

According to Goldman, the West's freezing of Russia's foreign exchange reserves has created a turning point in how emerging economies perceive geopolitical risks. In addition, the proportion of gold in the reserves of many central banks, including China, remains low compared to global standards, while the demand for reserve diversification is increasing.

Individual investors may push gold prices above forecast

Goldman Sachs also emphasized the possibility of gold prices exceeding the $4,900/ounce scenario if cash flow from individual investors joins more strongly.

According to estimates by this bank, each 1 basis point increase in the proportion of gold in the US financial portfolio - stemming from net buying rather than price increases - could cause gold prices to increase by about 1.4%.

World gold prices closed last week at 4,534.16 USD/ounce, up 54.63 USD, equivalent to an increase of 1.22%.

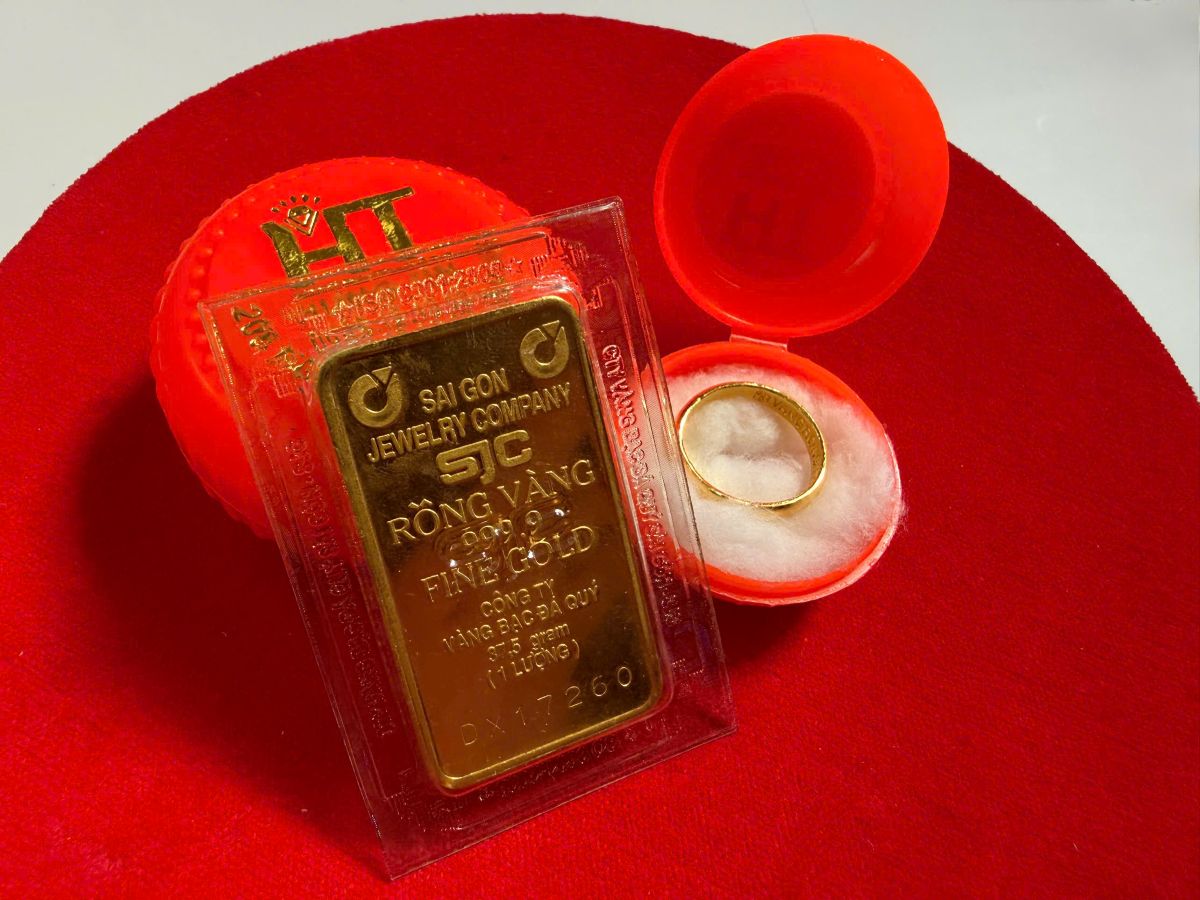

Regarding domestic gold prices, SJC gold bar prices are traded at 157.7 - 159.7 million VND/tael (buying - selling).

The price of 9999 Bao Tin Minh Chau gold rings is trading at 156.9 - 159.9 million VND/tael (buying - selling).