World gold prices continued to break out strongly, surpassing the 4,400 USD/ounce mark for the first time, in the context of expectations of the US soon cutting interest rates to increase and safe-haven demand remaining high. Along with gold, silver prices also hit a historic peak, reflecting the wave of money flowing into the precious metal group.

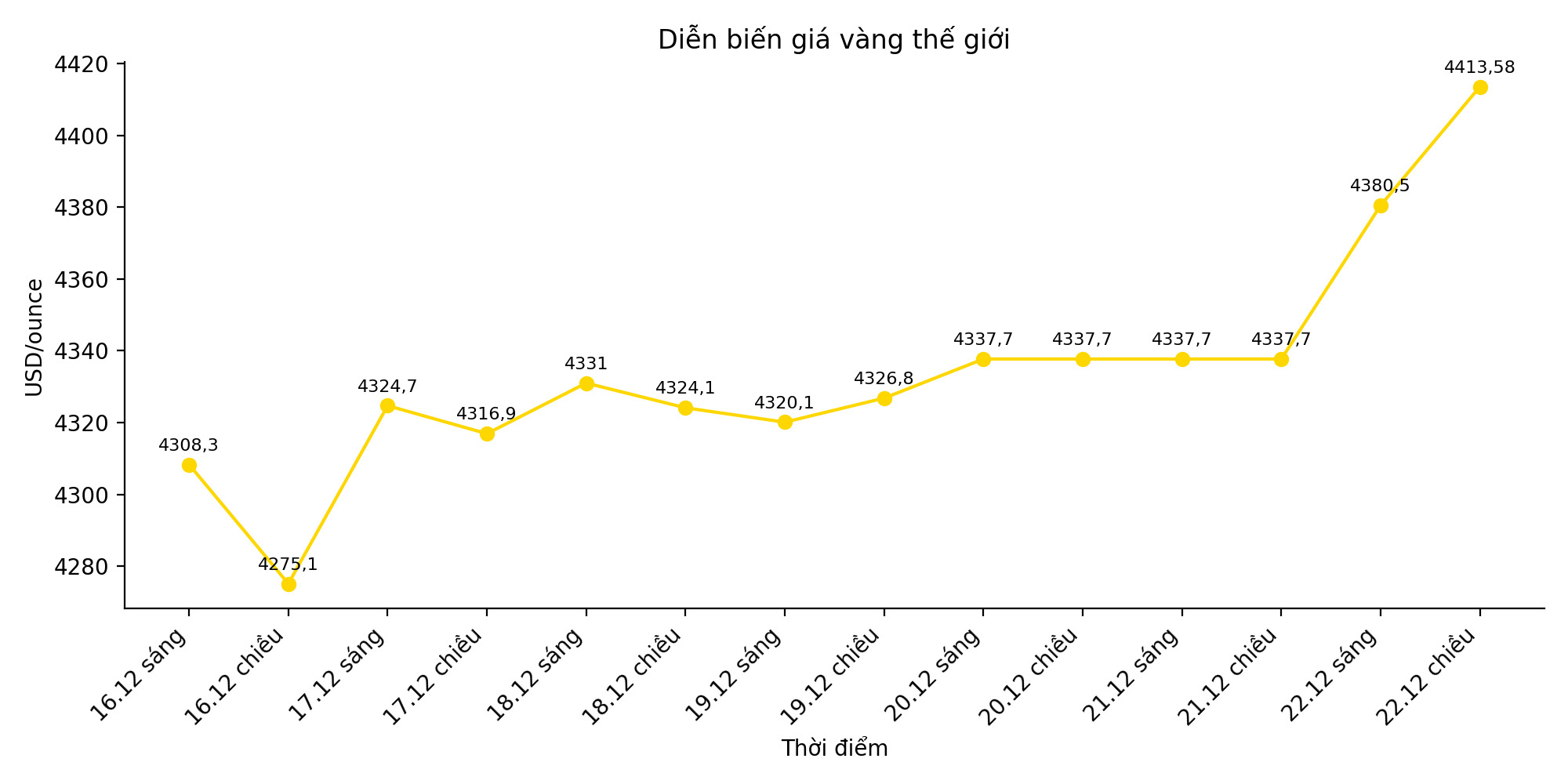

In the trading session on Monday, spot gold increased by more than 1%, reaching a record high of 4,413.58 USD/ounce, before falling slightly. Silver prices rose more than 3%, to nearly $70 an ounce the highest level ever. In the futures market, the US gold price for February delivery also approached the 4,430 USD/ounce zone.

Since the beginning of the year, gold prices have increased by about 67%, continuously breaking important psychological markers of 3,000 USD and 4,000 USD/ounce, towards the strongest increase of the year since 1979. Notably, silver increased even more strongly with an increase of up to 138%, thanks to persistent investment flows and limited global supply.

According to analysts, seasonal factors are continuing to support the precious metal's increase in December. However, as prices have increased sharply and the year is about to end, profit-taking risks may appear when market liquidity declines.

Technically, gold's breaking of the key resistance level around $4.375/ounce opens up the possibility of prices moving up to $4,427/ounce in the short term. In the medium term, the precious metal is still supported by geopolitical instability, steady buying from central banks, a weakening USD and expectations of falling interest rates in the coming years.

Although the Federal Reserve still signals caution, the market is now leaning towards the scenario of the US cutting interest rates twice a year, even extending to 2026. In a low interest rate environment, non-interest-bearing assets such as gold and silver continue to be seen as attractive destinations for cash flow.