Gold prices have just set a new historical high, as geopolitical tensions escalate with expectations of the Fed continuing to loosen monetary policy, creating a strong boost for the precious metals market. This increase brings gold closer to its strongest year of price increase since the late 1970s.

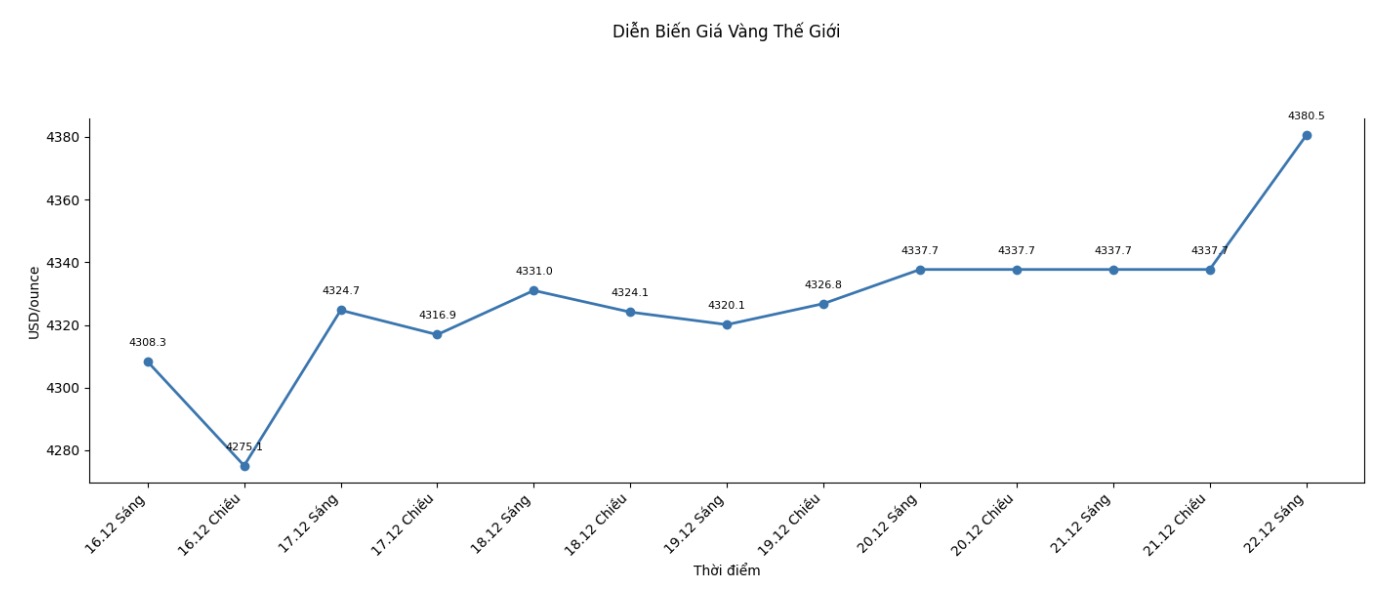

In the latest trading session, gold prices increased by more than 1%, surpassing the record of 4,381 USD/ounce set in October. Investors are now betting that the Fed will cut interest rates twice in 2026, in the context of recent US economic data that is not clear enough to change policy expectations. Maintaining interest rates at a low level is considered an important supporting factor for gold and silver - non-interest-bearing assets.

In addition, complex geopolitical developments are strengthening the safe haven role of precious metals. The US has increased pressure on Venezuela through measures to limit oil exports, while the Russia-Ukraine conflict continues to spread with the attack on oil tankers in the Mediterranean.

Since the beginning of the year, gold prices have increased by about two-thirds, towards the strongest increase since 1979. This increase is supported by persistent net buying demand from central banks and continuous cash flow into gold ETFs.

Market data shows that gold ETFs have recorded capital flows for 5 consecutive weeks, while total gold holdings have increased steadily over most months of the year.

Notably, after a short correction in October, gold prices have quickly regained their upward momentum. Several major financial institutions, including Goldman Sachs, continue to maintain optimism, predicting that gold prices could move to $4,900/ounce by 2026.

According to experts, ETF investors are increasingly competing directly with central banks to access physical gold supply, thereby creating a foundation for new high price levels in the medium and long term.