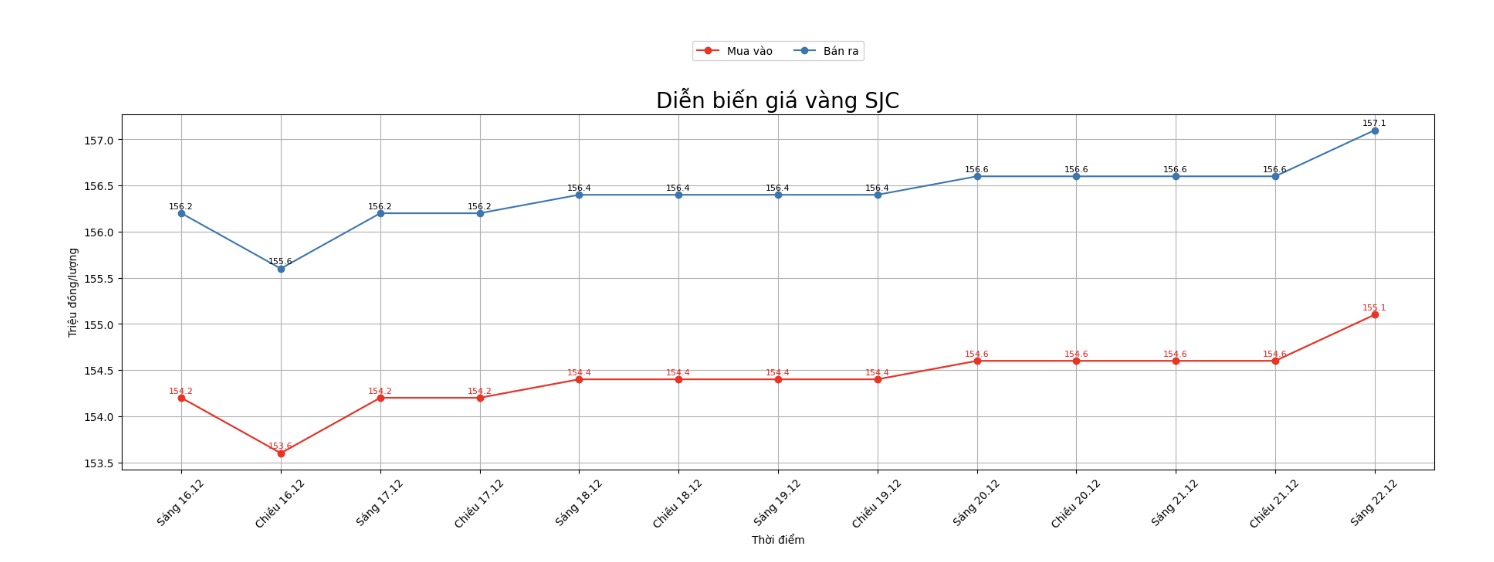

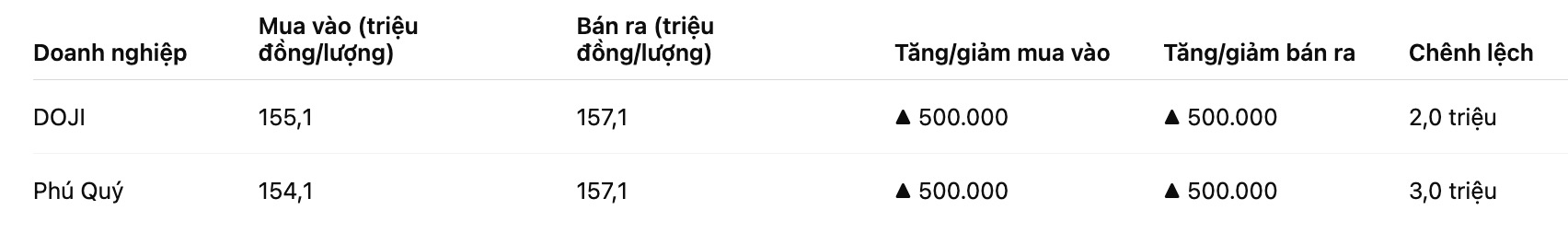

Updated SJC gold price

As of 9:20 a.m., DOJI Group listed the price of SJC gold bars at VND155.1-157.1 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 154.1-157.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

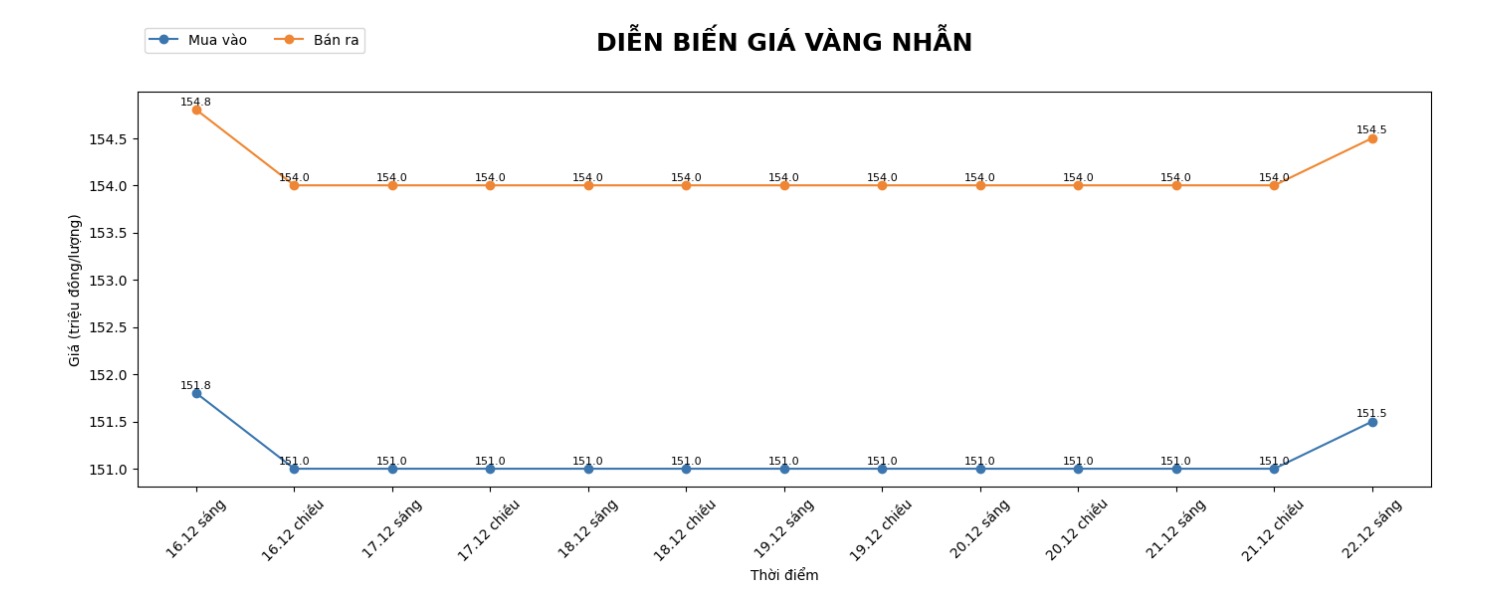

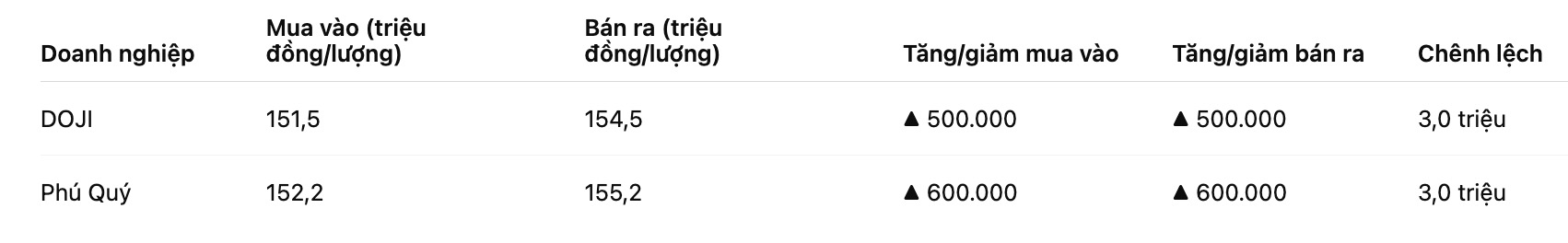

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

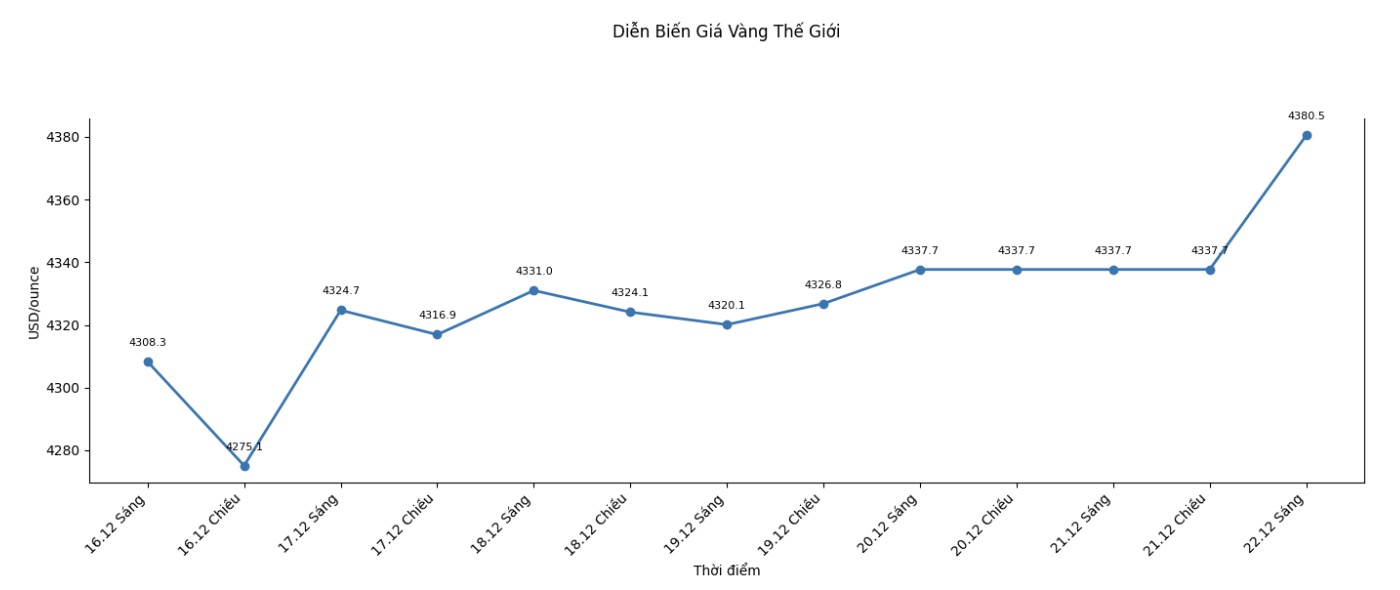

World gold price

At 8:55 a.m., the world gold price was listed around 4,380.5 USD/ounce, up sharply by 42.8 USD compared to a day ago.

Gold price forecast

According to Reuters, spot gold prices have skyrocketed to a record high in the trading session on Monday, driven by expectations that the US Federal Reserve (Fed) will continue to cut interest rates after a 0.25 percentage point cut last week, along with safe-haven demand remaining high and the US dollar weakening.

Gold - traditional safe-haven assets have increased by 67% since the beginning of the year, thanks to geopolitical and trade tensions, strong buying activities of central banks, as well as expectations of interest rates to decrease next year.

In addition, the decline in the USD index also supports gold prices by making this precious metal cheaper for foreign buyers.

Investors are now pricing in the possibility of a two-time US interest rate cut in 2026, thereby increasing the attractiveness of gold - an asset that does not yield.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...