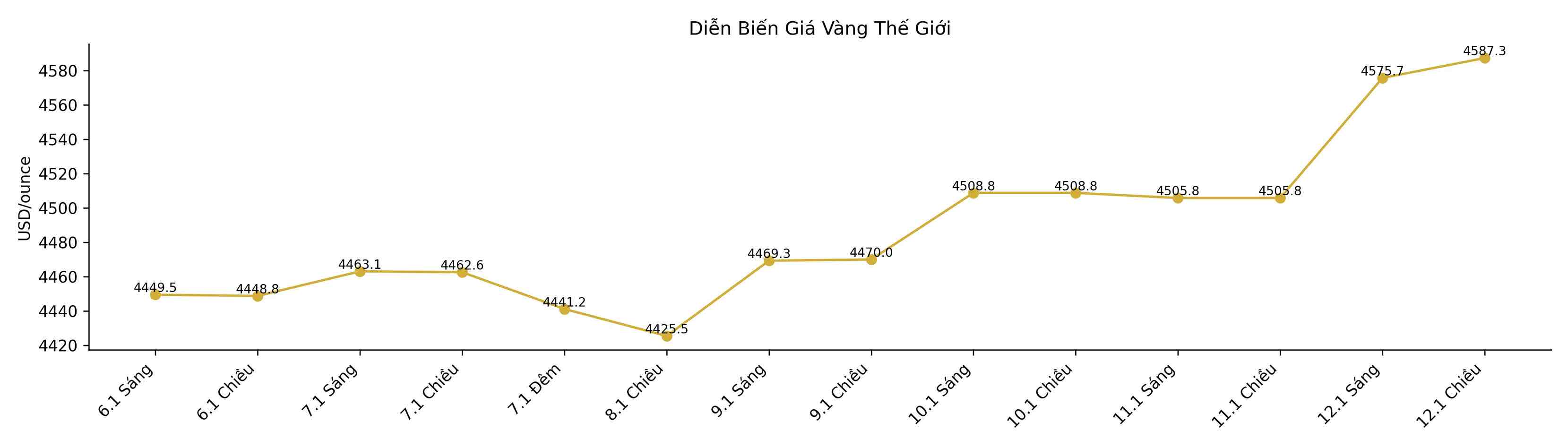

Spot gold prices rose 1.4% to 4,572.36 USD/ounce in this afternoon's trading session, after hitting a historic peak of 4,600.33 USD/ounce right at the beginning of the session. February gold futures contracts in the US rose 1.8% to 4,583.20 USD.

Amid developments in Iran, plus the fact that the Chairman of the US Federal Reserve (Fed) has become the focus of a criminal investigation, the US futures contract has turned down and that is a'green signal' for gold to break through," said Tim Waterer, chief analyst at KCM Trade.

Goldman Sachs, although postponing the Fed's forecast to cut interest rates, still expects two fundamental 25-point reduction periods to take place in June and September 2026 instead of March and June as before.

In the context of instability and low interest rates, non-profit assets such as gold are shining stronger than ever.

With the current developments, silver prices can completely reach 90 USD/ounce. Economic policy is still uncertain and China has just introduced new restrictions whose impacts have not yet been seen," ANZ commodity strategy expert Soni Kumari predicted.