Mr. Sean Lusk – co-director of commercial risk hedging at Walsh Trading – said he is simultaneously assessing economic and geopolitical factors to determine the driving force dominating the precious metals market.

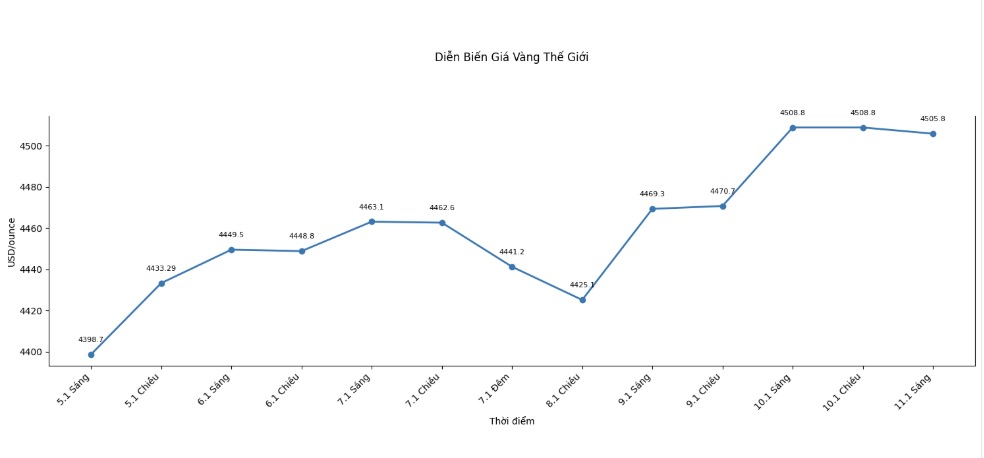

According to him, in the first half of the week, precious metal prices increased sharply, then decreased before the employment report was released.

Mr. Lusk said that risk information on the international market appeared in a rush on the news, contributing to maintaining shelter demand. However, he said that the overall picture has not changed fundamentally. Notably, even when the USD recovered in the session, the upward momentum of the precious metal was not eliminated.

In addition, Mr. Lusk mentioned the seasonal factor when the period from Christmas to Valentine's Day is often considered a positive period for the precious metals market. He also said that investors tend to limit opening sales positions before the weekend holiday in the context of increasing uncertainty.

Regarding macro data, Mr. Lusk assessed that although not all data is positive, there is no information bad enough to change expectations that the Fed will shift to a more relaxed stance, or severely weaken market sentiment.

He noted that after-holiday liquidity has not fully returned and fluctuations may be clearer when entering the next trading weeks of January, when many important data is released.

According to Mr. Lusk, precious metals are still the focus of the market. He forecasts that gold may have another rally in the first quarter before the market re-evaluates the outlook for later periods.

Meanwhile, Mr. Jim Wyckoff - senior analyst at Kitco - said that buying power still appears steadily every time the price adjusts, in the context of high risk avoidance, supporting shelter demand for precious metals in the last session of the week.

Technically, Mr. Wyckoff said that the next upward target of the buying side for the February gold futures contract is to close above the strong resistance zone at a record high of 4,584 USD/ounce.

In the opposite direction, the closest target of the selling side is to push the price below the strong support zone of 4,284.3 USD/ounce. Other notable levels include immediate resistance at 4,500 USD/ounce and 4,512.4 USD/ounce; near support at 4,415 USD/ounce and 4,400 USD/ounce.

See more news related to gold prices HERE...