World gold prices are continuing to climb in the context of global economic and geopolitical instability, along with increasingly clear expectations that the US Federal Reserve (Fed) will soon ease monetary policy.

However, besides the positive prospects in the medium and long term, many analysts warn that the market may face a short-term correction due to profit-taking pressure.

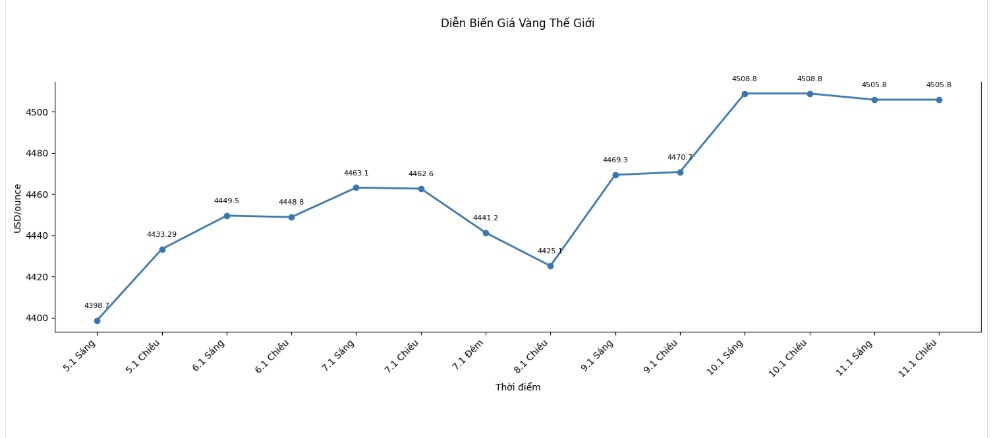

The latest driving force supporting gold prices to surpass 4,500 USD/ounce comes from the US Non-Agricultural Labor (NFP) report in December. Accordingly, the US economy only created 50,000 jobs, lower than the expected level of 60,000, while the unemployment rate fell to 4.4%, lower than the forecast of 4.5%.

These figures reflect that the labor market is showing signs of cooling down, reinforcing expectations that the Fed will have to shift to a softer stance to support growth.

Mr. Bart Melek - Head of Global Commodity Strategy at TD Securities - commented: "Employment data shows that the job creation environment is weakening. Combined with high oil prices, inflationary pressure, economic instability and the possibility of the Fed easing policies, this is a very favorable context for the precious metal market.

The market is currently forecasting that the Fed will cut interest rates at least twice this year - a historically strong support for gold prices, due to reducing the opportunity cost of holding non-profit assets.

In the medium term, Metals Focus even believes that gold prices may exceed the 5,000 USD/ounce mark in 2026, thanks to the trend of central banks diversifying foreign exchange reserves and increasing risk hedging demand.

However, not all signals lean completely towards price increases. CPM Group warns that after a strong increase in recent months, the gold market is facing the risk of a short-term profit-taking wave.

This group has issued a sell recommendation, with an initial price target of 4,385 USD/ounce, a cut-loss level at 4,525 USD/ounce, applicable to the period from January 9 to 20, 2026.

Investors are still very concerned about the political and economic environment, but are also increasingly cautious after earning large profits from previous buying positions. A short-term sell-off is entirely possible" - CPM Group said.

However, this organization still maintains a positive view in the medium term, believing that from the end of January and in the remainder of the first quarter, gold prices are likely to continue to rise as fundamental risks have not been resolved.

From a technical analysis perspective, Mr. Marc Chandler, CEO of Bannockburn Global Forex, assessed that the upward trend still prevails. “The record peak set on December 26 was only slightly lower than 4,550 USD/ounce. The support zone above 4,400 USD was maintained last week, paving the way for the possibility of retesting higher milestones” - he said. According to Mr. Chandler, the moving averages and volume indicators are still signaling positive.

In general, gold prices may still fluctuate strongly in the coming weeks, especially when the market is waiting for important policy decisions and new developments from the global economy. In that context, investors need to be more cautious with short-term fluctuations, even when the long-term outlook for gold is still positively assessed.

See more news related to gold prices HERE...