Gold futures have reversed from previous declines after the US Federal Reserve (Fed) announced a 25 basis point interest rate cut at 2:00 p.m. ET (ie 2:00 a.m. on December 11, 2025 Hanoi time).

The precious metal rebounded $35 within an hour of the decision, hitting a day peak of $4,268. Although prices later withdrew from the highest level, gold remained firmly above $4,250, or 0.49% in the session.

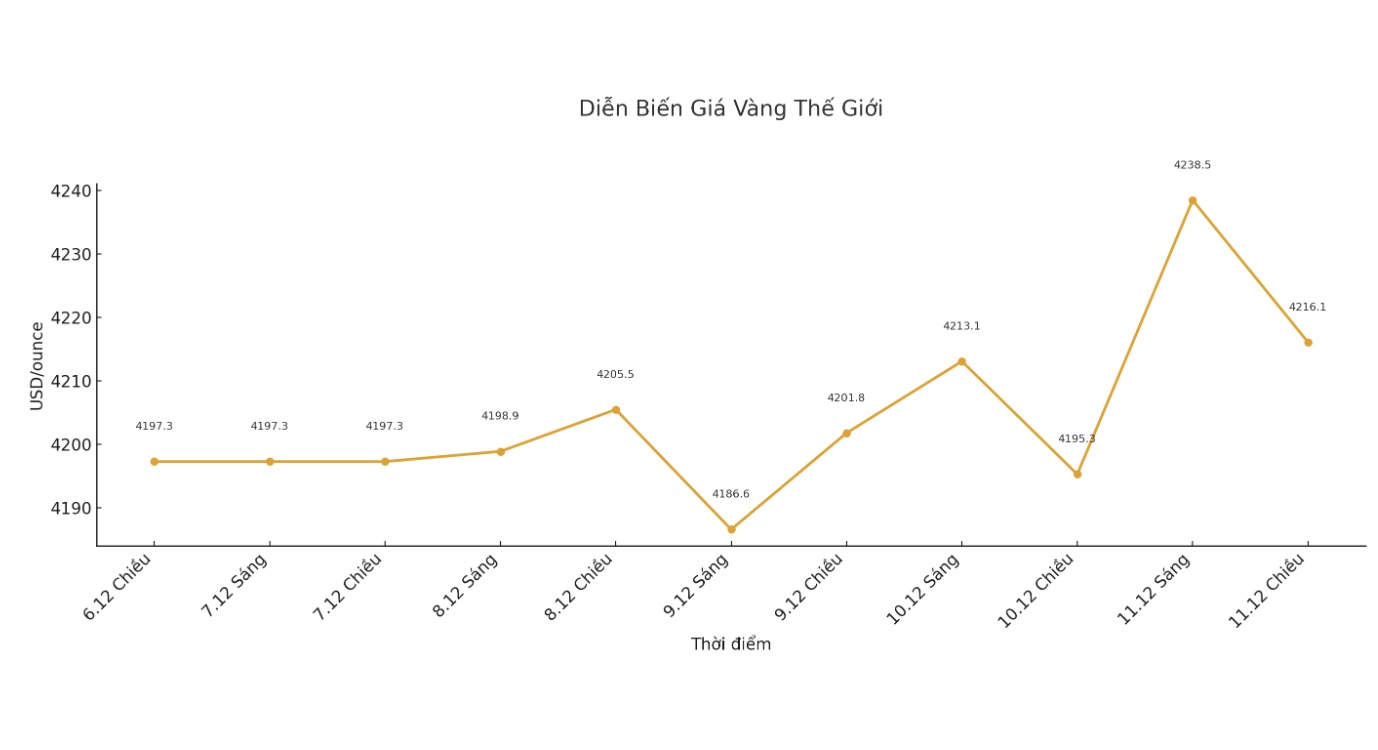

By 2:50 p.m. today, December 11, the price tended to decrease, to 4,216.1 USD/ounce.

Silver also showed similar strength after setting a new record in the session. After a slight decline before the announcement, the white metal increased by 1.35 USD in the recovery after the decision, surpassing 62 USD to set a new record high.

The silver futures contract was last traded at 62.2 USD, up 1.03 USD, equivalent to 1.67%.

The gold- silvery ratio narrowed to 68.39, approaching the target area of 62-65. If this ratio reaches the above technical threshold, it could signal that the current record increase in silver is approaching completion.

The widely forecasted 0.25-point interest rate cut has dragged real interest rates down and eased the pressure from the US dollar on precious metals, thereby creating a more solid price foundation. However, the Fed's cautious orientation and interest rate forecast chart (dot plot) have restrained expectations for further easing, thereby limiting the room for short-term increases.

We suspect the Fed will not cut further until Chairman Jerome Powells term ends in May, Capital Economics said in its post-meeting report. The upcoming leadership shift could make the Commission maintain a waiting stance, which could likely increase the appeal of safe-haven assets such as gold and silver in this transition period.

Both metals benefited from the weakening of the US dollar, as the greenback index fell 0.59% to 98.65. The decline after the Fed's decision has strengthened the traditional inverse relationship between US yields and gold prices.

In addition, strong demand from the central banking sector continues to be an important support. China added gold reserves for the 13th consecutive month, while global central banks maintained a net buying status. Stable ETF capital flows and solid physical demand in Asia continue to absorb market supply, contributing to consolidating the increase of both gold and silver.

The world gold and silver market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.