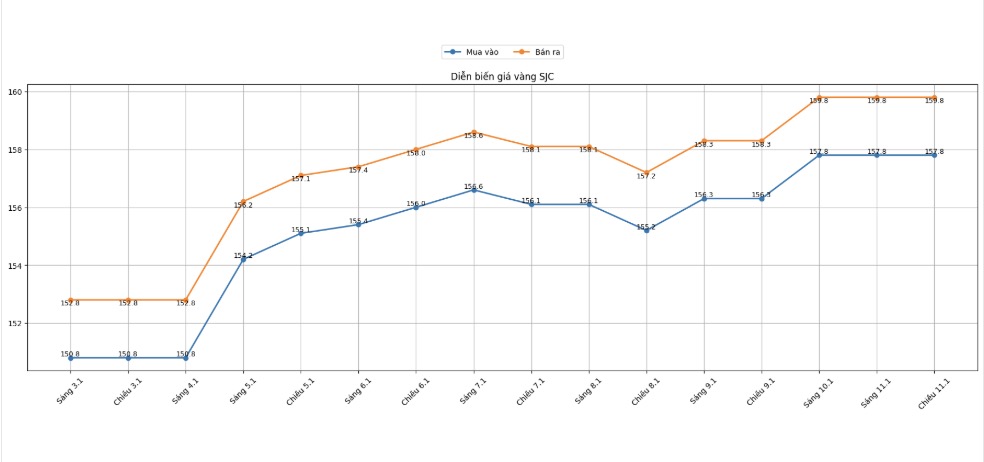

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.8-159.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 157.8-159.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 157.3-159.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

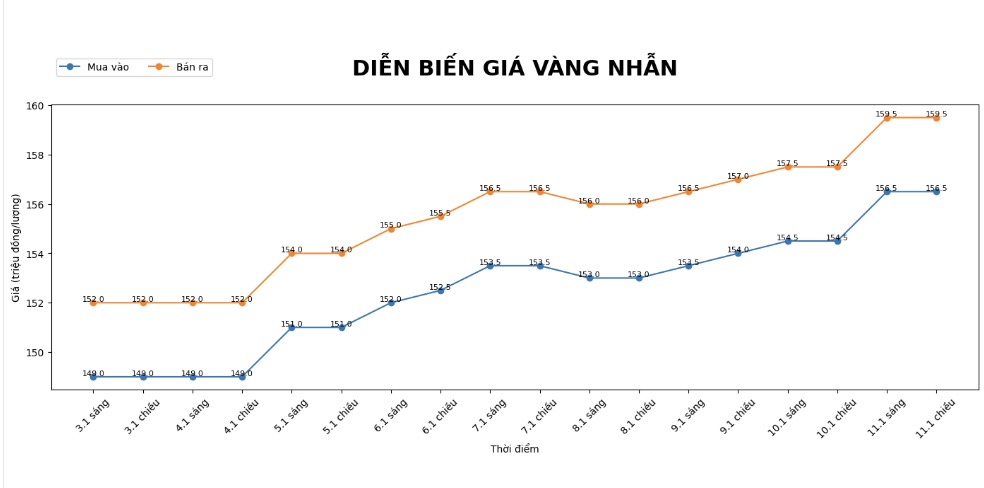

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 154.5-157.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 155-158 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

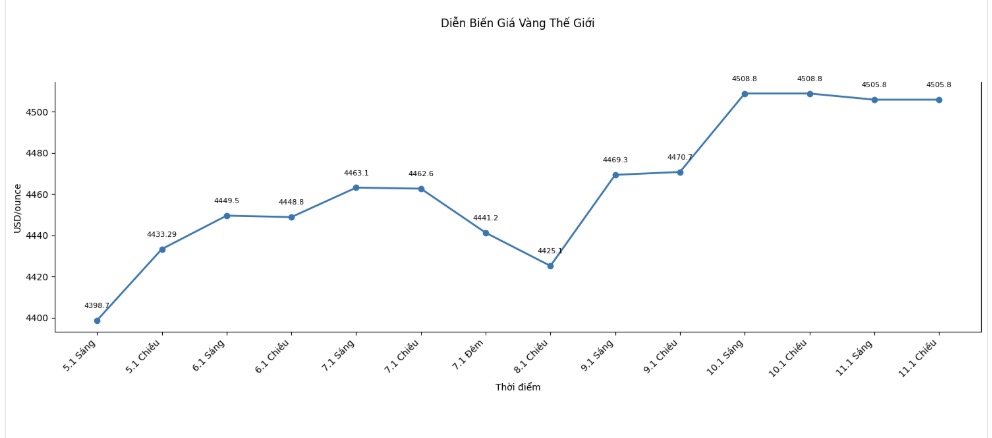

World gold price

World gold price listed at 6:00 am at the threshold of 4,508.8 USD/ounce, moving sideways in both directions.

Gold price forecast

After ending the trading week with a strong increase, world gold prices are maintaining around the 4,500 USD/ounce range, reflecting that safe-haven cash continues to prevail.

This development also created a spillover effect on the domestic market, when SJC gold bars and gold rings both set new high price levels in recent years.

This precious metal is receiving very positive forecasts from Wall Street experts. According to Mr. Darin Newsom, senior market analyst at Barchart.com, the current trend of gold is still very clear. He believes that in technical analysis and market behavior, once a trend has formed, it will usually continue until a significant external resistance appears.

At this time, I have not seen any strong enough factors to reverse the upward trend of gold, especially when buying demand from investors and central banks is still very large" - Mr. Newsom assessed.

Sharing that view, Mr. Rich Checkan, Chairman and CEO of Asset Strategies International, said that entering the new year does not change the core foundations that support the precious metals market.

According to him, central banks around the world continue to increase gold reserves, while geopolitical tensions in many regions show no signs of cooling down. In addition, the low interest rate environment and the weakening USD also make gold more attractive as a value-preserving channel.

In the short term, gold prices may encounter technical corrections as they approach important psychological milestones, but experts believe that defensive buying power will soon appear.

The reality of recent sessions shows that every time the price retreats, it attracts new cash flow, showing that the market's belief in the upward trend is still quite solid.

With the global economic and political context still uncertain, gold continues to be considered one of the important safe haven assets.

In the coming weeks, as more US economic data is released and monetary policy gradually becomes clearer, the market may fluctuate sharply. However, as long as major risks are not removed, the dominant trend of gold is still assessed as leaning towards a rising scenario.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...