On October 9, discussing at the 2024 Business and Law Forum, experts commented that if VAT refund issues are not resolved, they will become a bottleneck, affecting the stability, transparency and fairness of the investment and business environment.

Ms. Nguyen Thi Cuc - President of the Vietnam Tax Consulting Association, former Deputy Directorate of Tax Directorate gave specific examples of two tax refund cases of wood production and export enterprises and cassava trading establishments. From there, Ms. Cuc pointed out the difficulties and obstacles of enterprises and tax authorities when implementing VAT refunds.

According to Ms. Cuc, in order for businesses and state management agencies to feel secure in carrying out tax refund procedures, it is necessary to "cut into pieces" each specific business stage, thereby determining the responsibility of each state agency for each stage.

In addition, there should also be a mechanism to protect tax officials in case an inspection discovers errors that are not the responsibility of the declaring enterprise or the tax official.

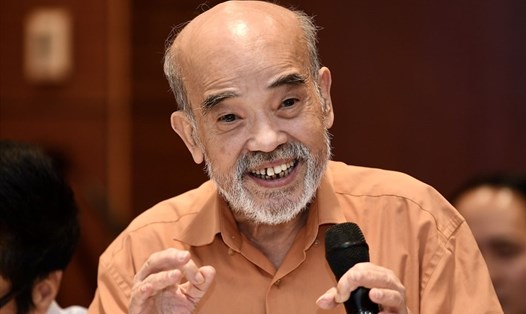

Mr. Nguyen Van Phung - Member of the Vietnam Association of Accountants and Auditors, former Director of the Department of Large Enterprise Tax Management, Tax Directorate - also commented that VAT refund is a "hot" issue because it is related to the refund of corporate tax paid from the state budget.

Therefore, the tax industry's multi-round inspection, although aimed at protecting the state budget, also causes difficulties for businesses operating legally.

To harmonize the interests of both the state and businesses, Mr. Phung recommended that ministries, branches and localities must have consistent direction in resolving tax violations, violations at each stage will be resolved at that stage, not placing responsibility solely on the tax authorities and tax officials.

In addition, it is also necessary to clearly define the responsibilities of tax officials in the Law on Value Added Tax and the Law on Tax Administration, in which tax officials are only responsible for reviewing documents according to the provisions of law.

Ms. Nguyen Quynh Anh - Vice President of the Vietnam Bar Federation - also said that tax officials should only be responsible for handling tax records and tax refund records in accordance with their duties and responsibilities and in compliance with legal regulations.

This will solve the bottleneck of VAT refunds, contributing to creating a stable and flexible policy environment for both taxpayers and tax authorities.

Regarding this issue, Mr. Mai Xuan Thanh - Directorate of Tax Directorate, Ministry of Finance - said that in the process of drafting the amended Law on VAT expected to be passed at the 8th session of the 15th National Assembly, the Tax Directorate reported to the Ministry of Finance to propose adding to the Law a provision that tax officials are responsible for tax refunds in accordance with their duties and responsibilities, complying with the provisions of the law on VAT, the law on tax management within the scope of the records, documents provided, and information documents provided by competent state agencies related to the settlement of tax refund dossiers.