On the occasion of the Lunar New Year holiday of At Ty 2025, Techcombank officially applies a new savings interest rate schedule, creating an attractive opportunity for customers to optimize their idle cash flow during Tet. Interest rates are divided by customer groups: Private (premium priority), Priority (priority), Inspire (general customers), and Regular customers.

In particular, the online savings form (Phat Loc Online) still holds the advantage of offering competitive interest rates and convenient transactions.

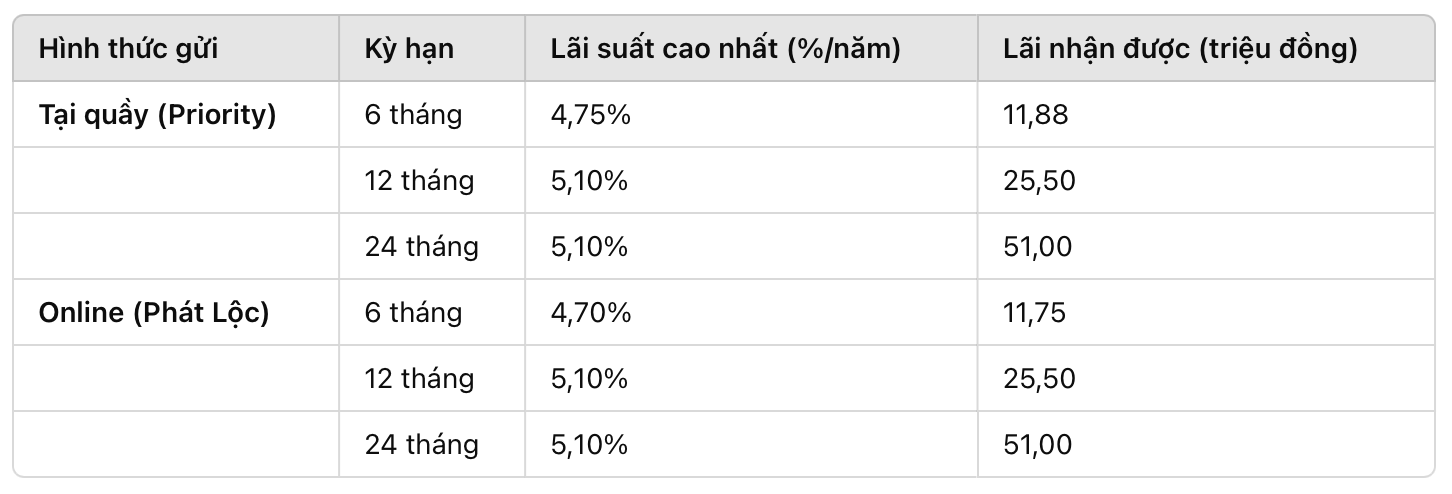

Amount received when depositing 500 million VND

With a deposit of 500 million VND, customers can receive different interest rates depending on the term and type of deposit.

For example:

If a customer deposits 500 million VND for a 12-month term at the counter, the highest interest rate applied is 5.10%/year, the interest received is 25.5 million VND after one year.

In the case of online savings, the interest rate is similar but customers save transaction time and can easily manage their accounts via the banking application.

Compared to other banks, Techcombank's interest rates are currently among the highest on the market, especially when customers deposit savings online.

This bank's Phat Loc Online savings form not only has attractive interest rates but also optimizes transaction time, especially during Tet holiday.

How to choose a term to optimize interest?

If you need flexible cash flow: 6-month term is a suitable choice, with the highest interest rate of 4.75%/year when deposited at the counter.

If you do not need to use capital for a long time: A 12-month or 24-month term will help maximize benefits, with the highest interest rate of up to 5.10%/year, equivalent to VND 25.5 million and VND 51 million in interest.

Note: Interest rates may change depending on bank policies at any time.

To enjoy the highest interest rate, customers should refer to details at the transaction counter or on the banking application before depositing money.