High-tech crimes are increasingly complicated

Voters in Binh Duong province sent a petition to the State Bank, requesting the banking industry to take measures to protect customers from fraud in cyberspace. According to the reflection, many individuals were threatened and enticed by subjects impersonating authorities, banks or financial companies to provide account information and OTP codes, causing money in their accounts to be withdrawn without them knowing.

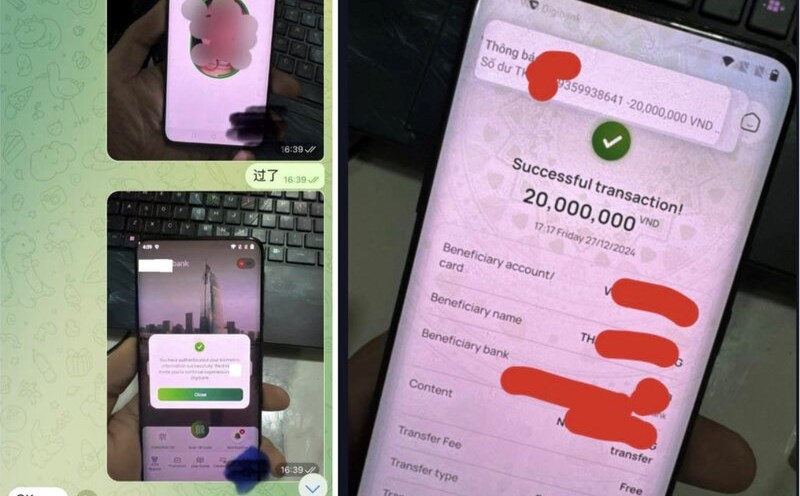

Bank scams no longer stop at familiar tricks such as impersonating police, courts or bank employees calling to request account verification. The subjects have applied new technology, using artificial intelligence (AI), Deepfake to create fake images and videos, trapping many people. Without strong measures, the risk of more and more victims falling into the trap is very high.

The State Bank deploys a series of new security measures

Faced with the above situation, the State Bank said that the unit is tightening regulations on security in online payments and banking transactions. One of the important measures is the mandatory requirement for biometric authentication for some large-value transactions. According to Decision No. 2345/QD-NHNN, from July 1, 2024, customers must authenticate with a chip-embedded citizen ID card or VNeID account when conducting transactions from 10 million VND or more, when the total transaction value per day exceeds 20 million VND or when logged in on a new device.

In addition, the State Bank also issued Circular No. 50/2024/TT-NHNN, effective from January 1, 2025, regulating security measures in online banking services. One of the notable points is the regulation that banks and credit institutions are not allowed to send SMS messages or emails containing links to websites, unless customers proactively request. This is to prevent fraud tricks impersonating banks to send fake messages to appropriate user accounts.

To ensure transaction safety, banks must also apply biometric comparison technology according to international standards to accurately determine the transaction participants. New security measures also include detecting biometric forgery using Liveness detection technology, helping to identify and prevent sophisticated scams such as using static photos, fake videos, 3D masks or Deepfake to illegally open accounts.

Transaction monitoring system helps immediately block suspicious accounts

Another important solution being deployed is the SIMO monitoring system, which helps track payment accounts and e-wallets with signs of fraud. When detecting suspicious accounts, banks can report, share information and immediately block transactions to prevent fraud in a timely manner.

The State Bank is also coordinating with the Ministry of Public Security and the Ministry of Information and Communications to connect data with the National Population Database, in order to verify customer identification and detect fake accounts right from the registration stage. In addition, this agency also coordinates cross-checking banking and telecommunications data to ensure that each bank account is connected to a number of their own phones, immediately blocking specialized junk subscribers for fraud purposes.

In particular, the State Bank and authorities have established a quick response channel to immediately detect and handle fake banking websites. When detecting unusual signs, customers need to immediately contact the bank to verify the information and avoid being taken over by scammers.

Users need to be more vigilant

Although the bank has implemented many security measures, to avoid becoming victims of scams, users need to proactively raise their vigilance. If you receive a message or strange email containing a link requesting a bank account login, absolutely do not click on it. In any case, customers should not provide personal information, OTP code or bank password to anyone.

The State Bank recommends that when there are signs of suspected fraud, customers should immediately contact the bank's support hotline to lock their accounts and report the incident. The faster you react, the higher the chance of protecting your account and personal property.

With a series of new security measures, the State Bank hopes to minimize fraud through bank accounts, helping customers feel more secure when transacting online. However, user vigilance is still the most important "shield" to prevent high-tech crimes.