From 2026, household businesses selling goods through many platforms such as Shopee, TikTok Shop, Facebook, Instagram or payment-transportation applications will be subject to stricter tax management when revenue is compared from electronic data sources. The abolition of fixed tax and replacement with a mechanism to declare actual revenue according to Resolution 198/2025/QH15 makes the multi-platform sales model no longer empty space to "break numbers" as before.

Revenue from all platforms will be compiled according to reality from 2026

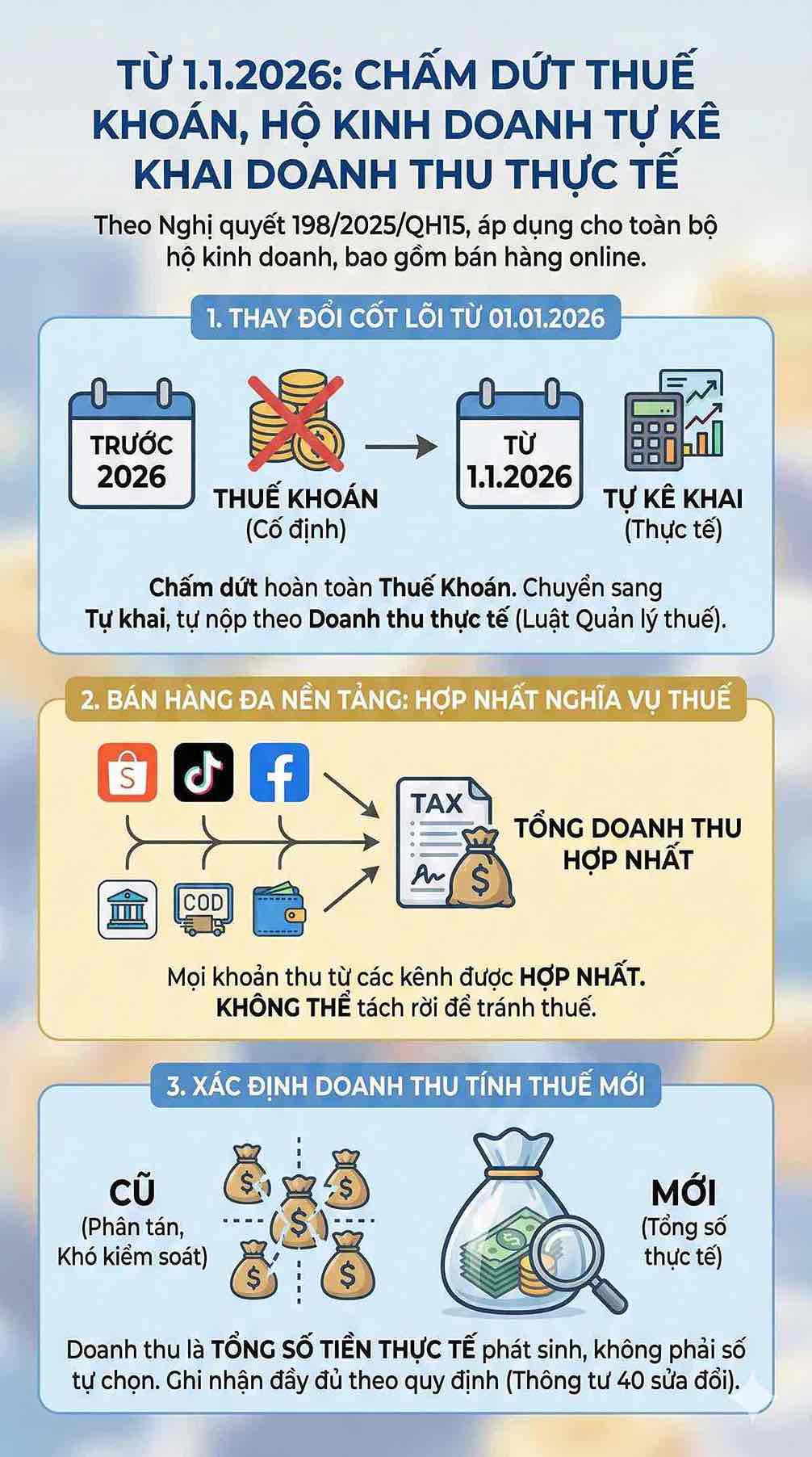

According to Resolution 198/2025/QH15, from January 1, 2026, the fixed tax method officially ends for business households. All business households, including online sales models, must switch to the form of self-declaration of actual revenue according to the principle of self-declaration and self-submission specified in the Law on Tax Administration No. 38/2019/QH14, which has been amended and supplemented by Law No. 56/2024/QH15 (effective until June 30, 2026). This means that all revenues from different sales channels will be consolidated when tax obligations are determined, and cannot be separated by each platform.

In the period before 2026, multi-platform sales helped business households expand revenue but also created a dispersal of cash flow on many channels such as Shopee, TikTok, Facebook, bank transfers, electronic wallets or COD. This made it difficult for tax authorities to determine actual revenue, especially for households with high transaction frequencies. The abolition of fixed tax has ended the fixed collection mechanism and required business households to fully record revenue generated in accordance with the provisions of Circular 40/2021/TT-BTC (amended and supplemented by Circular 40/2025/TT-BTC).

From 2026, revenue is no longer understood as the amount of money business households choose to declare on a specific channel, but is determined based on the total amount of real money.

Multi-source data becomes a central revenue control tool

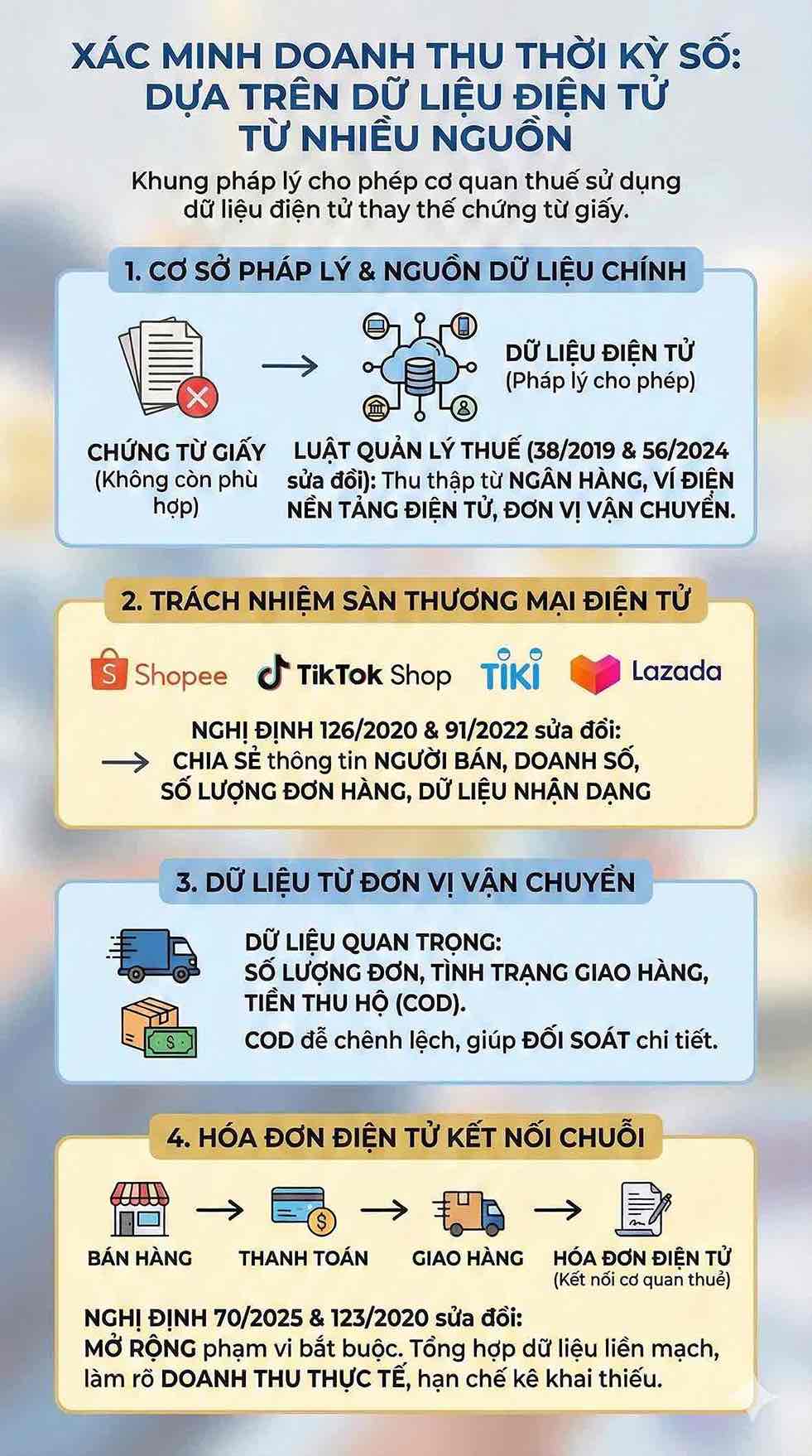

In the context of digital transformation, verifying revenue based on paper documents or manual declarations is no longer appropriate. The current legal framework allows tax authorities to verify revenue based on electronic data from many sources. Law on Tax Administration 38/2019/QH14 (amended by Law 56/2024/QH15) stipulates that tax authorities have the right to collect information from banks, payment organizations, electronic wallets, electronic platforms and transportation units serving tax management.

For e-commerce platforms, the responsibility for providing seller information and transaction data is stipulated in Decree 126/2020/ND-CP, and amended in Decree 91/2022/ND-CP. Accordingly, platforms such as Shopee, TikTok Shop, Tiki, Lazada must share information related to sales, number of orders and seller identification data to serve revenue comparison.

Data from transportation units including the number of orders, delivery status and receivables (COD) is also an important basis for identifying the scale of business operations of households. COD is inherently a cash flow that easily generates differences if only based on self-declared reports, so this data source helps tax authorities control each order in more detail.

In addition, Decree 70/2025/ND-CP amends Decree 123/2020/ND-CP on electronic invoices, expanding the scope of mandatory use of invoices. When electronic invoices are directly connected to the tax authority, the data system is created into a seamless chain from sales, payment to delivery. The synthesis of data from invoices, payments and transportation helps clarify actual revenue, minimizing the situation of incomplete declaration.

Data control forces multi-platform business households to be transparent about revenue

In conditions where tax authorities have the right to cross-reference information from multiple data systems, multi-platform sales – whether done via livestream, stores on e-commerce platforms or via social networks – all leave traces that can be traced. When there is a significant difference between self-declared data and control data, business households may have to explain or be inspected according to the provisions of the Law on Tax Administration.

Tightening data management is not aimed at increasing the burden on business households, but towards a transparent, fair and consistent tax system with the development speed of e-commerce. For many multi-platform business households, this is the time to standardize the revenue recording system, cash flow management and apply electronic invoices to ensure full compliance from 2026.