From January 1, 2026, the accounting regime applied to business households and individual businesses has many new points, among which noteworthy is a separate regulation for groups of business households not subject to value-added tax (VAT), not required to pay personal income tax (PIT). This content is specifically guided by the Ministry of Finance in Circular 152/2025/TT-BTC.

What is the revenue that business households are not subject to tax?

According to Clause 1, Article 7 of the 2025 Personal Income Tax Law, resident individuals with production and business activities with annual revenue of 500 million VND or less are not required to pay PIT. At the same time, if they are not subject to VAT according to the provisions of the VAT law, business households are classified as not subject to tax.

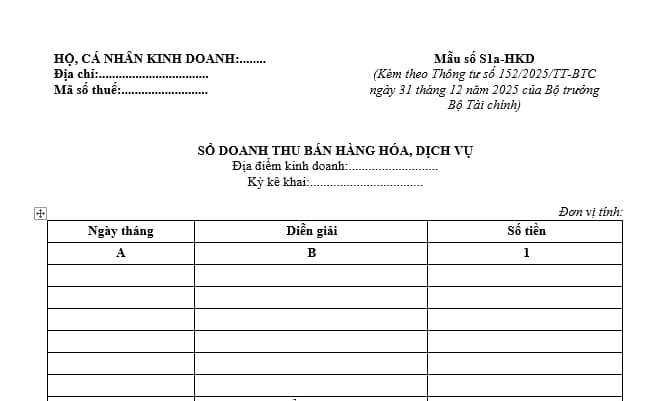

Article 4 of Circular 152/2025/TT-BTC clearly stipulates: Business households and individuals doing business who are not subject to VAT and do not have to pay PIT only need to use the sales revenue book of goods and services (Form S1a-HKD) for recording.

This is the simplest type of accounting book, suitable for small business households, family-scale trading, and personal services.

The purpose of the revenue book is: To monitor the total revenue from selling goods and services; to be the basis for determining when business households exceed the threshold of 500 million VND/year, thereby generating tax obligations; to compare data with tax authorities when necessary.

Circular 152/2025/TT-BTC also specifically guides the method of recording books. A noteworthy point is that it is not mandatory to record costs, and there is no need to create many types of complicated books like businesses. However, business households need to record revenue truthfully and fully to avoid the risk of being taxed when the tax authority inspects.

When will business households have to switch to a higher accounting regime?

If in the year, revenue exceeds 500 million VND, business households will no longer be subject to personal income tax. At that time, accounting and tax obligations will change according to the tax payment method.

According to Circular 152/2025/TT-BTC:

Business households paying VAT and PIT at a rate of % on revenue must apply Article 5, using: Invoices and documents as prescribed; Sales book of goods and services (Form number S2a-HKD).

PIT is calculated based on revenue minus expenses, applying progressive tax rates based on revenue:

Over 500 million to 3 billion VND: 15%;

Over 3 billion to 50 billion VND: 17%;

Over 50 billion VND: 20%.

Even if they are not subject to tax, business households should still record their revenue book right from the start of business; closely monitor revenue by month, by quarter; prepare a plan to convert the accounting regime when revenue increases.

Recording books correctly, fully, and in the correct form according to Circular 152/2025/TT-BTC not only helps business households comply with the law, but also avoids legal risks and tax arrears.

It's a bit of a bit of a bit of a bit of a bit of a bit.