From 2026, business households are required to comply with the process of destroying electronic invoices according to the new data standards specified in Decree 70/2025/ND-CP (amended and supplemented by Decree 123/2020/ND-CP). Acts of arbitrarily deleting files, deleting emails, losing data or destroying inaccurate invoices are considered violations. Business households can be fined up to 20 million VND according to Decree 125/2020/ND-CP, amended by Decree 310/2025/ND-CP.

This change takes place in the context of tax authorities strengthening the management of electronic invoices, especially for household businesses selling goods through e-commerce (e-commerce). According to Decree 91/2022/ND-CP, transaction data from e-commerce platforms, transportation units, electronic wallets and banks are sent directly and periodically to tax authorities, making it possible to detect any errors or lack of invoice data.

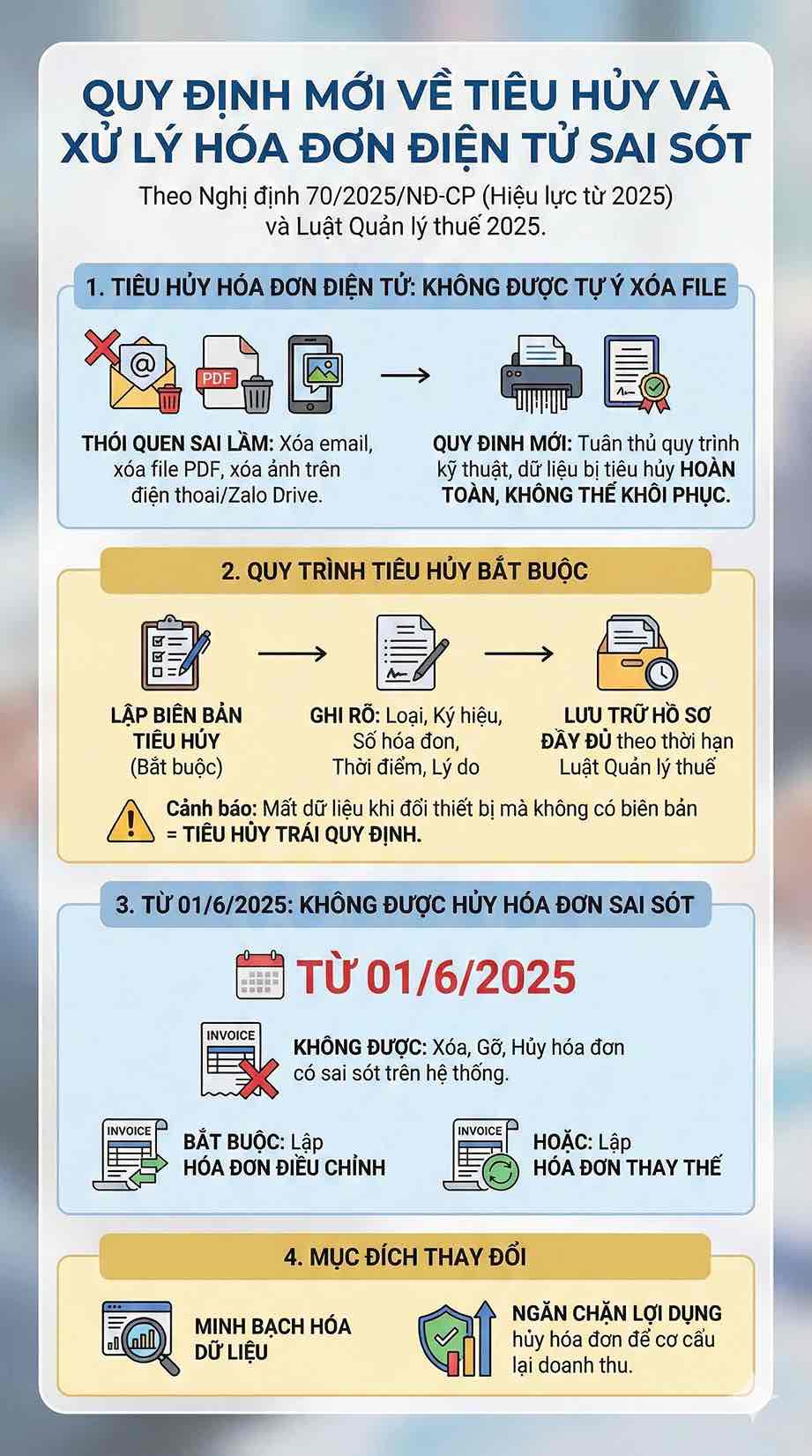

Destroying electronic invoices is no longer about "erasing files

For many years, most business households still maintain the habit of seeing electronic invoice destruction as deleting emails, deleting PDF files or deleting invoices in software. However, when Decree 70/2025 took effect, this process completely changed. Destruction must comply with technical procedures, ensuring that data is completely destroyed and cannot be recovered.

Sellers must make a record of destruction, clearly state the type of invoice, symbol, invoice number, time and reason for destruction, and store complete documents according to the deadline of the 2025 Tax Administration Law. Acts such as removing invoice photos, deleting files on Zalo Drive, deleting items on phones or losing data when changing devices without a record are considered illegal invoice destruction.

According to Clause 13, Article 1 of Decree 70/2025/ND-CP, from June 1, 2025, sellers are not allowed to cancel electronic invoices with errors as before. Invoices with incorrect information are not deleted, removed or canceled on the system. Instead, sellers are required to prepare adjusted invoices or replacement invoices according to the method specified in the decree.

An adjusted or replaced invoice can handle multiple incorrect invoices in the same period if the conditions are met. This change aims to transparentize data, preventing the situation of taking advantage of invoice cancellation to restructure revenue.

Violating the destruction process, the fine can be up to 20 million VND

According to Article 27 and Article 28 of Decree 125/2020/ND-CP, amended by Decree 310/2025/ND-CP, the act of destroying invoices in violation of regulations is penalized in two levels:

- Fine of 4–8 million VND for destroying invoices at the wrong time.

- A fine of 8-20 million VND when destroying invoices not in accordance with regulations, causing data loss or making invoices that cannot be traced.

Cases such as destruction without instructions, mistakenly deleting valid invoices or not making a destruction record can lead to penalties.

The risk is not only in the fine level. When the original data cannot be presented, the tax authority will use data from e-commerce platforms, transportation units and banks to compare, thereby re-determining the entire actual revenue. This makes the act of destroying invoices incorrectly a much greater risk than the initial fine level.

Losing invoice data, business households are easily put under suspicion of tax evasion

From 2026, electronic invoice data will be synchronized in real time with the tax authority, allowing revenue comparison according to each transaction, each order and each cash flow generated in the account. In the context of data being interconnected from e-commerce, banks and transportation units, loss of invoice data is no longer a simple technical error but becomes an unusual sign in revenue declaration.

If the destruction of invoices violates regulations leading to a lack of comparison data, business households may be retroactively charged for all undeclared revenue, specifically:

- Tracking all undeclared revenue,

- Fine 20% of the missing tax,

- Payment delay calculation 0.03%/day,

In case there are signs of intentionally concealing revenue, the act may be considered as a group of tax evasion violations under the 2025 Tax Administration Law. As long as invoice data does not match data from e-commerce or banks, business households may be subject to in-depth inspection.

In the context of increasingly strict data-based tax management, the destruction of electronic invoices is no longer a routine operation. Business households must comply with the correct procedures, use storage format standards and handle incorrect invoices according to adjustment or replacement plans instead of deletion. The habit of "removing is done" now not only leads to high fines but also leads to the risk of tax arrears and in-depth inspection of many tax calculation periods.