Input invoices are a legal basis for determining input costs, tax and financial obligations. Not taking invoices can put business households at risk of many legal and financial risks. When there are no invoices proving the origin of goods, they are easily seen as selling goods of unknown origin when inspected by functional agencies, leading to the risk of being penalized, confiscating goods or being suspected of fraud and tax evasion.

In addition, input invoices are also documents to determine valid costs, helping business households accurately account for revenue, expenses and actual profits. When there are no invoices, these expenses are not recognized, causing incorrect tax declarations, leading to the risk of being recovered or administratively sanctioned.

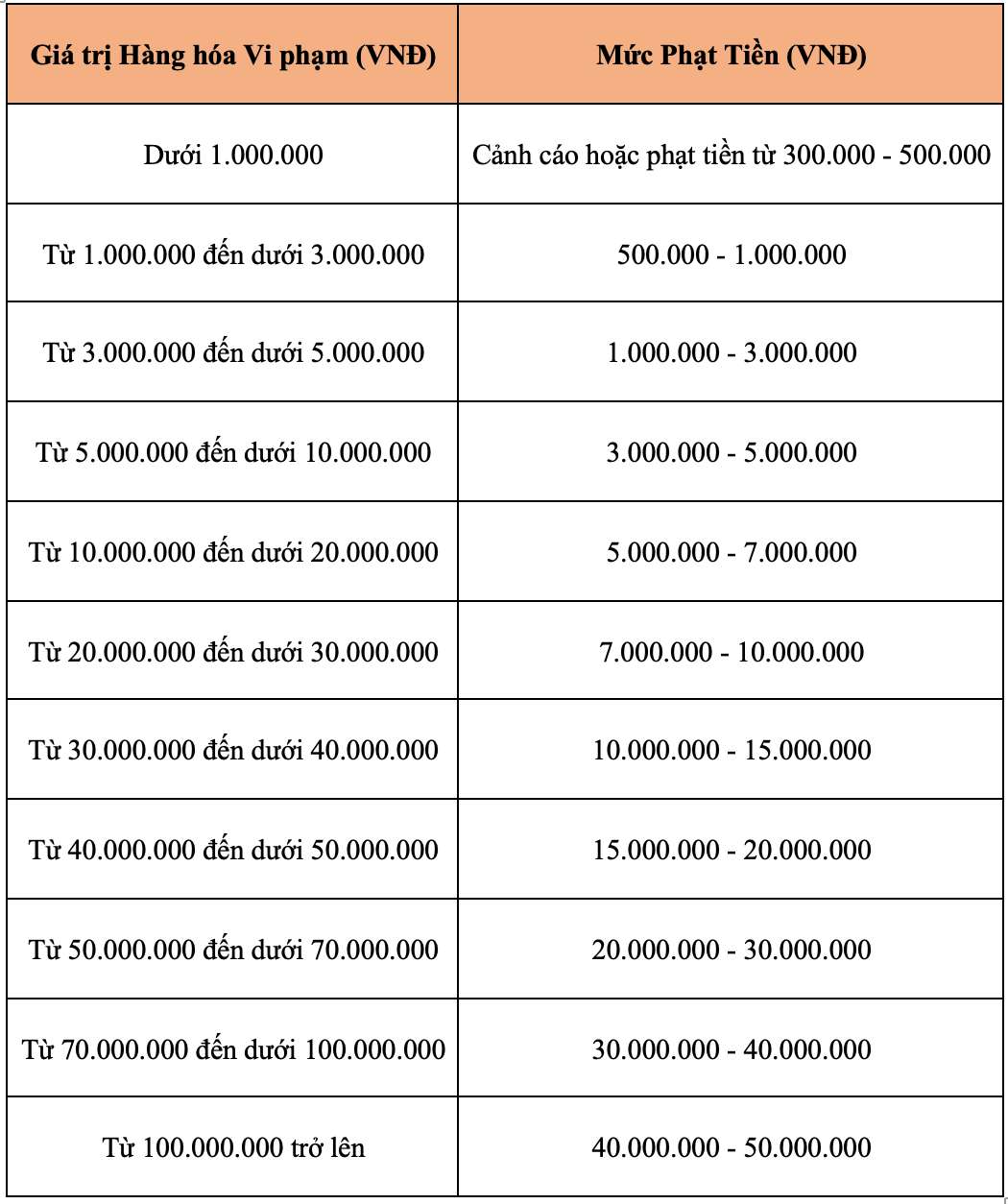

According to the provisions of Article 17 of Decree 98/2020/ND-CP, amended by Decree 24/2025/ND-CP, goods of unknown origin are fined as follows:

- A two-fold fine shall be imposed on the manufacturer or importer who commits an administrative violation or violating goods in one of the following cases:

+ Being food, food additives, food processing aids, food preservatives, disease prevention drugs and drugs, drug ingredients, cosmetics, medical equipment;

+ Being detergents, chemicals, insecticides, antibacterial preparations used in the household and medical fields, aquaculture environmental treatment products, livestock waste treatment products, veterinary drugs, plant protection drugs, fertilizers, cement, growth stimulants, plant varieties, livestock varieties, aquaculture seeds, aquatic feed or minerals that are not ordinary building materials as prescribed by law;

+ Other goods belonging to the list of conditional business lines and occupations.

+ Additional penalty form: Confiscation of exhibits for violations, except in cases of applying remedial measures to destroy exhibits.

Remedial measures

- Forcing the destruction of exhibits of violations that cause harm to human health, livestock, crops and the environment;

- Forced to return the illegal profits obtained from the violation.