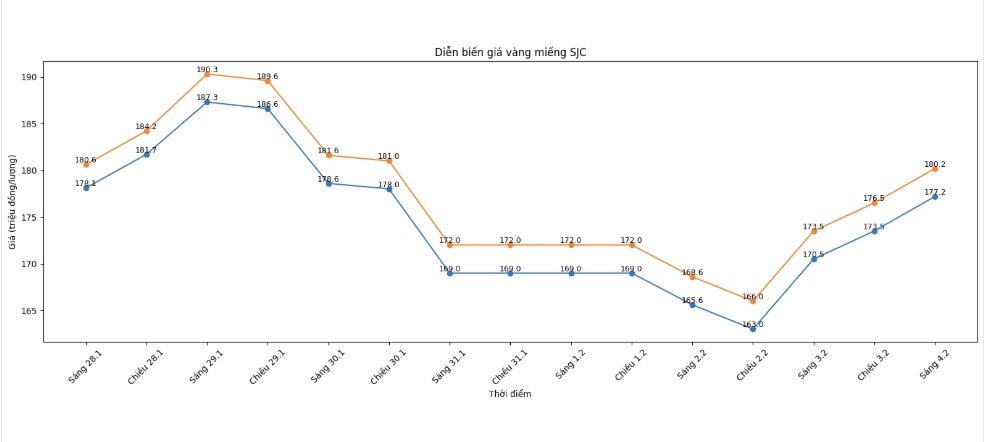

SJC gold bar price

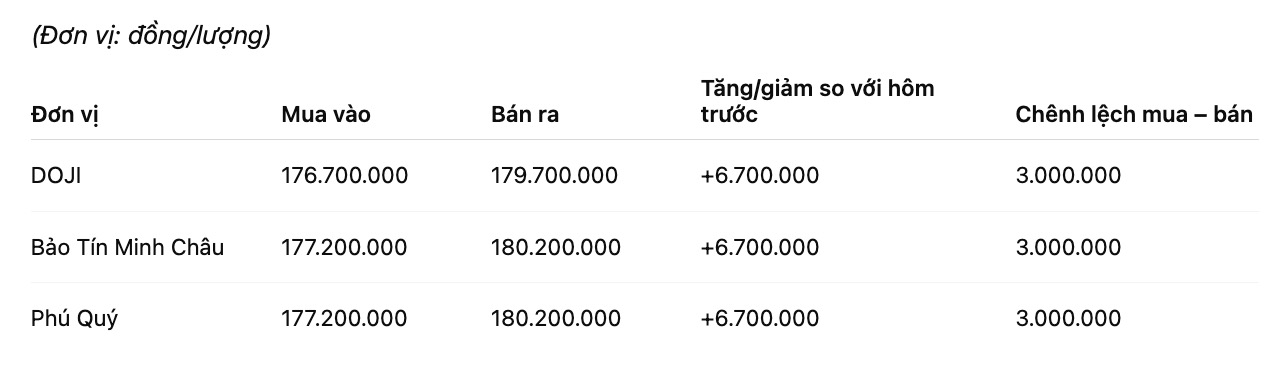

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 177.2-180.2 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

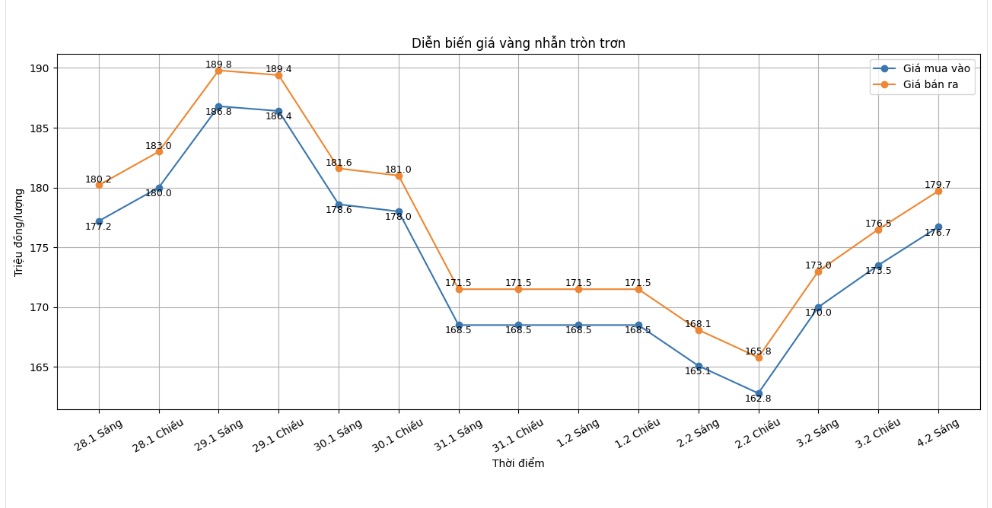

9999 gold ring price

As of 9:30 am, DOJI Group listed the price of gold rings at 176.7-179.7 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

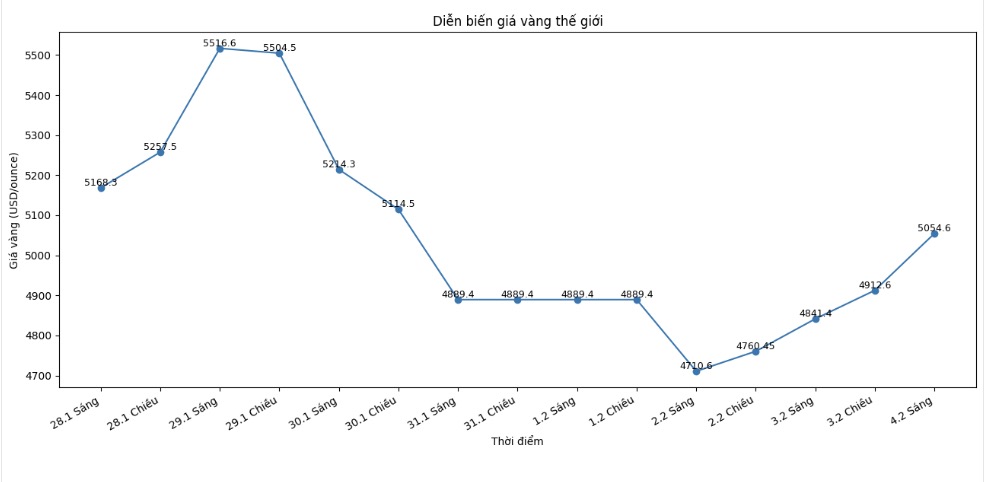

World gold price

At 9:30 am, world gold prices were listed around the threshold of 5,054.6 USD/ounce, a sharp increase of 213.2 USD compared to the previous day.

Gold price forecast

The world gold market is entering a period of volatility with a large amplitude, reflecting the interweaving of cautious sentiment and long-term expectations of investors. The rapid recovery after two sell-off sessions shows that bottom-fishing demand is still clearly present, especially when prices retreat to areas considered important technical support.

Experts believe that the recent deep correction is more of a "relief" than a signal of trend reversal. Previously, gold prices had increased sharply and continuously set new record levels, causing strong profit-taking pressure to accumulate. The sharp price drop in a short time has pulled cash flow back, especially in the context that many foundational factors supporting gold have not changed significantly.

The risk of US monetary policy continues to be a major variable dominating market developments. The US President's nomination of Mr. Kevin Warsh - a figure considered to have a tough stance on inflation - to the position of Chairman of the US Federal Reserve (Fed) has caused expectations of monetary easing in the short term to decline. However, many analysts believe that even in the scenario where the Fed maintains a cautious stance, gold still maintains its defensive role against inflation and financial risks.

Mr. Bart Melek - Head of Commodity Strategy at TD Securities - said that inflation is still higher than the target, global public debt continues to increase, while investors tend to look for havens outside of stocks, bonds and legal tender. According to him, these factors still lay the foundation for the need to hold gold in the medium and long term.

From the perspective of the physical market, gold buying demand is expected to improve after the Lunar New Year holiday in Asia - the world's largest gold consuming region. This is considered an important factor helping gold prices consolidate a new level, after a period of strong fluctuations recently.

Mr. Philip Newman - Director of Metals Focus - said that gold still has the opportunity to move up to higher price zones this year, but the upward momentum will not take place in a straight line but will be accompanied by deep corrections.

In that context, gold is still considered a potential investment channel, but requires investors to be more cautious with short-term buying and selling strategies, especially when the fluctuation range and price difference are still high.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...