Applying the method of tax declaration and self-payment

According to sub-section 2.2 Section 2, Part I, Article 1 of Decision 3389/QD-BTC, the Ministry of Finance clearly defines the target as follows:

- Legal documents and guiding documents related to tax management of business households are supplemented or newly issued according to plan.

- Ensure that business households apply self-declaration and self-payment of taxes from January 1, 2026.

- Simplify, cut at least 30% of the time for handling administrative procedures, at least 30% of compliance costs and continue to cut sharply in the following years in accordance with the spirit of Resolution No. 68-NQ/TW.

- Ensure that 100% of business households have access to information and receive support from tax authorities on the content of converting from the contract tax method to the declaration method, converting from business household to enterprise.

- Ensure that 100% of subjects subject to electronic invoices generated from cash registers according to Decree No. 70/ND-CP of the Government must register and use them.

- Ensure that 100% of business households carry out tax procedures electronically conveniently and easily.

Accordingly, from January 1, 2026, business households will officially switch from the contract tax method to the method of declaration and self-payment of taxes.

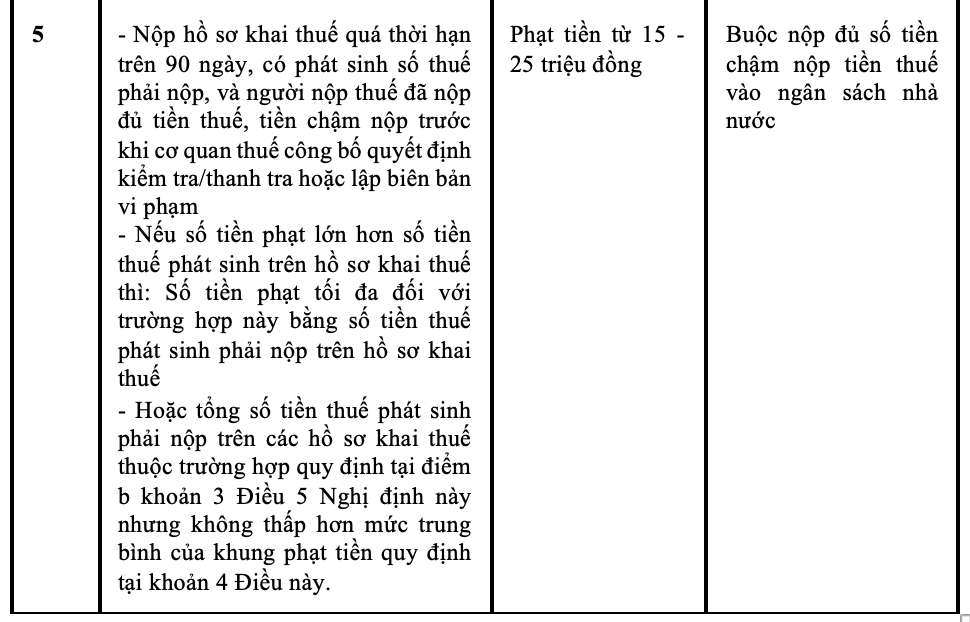

Penalties for late tax declaration in 2026

According to Article 13 of Decree 125/2020/ND-CP amended and supplemented by Decree 310/2025/ND-CP, the penalty for late tax registration is as follows:

In addition, Clause 5, Article 5 of Decree 125/2020/ND-CP stipulates: For the same administrative violation of taxes and invoices, the fine for an organization is twice the fine for an individual.

In addition, according to Clause 2, Article 59 of the Law on Tax Administration, No. 38/2019/QH14 amended and supplemented by Law No. 56/2024/QH15:

- The late payment fee is 0.03%/day calculated on the late payment tax amount.

Fine amount = Late payment tax amount x 0.03% x Number of days of late payment

In which:

- Number of days for late payment of fines including holidays and days off.

- The time for calculating late payment fees is calculated continuously from the day following the last day of the tax payment period, the tax payment extension period, the period stated in the notice or decision on tax fixation or decision on handling of the tax management agency to the day immediately preceding the date the tax debt amount, tax refund, additional tax, tax fixed, and late transfer tax are paid to the state budget.