16:38: Ms. Le Thi Thuy Ha - Director of Digital Lending Project - MBBank Digital Banking Block:

Digital transformation in the banking sector has been a great opportunity to simplify the loan process, improve customer experience, and at the same time meet the requirements of cutting administrative procedures. In that picture, electronic customer identification (eKYC) and digital signatures are set as two key factors, deciding the ability to successfully deploy online lending products.

Currently, MB to provide online banking products or online banking services, especially online loan services, we are deploying 2 APP platforms MBBank and Biz MBBank.

On the MBBank APP platform, we are serving more than 33 million individual customers. Of which, 100% of individual customers who opened online banking accounts and services on channels were successfully collected with eKYC's accurate birth documents; 100% of unsecured consumer loans (unsecured consumer loans) had been registered and fully disbursed online; 90.8% of production and business loans had been disbursed online, with accumulated sales of more than 165 trillion VND in the first 8 months of 2025.

On thebiz MBBank platform: We are currently serving more than 350,000 corporate customers. Of which, 100% of micro- small enterprises (Micro SME - mSME) receive and disburse capital throughbiz MBBank. All online loan transactions on both APP MBBank and Biz MBBank use electronic contracts with digital signatures, ensuring legality and customer experience.

To achieve this result, MBBank has implemented many synchronous solutions.

First of all, it is the Technology solution. For technology, the eKYC tool is the key to opening the digital journey. If customers previously had to go directly to the transaction counter, submit documents and sign a request to open a Payment Account, now eKYC allows online identification by:

Identify customers online, without having to meet in person, thanks to biometrics for facial recognition, AI for document recognition, and match data with the national population database - VNeID to confirm identity quickly and accurately.

Integrating the most advanced security technologies applied by MB to be able to detect fraudulent acts such as: fake identification documents images, creating fake videos using deepfake technology, detecting camera infect or virtual camera techniques ... significantly reduce the risk of fraud.

In addition to applying eKYC to open an Account, MB applies a solution to improve security for high-risk transactions such as: Login to devices, large-value transactions, Online deposits, etc.

In addition to eKYC, Digital signatures are the legal platform for Electronic Contracts.MB has cooperated with partners to provide Digital signature solutions licensed by the Ministry of Information and Communications, implemented in accordance with the provisions of the Law on Electronic Transactions 2023 (effective from July 1, 2024).

If previously, Customers had to sign 2-3 sets of paper documents for each loan, now they only need one touch to sign a number on the APP/biz MBBank platform;

With the digital signature, MB has signed all online loan credit documents in the form of an electronic contract. Customers, Repa amounters and MB use digital signatures to authenticate the Contract on APP MBBank. Digital signatures accurately identify the borrower as the person performing the transaction.

Without these two tools, the online lending process will forever stop at the "online sale" level - that is, customers fill out online forms, but still have to go to the counter to sign and complete the application.

Regarding the entire digital loan process, a full online lending process at MB includes: Customer identification: eKYC checked in for 2 minutes on APP MBBank; loan proposal: APP MBBank automatically suggests suitable loans. Customers enter basic information; appraisal & Approvement: MB system is responsible for checking conditions, scoring credit, making automatic approval decisions; signing electronic contracts: Automatic system for drafting electronic contracts, Customers use digital signatures to confirm transactions; disbursement: money is immediately disbursed to the beneficiary's account as prescribed by the Customer.

The entire process takes just a few minutes, bringing a truly digital experience to customers.

With this model, the benefits for customers are quite large. Quick transactions: the process from identification to signing and package disbursement is limited to a few minutes, no need to meet. Application, smooth - seamless experience: all operations are done on smartphones, no cumbersomeness;

Ensure safety - Security: manufacture the correct identification of the customer performing the transaction, digital signature with paper value, ensuring contract integrity.

At the same time, it helps customers have a wide range: even for customers where the banking network is not yet available.

For banks and the financial system: Streamlined procedures, saving operating costs; transparent data, easy to check, reducing fraud; meeting the Prime Minister's direction: cutting procedures, speeding up disbursement.

The application of eKYC and digital signatures has helped MB digitize the entire online lending process, bringing a digital experience to customers, creating value: Quick - Safe - convenient. This is a step forward to contribute to promoting comprehensive finance and improving the competitiveness of the banking industry in the digital age.

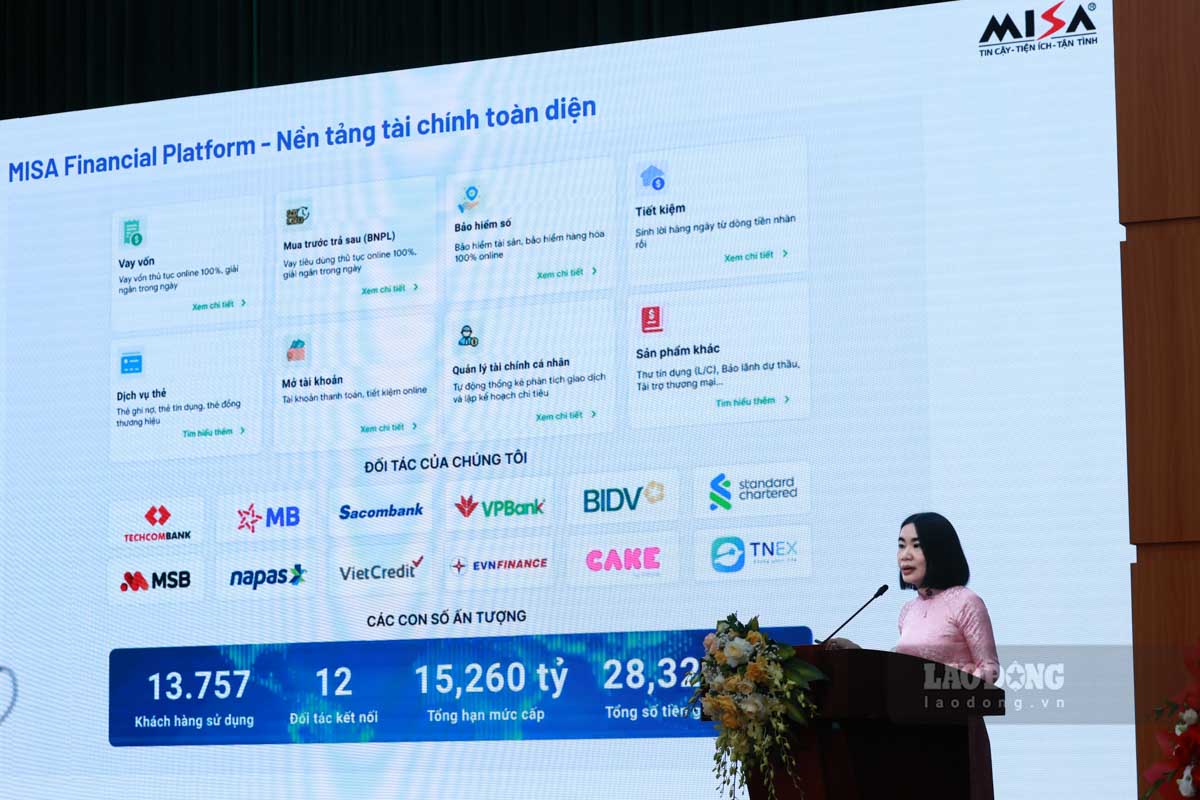

16:32: Ms. Nguyen Thi Ngoan - Finance Director of MISA Lending:

In traditional loans, small and medium-sized enterprises (SMEs) are facing many difficulties. The dossier is often incomplete, with too many documents, accounting books and financial reports lacking transparency, hindering the approval process. Loan procedures take a lot of time, can last from several weeks to a month, leading to costly costs and loss of business opportunities, many missed contracts, limiting production and business activities. In addition, businesses still have difficulty accessing suitable loan products such as mobile loans or invoice loans, making capital mobilization ineffective.

On that basis, Ms. Ngoan commented that online loans, unsecured deposits, and unregulated documents are the main trends and keys to removing bottlenecks for the capital needs of employees. This solution allows for complete digital transformation of the process, without paper documents and 100% online. The disbursement also took place quickly, within just 24 hours instead of lasting for many weeks as in traditional lending; without collateral but instead with digital data-based assessments.

15:45: Associate Professor, Dr. Dang Ngoc Duc - Director of the Institute of Financial Technology, Dai Nam University

Online lending is a product or result of the digitalization of traditional lending processes of commercial banks. Thanks to the application of technologies such as electronic customer identification (eKYC), application of artificial intelligence (AI) in credit rating, Big Data analysis, electronic contracts... online lending completely automates the stages of credit appraisal, approval and disbursement, thereby saving time on loan application processing, reducing operating costs and expanding access for borrowers.

Online lending in today's era has many advantages. First, online lending helps commercial banks expand their retail credit market share. Online lending allows commercial banks to reach individual customers, small and micro enterprises, which is a very potential and large-scale market in the economy of every country. Online lending allows banks to reach new customers, especially the younger generation, those who prefer to use high technology and individuals who have never used traditional banking services. Online lending helps remove geographical barriers and administrative procedures, especially useful for customers who have no credit history or live in remote areas.

Second, optimize operating costs and improve lending efficiency of commercial banks. Many commercial banks use an automatic loan opening system (RLOS), allowing for application processing in a very short period of time, even just a few minutes. This not only improves customer experience but also reduces operating costs, human resources and paperwork.

Third, based on the exploitation of big data (DA), the support of artificial intelligence (AI) and the Internet of Things (IoT) has helped the risk management of commercial banks become more effective. Online lending is essentially a digitalization of the lending process, but it is also a change in the way credit risk is measured and assessed. Instead of relying on paperwork and passed data, online lending with the support of new technology, banks can not only analyze consumer behavior, transaction history, social network data to assess the ability to repay debts in real time but can also predict the potential risk level of each customer, allowing personal loans with the most suitable conditions and risk management methods.

Fourth, online lending plays an increasingly important role in promoting the comprehensive financial strategy of countries, especially in developing countries. Online lending contributes to promoting financial inclusion an important goal in sustainable economic development of almost every country.

Fifth, online lending will contribute to raising awareness of personal responsibility and community spirit of people as well as businesses.

In recent times, especially in the past 10 years, online lending has become one of the fastest growing segments in the global financial industry. According to the global analysis and forecast report for the period 2019-2029 of Mordor Intelligence (2024), the scale of the global digital lending market (including online lending from commercial banks and P2P lending) is expected to reach 889.99 billion USD by 2029, up from 507.27 billion USD in 2024, with an average annual growth rate (CAGR) of 11.9%. Agreeing with the above report from Mordor Intelligence, reports from McKinsey (2024) and Ernst & Young (2023) also show that in the context of strong digital transformation taking place in almost all countries, consumers increasingly expect a digital experience, while banks need to restructure operating models to compete with financial technology companies (Fintech). Accordingly, commercial banks have increased the use of data and artificial intelligence to personalize financial services in general, including online lending.

With the State Bank's orientation to increase online lending, it can be expected that this type of lending will continue to be expanded, especially in the field of consumer loans, SMEs and MSMEs loans, especially non-guaranteed loans. The trend of online lending is not only an opportunity, but also a strategic solution for commercial banks to approach and dominate the market segment with the largest scale and potential of the Vietnamese economy in the digital financial era.

The legal basis for online lending of Vietnamese commercial banks is gradually being completed, creating a solid foundation for the widespread implementation of credit granting in the digital environment. The two most important legal documents can be pointed out, Circular 06/2023/TT-NHNN issued by the State Bank, amending and supplementing Circular 39/2016/TT-NHNN, in which for the first time specifically regulating lending activities by electronic means. Second, Decision 810/QD-NHNN on digital transformation of the banking industry by 2025, with a vision to 2030, also plays a strategic orientation role, setting a target of having at least 50% of retail loans implemented in the digital environment by 2025. The completion of this legal corridor helps commercial banks feel secure in implementing digital credit products, while ensuring transparency, safety and efficiency in credit granting activities.

It can be seen that these are important legal bases, creating a corridor for commercial banks to implement completely digital lending processes, including eKYC, electronic contracts, and online disbursement... allowing credit institutions to lend online without having to meet customers directly. The loan contract can be signed electronically, using a digital signature or electronic signature. The lending process includes: eKYC, automatic application approval, and disbursement via digital account. Expanding the lending scope to serve living needs such as buying a house, renovating a house, and transferring land.

The report of the State Bank of Vietnam (2024) shows that as of March 2024, credit institutions have implemented online lending, with an approval period of only 13 days, in which some typical products are provided by commercial banks. Vietnam in the period of 2021-2025 shows that commercial banks have digitized the process of implementing online unsecured loans, installment loans, savings books... with a completely online process. The demand for online loans is increasing, as people are increasingly familiar with digital transactions, especially young customers, small businesses and freelancers. By 2025, online lending has become an indispensable part of the digital financial ecosystem of commercial banks. Many banks recorded outstanding growth rates from digital channels far exceeding expectations, while expanding the scope of service to rural areas and remote areas - places that previously had difficulty accessing traditional financial services. Integrating artificial intelligence (AI), Big Data and machine learning into the credit approval process helps reduce risks, speed up file processing and improve customer experience. It can be said that the period of 2021-2025 is a pivotal period, laying the foundation for a stronger, more transparent and comprehensive digital credit market in the coming years.

According to the State Bank's Report by the end of 2024, there are only less than 20 credit institutions implementing online lending, of which Tien Phong Commercial Joint Stock Bank (TPBank), Vietnam Prosperity Joint Stock Commercial Bank (VPBank), Military Commercial Joint Stock Bank (MB), Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) and Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) are the pioneers. Strong growth in online lending thanks to digital transformation of the online banking lending industry has become one of the bright spots of the digitalization of the financial - banking industry in Vietnam and the forms of online lending implementation are increasingly diverse when compared to online lending models in Vietnam.

Analysis of the online lending situation of Vietnamese commercial banks shows that although it has been identified as an inevitable trend, with a rapid development rate in the period of 2021-2025 and there is still a lot of potential/ space for development, online lending of Vietnamese commercial banks is still facing many difficulties and challenges, which need to be identified as follows:

First, legal challenges and risk control requirements. Circular 06/2023/TT-NHNN is considered an important milestone in legality, but many regulations related to electronic contracts, dispute handling, personal data protection and customer authentication have not been fully issued, so the determination of legal responsibility when a dispute arises is still vague.

Second, the lack of data and technology to analyze customer behavior, high credit risk and fraud. One of the advantages of online lending is the ability to serve customers who do not meet normal lending standards in terms of both collateral and credit history. While the credit scoring system of many banks still only relies on traditional data, it has not effectively exploited non-financial data such as consumer behavior, social networks or telecommunications data. This reduces the accuracy of online application approval.

Third, awareness and limitations of customer trust. In Vietnam, in addition to customers who are not well aware, many customers are very hesitant/concerned about the legality of electronic contracts, the security of personal information and the ability to support when disputes arise, because as mentioned above, there are currently no detailed regulations on electronic contracts, digital signatures, and online loan data storage.

Fourth, competitive pressure from Fintech companies and non-bank financial institutions. Providing online lending services, electronic payments and invested finance, Fintech Vietnam companies such as MoMo, Tima, or P2P Lending platforms are developing strongly, providing fast, flexible loan products, without collateral. This creates great pressure for commercial banks that have a strict risk control process and strict compliance with the regulations of the State Bank.

To promote the sustainable, effective and safe development of online lending, Vietnamese commercial banks need to have synchronous solutions between technology - engineering and finance. Based on the difficulties and challenges presented above, 5 key recommendations can be studied and implemented by management agencies and commercial banks to remove existing barriers and facilitate the development of online lending for Vietnamese commercial banks in the coming time as follows:

First, perfect the legal framework and promote a controlled testing mechanism: Supplement regulations related to electronic contracts, customer authentication, data storage, dispute handling and personal information protection. The issuance of a separate legal framework for the P2P Lending model is also a necessary step to facilitate the commercial banks to expand to a new form of credit granting. Although there is a controlled testing mechanism (sandbox) according to Decree 94/2025, there should be detailed instructions and a strict monitoring mechanism while encouraging commercial banks to participate in testing new digital lending models, thereby assessing risks and effectiveness before mass deployment.

Second, increase investment and application of digital technology in the entire lending process: MVs need to upgrade the core banking system, integrate AI, Big Data, machine Learning, Blockchain, AI and IoT to automate the approval process, risk management and personalization of loan products.

Third, proactively and actively cooperate strategically with reputable Fintech: commercial banks strengthen linkages with technology companies to take advantage of platforms, algorithms and data to optimize the lending process. The multidimensional connection will help the bank expand the market and improve operational efficiency. On that basis, develop a digital financial ecosystem to integrate online lending with other services such as payment, insurance, and investment to create a seamless (comprehensive) experience for customers. This helps increase the retention rate and expand the transaction value with customers of the Bank and Fintech's customer platform to increase market share on the basis of clear cooperation in security, authentication and data sharing.

Fourth, enhance communication activities, raise awareness of customers.

Fifth, training and retraining to develop human resources to meet the requirements of online lending development. Bank branches need to focus on improving professional capacity, digital thinking and online credit system management skills for banking staff, from management level to professional staff. At the same time, form a workforce capable of interdisciplinary coordination between finance, technology and risk management on the basis of training and retraining human resources.

Online lending is an important step forward in the process of financial digitalization, bringing many benefits in terms of time savings, costs and especially increasing financial access. However, to make this form truly effective and sustainable, there needs to be synchronous adjustments in legal and state management, infrastructure investment strategies and technology application in lending activities of commercial banks. Moreover, the development of online lending cannot rely solely on technology, but must be placed in a safe, transparent and responsible digital financial ecosystem.

Therefore, the development of online lending needs to be carried out with strict control of personal data security and transparency of the credit approval process based on the responsible application of technology, avoiding unconscious favor and ensuring fairness in access to capital. Finally, the formation and development of a team of personnel with the capacity to deploy and operate the online lending system effectively, safely and creatively is still a decisive factor, not only minimizing operational risks, fraud and errors in the digital credit granting process but also rapidly increasing the speed of new product implementation, improving customer experience and enhancing the competitiveness of commercial banks in the digital era.

15: 15:5: Mr. Vu Ngoc Son - Head of the Department of Research, Consulting, Technology Development and International Cooperation, National Cyber Security Association:

Recently, cybersecurity issues for cross-border payments have been heating up. Today, I will present a speech on cybersecurity risks and personal data violations in international payments - Current situation, causes and experience in prevention

In the digital age, international payments are increasingly becoming an important driving force for global trade and investment. Systems such as SWIFT, international credit cards, cross-border e-wallets and fintech services help transactions be quick, convenient and connect millions of businesses and individuals around the world.

However, along with this boom, cybersecurity risks and personal data breaches in the international payment sector are also increasing. The attacks not only caused financial losses of hundreds of millions, even billions of USD, but also undermined user trust and had a profound impact on global economic and financial security.

The most common driver of hackers is financial interests, when they directly appropriate money, steal credit card data or exploit e-wallets for profit. In addition, transaction data and personal information in these systems are very valuable in the underground market, and can be used for fraud, blackmail or sale to other criminal organizations. Some attack groups also have political or sabotage motives, aiming to lose confidence in the global financial system, undermine the reputation of the country or organization.

In addition, the complex nature and multidimensional connectivity of international payment systems make them susceptible to security vulnerabilities, while the level of security between countries is uneven.hackers also take advantage of the huge transaction volume to launder money or hide traces, making it difficult to detect unusual transactions.

Cybersecurity risks in international payments:

Fraud and fake (Phiming, Spoofing): hackers often send emails, messages or create fake websites of banks to steal login information, thereby breaking into accounts and conducting cross-border transactions.

malware (Malware, ransomware, Trojan): When Hacking the payment system, the malware can record keyboard operations, change the account number in the money transfer order or encrypt all data to claim a ransom, disrupting global operations.

Account misappropriation and transaction fraud: hackers can take control of bank accounts or SWIFT systems to issue fake money transfer orders. This is a form of attack that causes direct financial damage and is difficult to recover because transactions often go through many intermediary banks.

Leaked personal data and financial information: Credit card information, account numbers, KYC data are often stolen and sold on the "black market" (dark web). Users are taken advantage of to open fake accounts, borrow money or make fraudulent transactions.

Supply chain and third-party attacks: Modern payment systems rely heavily on fintech service providers, payment gateways, and connection APIs. A vulnerability from a third party could pave the way for hackers to penetrate the entire system.

DDoS attack: Some major payment systems such as Visa, Master card, PayPal were temporarily paralyzed by DDoS, disrupting global transactions, directly affecting the economy and user trust.

Over the years, the world has witnessed many serious cyber attacks directly related to financial and banking activities. There are cases of hackers breaking into international payment systems, forging money transfer orders, causing tens of millions of USD in damage. There was a case of personal data of hundreds of millions of users being leaked, causing them to face the risk of identity theft for many years. Even airlines and online service providers have become targets, exposing customers' credit card information and leading to record fines.

Notably, not only banks or businesses are directly affected, but even third-party software providers have become a weak link in the supply chain, creating conditions for hackers to attack a series of organizations on a global scale. These events show that cybersecurity in the financial and banking sector is not "untouchable" and requires countries and businesses to invest more heavily in system security as well as protect user data.

Causes of the incidents include 5 main causes:

1. Technical loopholes: delay in patching errors (Equifax), lack of transaction supervision (Bangladesh Bank). Many incidents in the world have occurred due to this cause.

2. Human factors: employees being scammed, weak security management. After patching the error, there are still loopholes from users themselves, such as clicking on fake emails...

3. Complex supply chains: dependence on third parties (SolarWinds) causes risks to spread. If this supply chain is attacked, it will pose many risks to the security and security system. There have been many incidents in the world.

4. Legal differences and international regulations: some countries are lax, used as intermediaries. Vietnam has specific regulations and specific laws on personal data protection, but not all countries in the world strictly implement this.

5. Lack of investment in cybersecurity: many organizations, especially in developing countries, do not take investment in security seriously. Cybersecurity can take down an entire organization's foundation, which will seriously affect the reputation of the organization. If we do not invest in strong security, this risk will be very high.

Lessons learned and solutions:

First of all, for financial institutions and businesses: It is necessary to update and fix emergency software errors, apply multi-factor authentication (MFA); build an unusual transaction monitoring system using AI, control risks; need to periodically audit and evaluate the security of partners and third parties, to ensure all connections are safe; train staff to raise awareness of cybersecurity.

For individuals: Users need to be careful when receiving strange emails and messages related to international payments; avoid using public Wi-Fi when making financial transactions; use virtual cards or limited electronic wallets to reduce risks.

In terms of legality and international cooperation: The urgent need to build and perfect a strict legal framework on personal data protection (such as GDPR) needs to be promoted; strengthen international cooperation in sharing network intelligence; establish a cross-border emergency response mechanism when incidents occur.

At the end of the presentation, Mr. Son emphasized that international payments are the lifeline of the global economy, but also an attractive target for cybercrime. The above cases have shown major loopholes in international financial security: from central banks, credit institutions, service enterprises to third parties in the supply chain.

The lesson learned is that no system is absolutely safe. Only by synchronously combining advanced technology, strict security governance, human training, a clear legal framework and international cooperation, can we effectively protect personal data and ensure safety and sustainability for the global payment system.

14:55: Associate Professor, Dr. Pham Thi Hoang Anh - Deputy Head of the Board of Directors (Banking Academy) - said that Border trade payment, unlike cross-border payment, is a transaction serving trade activities taking place in border areas between countries sharing land borders. This activity has outstanding characteristics such as limited geographical scope, subject to adjustment by specific legal regulations and based on mutual support between two or more border countries.

In addition, border payments often have low transaction costs and are flexible in using foreign currency or national currency, facilitating trade and trade in border areas.

Conditions for organizing Border Trade Payments include many key factors. First of all, there needs to be a developed and adequate payment and transportation infrastructure to ensure transactions are carried out smoothly during the payment process. In addition, the legal system must be clear, with documents regulating and bilateral agreements on border payment mechanisms and processes. Close cooperation between commercial banks, payment intermediaries and management agencies also plays an important role, helping operations run safely and effectively. In addition, the human resources team needs to have enough capacity to operate the payment system and process international transactions. Finally, the application of information technology and automation to payment operations will improve speed, accuracy and risk control capability.

According to Associate Professor, Dr. Pham Thi Hoang Anh, the legal framework related to border payments between Vietnam and border countries focuses on a number of contents such as:

Regarding subjects with border payments, all organizations and individuals with business registration ( partners) are allowed to export goods across the border, in addition to border residents. The export of goods can be carried out at all border gates as well as border openings.

Regarding the type of currency in border payments, the general principle allows the use of free foreign currency, Vietnamese Dong or the currency of a country with a common border. Specifically, for Vietnam - China, VND or CNY is under Article 13 of Circular 19/2018 (no free foreign currency conversion); for Vietnam - Cambodia, VND and KHR are used through banks licensed in border areas under Articles 5, 6, 7, Decision 17/2004/QD-NHNN; for Vietnam - Laos, VND, LAK or free foreign currency conversion.

Regarding banks providing services in border payments, Vietnam - China: only banks allowed to have branches operating in border provinces bordering China are provided with CNY payment services; In case banks are allowed to operate foreign exchange without branches in border provinces, they can make CNY payments according to the entrustment mechanism for banks allowed to have branches in border provinces to make CNY payments. Vietnam - Cambodia: banks are allowed to operate foreign exchange (free foreign currency conversion); banks are allowed in border areas (VND and KHR. Vietnam - Laos: no difference between banks providing payment services in border provinces or outside border provinces.

Regarding payment methods, the general principle includes many forms such as payment via bank (L/C border crossing, goods crossing, goods crossing, goods crossing, customs clearance fee exchange, internet banking, QR code...), cash payment and goods exchange payment, creating flexibility in border trade.

Ms. Hoang Anh added that the mechanism of payment via QR code and payment using local currency between Vietnam and other countries is very convenient. For example, Vietnam - Laos: SBV and BOL have launched a cooperation framework on domestic currency payments and retail payment connections via QR codes (January 2025); Vietnam - China: In 2024, NAPAS signed an MoU with UnionPay International to expand QR code interaction; In 2025, "Cooperation Agreement on enhancing payment connections via QR codes between Vietnam and China" between: ICBC, UnionPay, NAPAS and Vietcombank; Vietnam - Cambodia: Cambodia is promoting agreements with Vietnam and Laos to use Riel coins in economic activities via QR codes linked to domestic payment systems; ASEAN - More extensive linkage: ASEAN Integrated QR Code Payment System initiative has opened a way to promote payment connections between many countries, including Vietnam (Vietnam), Laos (Vietnam) and Laos (Vietnam - Cambodia).

Associate Professor, Dr. Pham Thi Hoang Anh said that border payments still have many potential risks such as dependence on the economies of neighboring countries, related to national monetary security, exchange rate fluctuations, cross-border money laundering risks, risks in the payment process and policy changes of participants. In particular, a major risk is illegal money transfers, such as creating fake documents or late submission of customs declarations...

On that basis, Ms. Hoang Anh recommended strengthening the legal framework and operating mechanism for accepting multi-way QR codes; synchronizing technical standards, such as QR codes must have clear identification signs to avoid confusion between "money transfer" and "payment"; promoting connectivity between systems; building a coordination center (hub) that can be chaired by NAPAS, playing the role of a technical " cau" between countries to optimize the connection of the QR code system; strengthening inspection and supervision of banking - fintech activities to quickly handle incidents and ensure transaction safety; at the same time promoting the formation of an ASEAN-level joint venture or CLV triangle specializing in digital border payments.

14:38: Mr. Nguyen Hoang Long - Deputy General Director of Vietnam National Payment Joint Stock Company (Napas):

We are living in a world of rapid change. The market is constantly changing, traditional business and payment models no longer maintain the advantage as before. Many experiences that were very successful in the past may no longer be suitable.

In that context, Asian countries especially China have advanced a lot in the field of digital payments. In China, cashless payments have taken over, making cash almost disappear in daily life. People can travel across the country, from big cities to small towns, from supermarkets to sidewalk eateries, just by using domestic payment applications on their phones.

I had the opportunity to witness this firsthand during my recent business trip to China. Even though I carry an international card, I still cannot pay for the store at the shopping mall. Sales staff do not accept international cards, do not have a card scanning device, and only accept payments via domestic e-wallets. In the end, I had to use cash to pay. Such situations make us more aware that: traditional payment methods, including international cards, are no longer an effective means in many markets, especially in China.

Returning to Vietnam, the current payment ecosystem is still scattered: international cards, domestic cards, e-wallets, QR codes... exist in parallel but do not have effective cross-border connections. International tourists, especially those from China, Thailand, Korea... still face many difficulties when spending at small stores, markets, and sidewalk cafes - places that have not yet accepted cross-border digital payments. Meanwhile, Vietnamese businesses have not been able to make the most of the spending flows of international customers due to the lack of compatible payment infrastructure. This not only creates barriers for tourists but also causes Vietnamese businesses to miss a large amount of spending from foreign tourists. Therefore, connecting cross-border payments is an urgent requirement if we want to develop tourism, services and digital trade.

Popular cross-border payment methods and models are via cards and through bank accounts, currently mainly through QR codes.

Since 2022, we have begun to strongly shift direction, promoting bilateral payment connections between Vietnam and countries in the ASEAN region. We have deployed connections with Thailand, Cambodia, Laos, Indonesia, Singapore... to facilitate people from both sides to pay directly in each country's domestic currency.

At the present stage, we are completing the connection with China. This will allow Chinese tourists to use their domestic banking apps and accounts to pay directly in Vietnam. The system is expected to be tested in the last three months of this year.

At the same time, we are also coordinating with the Chinese side to prepare technical infrastructure for the opposite direction - that is, allowing Vietnamese users to use domestic bank accounts and applications to pay in China. The goal is to officially implement it from the beginning of 2026. This implementation received strong support from partners. Recently, we had a meeting with representatives of the People's Bank of China (PBoC) of Guangxi province to discuss cooperation in technical and communication support for the new system. They also committed to supporting the pilot implementation of this payment service at major tourist destinations such as Cao Bang, Lang Son border gate or in Nam Ninh, Quang Tay... to serve tourists.

For payment companies from 6 countries in the ASEAN region, we will sit together to analyze the difficulties in connecting. Connecting bilateral payments will bring many practical benefits. International visitors can easily spend in Vietnam with familiar tools, contributing to increasing tourism revenue. Direct trading between the Vietnamese Dong and the local currency of your country helps users reduce the cost of converting foreign currencies, not depending on a third currency, while reducing exchange rate risks to help countries in the region increase autonomy.

We are strongly promoting the implementation of payment cards with widespread connectivity, both domestically and internationally. If we continue to make continuous efforts, not only in education but also in the thinking of developing the digital economy, this will be a big step forward to bring Vietnam deeper into the global market. This card system is guaranteed to be flexible. In the country, cards will act as a means of domestic payment. Overseas, users can still use this card like other international cards.

This brings great benefits to consumers and businesses: just need an account, a card, users can pay anywhere, anytime, both domestically and internationally. This is a breakthrough in the journey of digitizing the payment system, helping Vietnam catch up with the global trend.

However, to do this, the focus must be on building modern payment connection infrastructure, ensuring connectivity between banks, financial institutions, businesses and technology platforms. We are also promoting cooperation with payment institutions of countries in the region to create a safe, simple and effective transnational payment channel. All differences between existing systems will gradually be resolved by connecting and standardizing. The goal is not only to create a strong card system for Vietnam, but also to build regional competitiveness and elevate the position of the Vietnamese currency in the international market.

When this system is completed, not only large businesses, but also small stores and local brands can easily accept payment via QR code from international tourists.

From there, people, businesses and the national economy will be more proactive, no longer dependent on foreign intermediaries. This is the way to enhance autonomy, strengthen market share, and enhance Vietnam's digital economic position in the region and the world.

14:15: Ms. Nguyen Thi Thu - Deputy Director of the Payment Department, State Bank:

cross-border payments are financial transactions in which the paysers and recipients are in two legal areas, that is, two different countries. These transactions involve many different currencies and are associated with specialized processes, such as the foreign exchange settlement process.

Regarding the connection method, it can be approached in two ways: bilateral and multilateral. At the bilateral level, we see connection models such as India's UPI with Singapore's Pay Now, or Singapore's Pay Now with Thailand's PromptPay through QR code payment. At the multilateral level, there are currently international payment systems and projects being implemented between many countries, typically ASEAN-5's Nexus5, P27 project in Northern Europe, or mBridge.

There are 6 issues to consider when it comes to cross-border payments. The first is legal policy. Secondly, the difference in the time zone affects the payment time. The third is settlement currency. Fourth is the application of new technologies. The fifth is the difference in technical standards. And finally, resources are involved in implementing the multi- system.

In Vietnam, the legal framework for cross-border payments is stipulated in many documents. The Law on Credit Institutions has Article 110 on the organization and participation in the payment system of commercial banks. The Foreign Exchange Ordinance, in Article 6, stipulates the released circulation of temporary transactions and in Article 7, stipulates the payment and money transfer related to the import and export of goods and services. In addition, there are documents guiding implementation. Recently, the Government issued Decree 52/2024/ND-CP dated May 15, 2024, in which Article 5 stipulates foreign currency payments and international payments. The State Bank also issued Circular 34/2024/TT-NHNN dated June 30, 2024, with Article 6 on the principle of granting and exchanging licenses and granting additional operations to the licenses.

In terms of implementation, Vietnam has officially connected bilateral payments using QR codes with a number of countries. For Laos, since June 2025, two-way connection has been completed, implemented according to the switching - switching model, and by July 2025, there have been more than 3,000 transactions with a total value of about 2.4 billion VND. For Thailand, since March 2021, two-way connection has been completed, also according to the switching - switching model; as of July 2025, there are more than 56,000 transactions, with a total value of nearly 49 billion VND. For Cambodia, since December 2023, it has provided services according to the banking - transfer model, and by July 2025, about 920 transactions with a total value of more than 520 million VND were recorded.

We are also implementing connections with other partners. For China, in October 2024, NAPAS and UPI signed a Memorandum of Understanding on coordination in deploying cross-border payment services using QR codes. Currently, the units are completing the technical steps, expected to test the inbound technical direction in September 2025 and the outbound in December 2025. For Korea, NAPAS is in talks with its two partners GLN and KFTC to serve the inbound and outbound directions. For Singapore, in March 2025, NAPAS and NETS signed a Memorandum of Understanding on cooperation; in August 2025, NAPAS continued to sign with LIQUID to jointly study the potential for implementation. All are following the "switch" model.

orientation in the coming time, the State Bank will continue to focus on a number of key tasks. First of all, it is necessary to perfect the legal framework, including amending Decree 52/2024/ND-CP and Circular 34/2024/TT-NHNN, to create a more synchronous legal basis and in line with the practice of implementing cross-border payments.

At the same time, we will upgrade the Financial Circuit and Electronic Clearing system, ensuring that it meets advanced technical standards, effectively serving international payment activities. Along with that, the development of payment infrastructure has also been promoted, expanding the payment acceptance network to meet the increasing needs of people and businesses.

One of the focuses is to continue expanding retail bilateral payment connections. In addition to the countries that have implemented, we are aiming to implement more with India, Taiwan (China), Malaysia, Indonesia... to better serve the needs of payment and cross-border money transfers, from tourism, study, shopping to treatment.

Finally, communication work will be strengthened. The State Bank will continue to guide customers and people to use cross-border payment services safely and effectively, thereby contributing to promoting international trade, investment and exchange.

14:10: Mr. Nguyen Ngoc Hien - Member of the Presidium of the Vietnam General Confederation of Labor, Editor-in-Chief of Lao Dong Newspaper - said that in the context of globalization and strong development of e-commerce, cross-border payment activities have become an inevitable need, contributing to promoting trade, connecting the economy and creating favorable conditions for both businesses and consumers. Along with that, online loans open up opportunities for faster, more transparent and convenient access to credit, especially in the digital transformation trend that is taking place widely in many fields, especially in the banking and finance industry.

The workshop "Cross-border payments and online loans: Digital utilities for business and consumption" organized by Lao Dong Newspaper in coordination with the State Bank of Vietnam aims to concretize the spirit of Resolution 57 of the Politburo on breakthroughs in the development of science, technology, innovation and national digital transformation, soon bringing policies into life, serving practically people and businesses.

Through the workshop, the recommendations and suggestions will contribute to removing difficulties and promoting innovation, thereby not only supporting the stronger development of the banking and financial system but also contributing to the sustainable development of the national digital economy.

14:00: Attending the workshop, on the side of the management agency, representatives of the State Bank of Vietnam were Mr. Pham Anh Tuan - Director of the Payment Department, State Bank; Ms. Nguyen Thi Thu - Deputy Director of the Payment Department; Ms. Mai Thi Trang - Deputy Director of the monetary policy department, State Bank.

On the side of Lao Dong Newspaper, there were Mr. Nguyen Ngoc Hien - Member of the Presidium of the Vietnam General Confederation of Labor, Editor-in-Chief of Lao Dong Newspaper; Mr. Nguyen Duc Thanh - Deputy Editor-in-Chief of Lao Dong Newspaper.

On the side of businesses, credit institutions, and commercial banks, there were Mr. Nguyen Quang Hung - Chairman of the Board of Directors of Vietnam National Payment Joint Stock Company (Napas); Mr. Nguyen Quang Minh - General Director of Napas; Mr. Nguyen Hoang Long - Deputy General Director of Napas; representative of Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank); Ms. Le Thi Thuy Ha - Director of Digital Lending Project - MBBank Digital Banking Bloc; Ms. Nguyen Thi Ngoan - Director of Finance of MISA Joint Stock Company

On the experts' side, there are: Associate Professor, Dr. Pham Thi Hoang Anh - Deputy Head of the Board of Directors - Banking Academy; Mr. Vu Ngoc Son - Head of the Department of Research, Consulting, Technology Development and International Cooperation, National Cyber Security Association; Associate Professor, Dr. Dang Ngoc Duc - Director of the Institute of Financial Technology, Dai Nam University.

The workshop "Cross-border payments and online loans: Digital utilities for business and consumption" was attended by leaders of the State Bank, representatives of ministries, branches, economic - financial experts, commercial banks, technology enterprises, domestic and foreign financial institutions; economic, financial - banking experts.

The workshop aims to clarify the role of cross-border payments and online loans in promoting trade, consumption and developing the digital economy, while finding solutions to the challenges that are arising: Completing the legal corridor for digital signatures and electronic identification, improving digital processes in lending activities, expanding the international payment ecosystem, as well as ensuring data safety and security.

These are urgent requirements in the context of globalization and strong growth of e-commerce, when the need for safe and fast cross-border payments, reasonable costs and transparent and convenient online credit access become increasingly important.

Immediately after the Politburo issued Resolution No. 57-NQ/TW on breakthroughs in science, technology, innovation and national digital transformation, ministries, branches and localities across the country urgently implemented and quickly put the Resolution into practice. In particular, the banking industry is identified as one of the pioneering forces, considering digital transformation as a key strategy to improve operational efficiency and towards sustainable development.

Connecting national databases, promoting cashless payments and developing digital banking have created a solid foundation, helping people and businesses access financial services quickly and conveniently. In particular, cross-border payments and online loans have made many important strides in recent times.

However, along with the achieved results, there are still many challenges, from completing the legal corridor for digital signatures and electronic identification, improving digital processes in loans, expanding the cross-border payment ecosystem, to ensuring information security and safety. These are urgent requirements that need to be realized in the coming time.

That requires synchronous coordination between many industries and levels, along with a strong enough technical infrastructure platform to effectively deploy digital banking solutions and services.