Step 1:

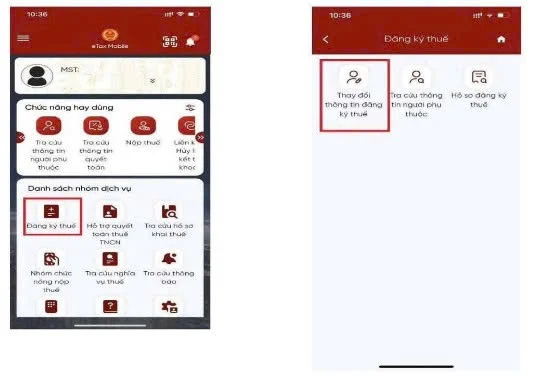

Taxpayers access and log in to the Etax Mobile app.

After successfully logging into the system, select the Tax Registration menu - Change information:

Step 2

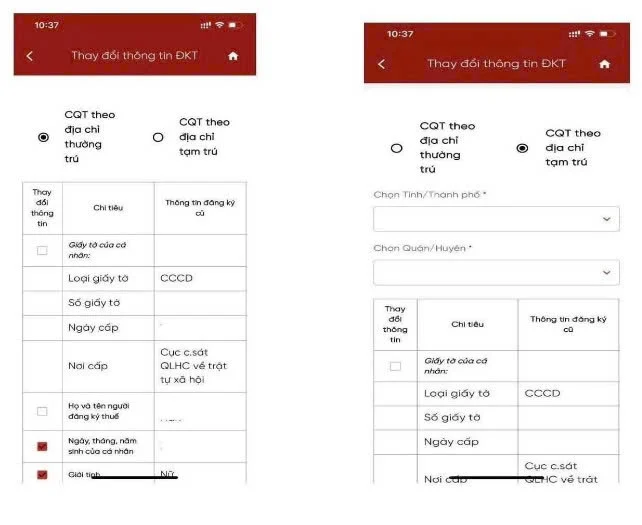

The display screen of taxpayer information includes:

- Taxpayer's name: display the name according to the tax registration information, allowing for amendment.

- birthday: Show date of birth according to tax registration information, permission to change.

- Old documents: Display the documents according to tax registration information, not allowed for amendment.

- New document number: Allowing import is CCCD number.

- get citizen information according to the old Document Number (let the information on the new Document Number be empty).

- get citizen information according to the new documents:

+ Enter new documents: Enter Citizen Identification Number or Citizen Identification Code

- Press To get citizen information:

Step 3:

Display screen:

- In case of not receiving citizen information from the National Population Database. Display a notification screen "NNT information is not available on the Population Information Center, NNTs contact the police to update information on the Population Information Center

- In case of receiving citizen information from the National Population Database. Display the old Tax Registration information screen and new Tax Registration information:

Taxpayers choose a tax authority to submit the declaration:

The tax authority submits the declaration: Select 1 of the 2 values "CQT by permanent address" or "CQT by temporary residence address".

- Taxpayers calculate the tax rate according to the temporary residence address for the tax authority to submit a declaration and display information of the province or district. The declaration form is sent to the competent authority corresponding to the selected district of the taxpayer.

- Taxpayers calculate the selection of taxpayers according to their permanent address for the tax authority to submit declarations

+ In case the taxpayer does not accumulate and choose to change the information "Residence address", the declaration will be sent to the tax authority corresponding to the district according to the old tax registration information.

+ In case the taxpayer selects to change the information "Residence address", the declaration is sent to the tax authority to the district according to the new tax registration information received from the National Population Database.

Step 4:

- The taxpayer accumulates to select the indicators that need to change information in the Information Change column, click Continue.

+ In case of accumulating and changing personal documents or Phone number or email information. Display the corresponding new registration information entered screen

+ In case of failure to save, select to change personal documents or Phone number or email. Display the screen to complete the declaration of information change according to form 08-MST

- Taxpayer enters new registration information:

+ Number of documents: Automatically display according to the number of newly accepted documents of the National Population Database, not allowed for editing;

+ Membership date: Compulsory selection from the list;

+ Place of issuance: Compulsory choice in the list;

+ Contact phone: Compulsory import;

+ Email: Compulsory import;

Step 5:

- The taxpayer clicks Complete the declaration, displaying the completed declaration screen to change information according to form 08-MST.

Note: The taxpayer pulls the screen to the right, down to see all the information on old and new Tax Registration.

Step 6:

Taxpayers click Sharing, share PDF format files on social networking platforms.

Step 7:

Taxpayers press Continue. Display a screen attached to documents:

- Press the attached file download icon from your phone

+ click on the icon using a phone camera to take photos of attached files

Step 8:

Taxpayers press Complete, display the screen to enter the OTP code:

- click For example: For example, do not send a declaration to change information

- Nhan Agree. The notification screen is displayed "The dossier of change of tax registration information has been successfully submitted. Please wait for the handling!