To protect the rights of taxpayers, the Tax Department of Region I has just issued guidance and recommend that taxpayers (Taxpayers) who are individuals update tax registration information (updated information about citizen identification cards).

The updated information of taxpayers is the basis for tax authorities to standardize data, aiming to use identification codes as tax codes according to the provisions of the Law on Tax Administration and carry out the task of implementing the Project to develop applications of data on population, identification and electronic authentication to serve national digital transformation in the period of 2022-2025, with a vision to 2030 issued with Decision No. 06/QD-TTg of the Prime Minister.

Individual taxpayers can choose one of the following methods to update and change tax registration information:

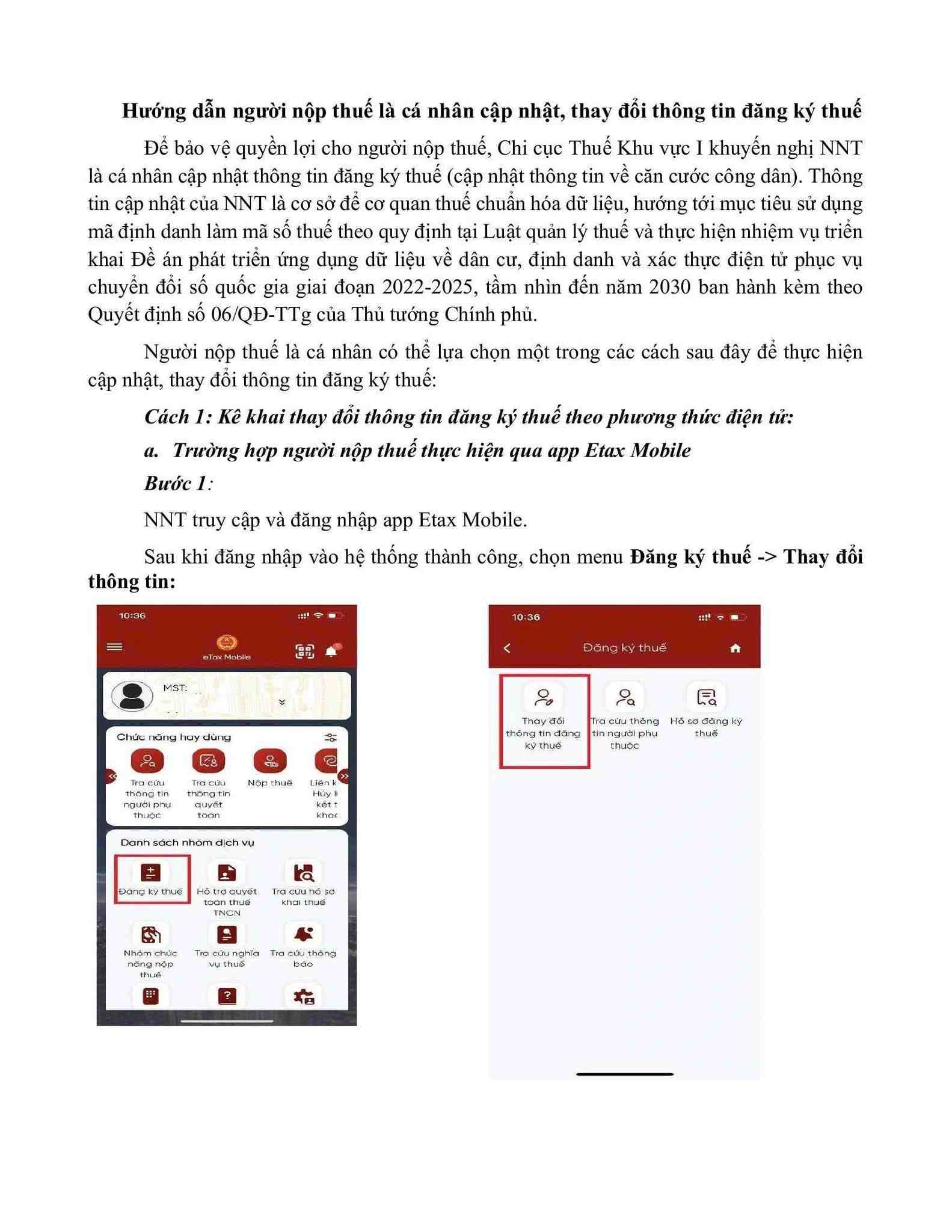

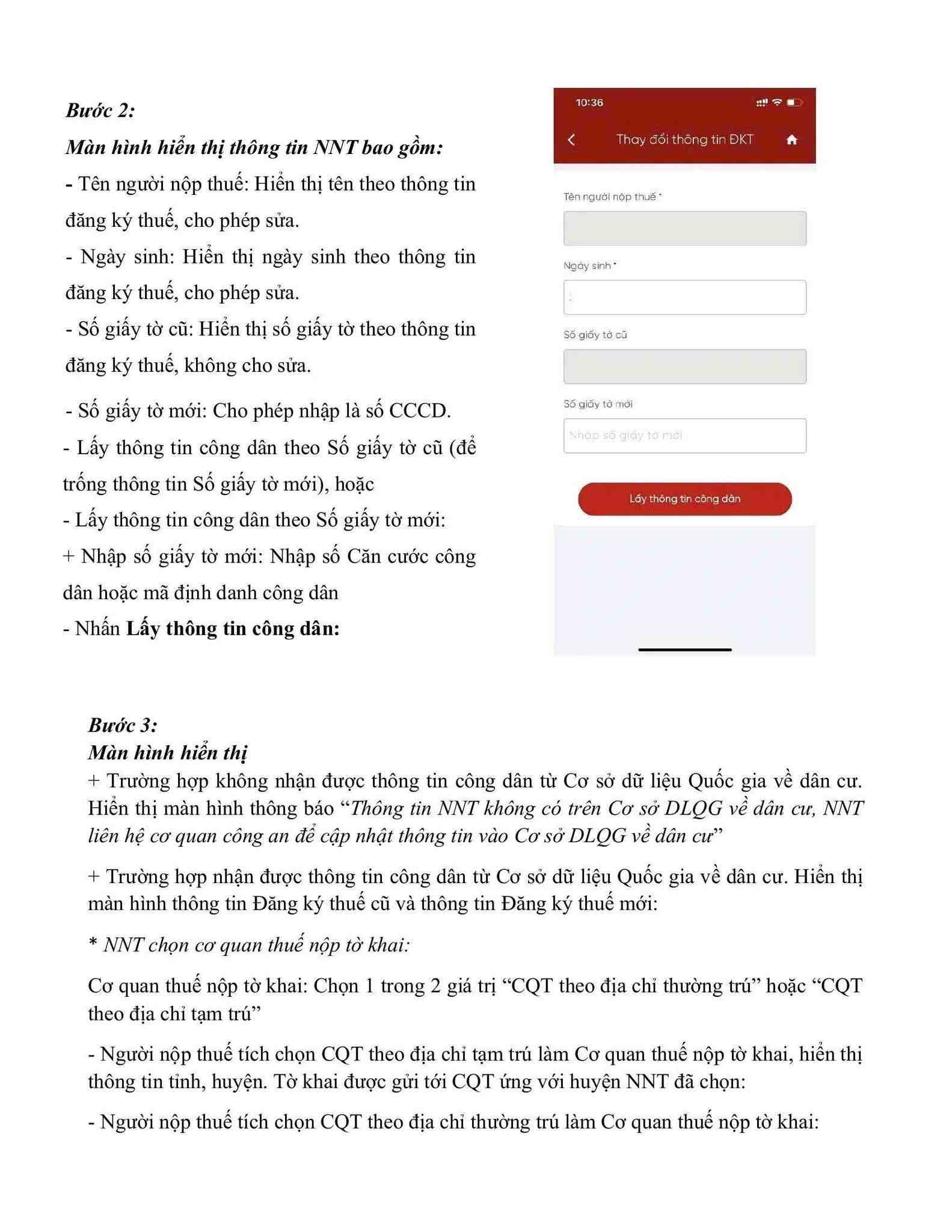

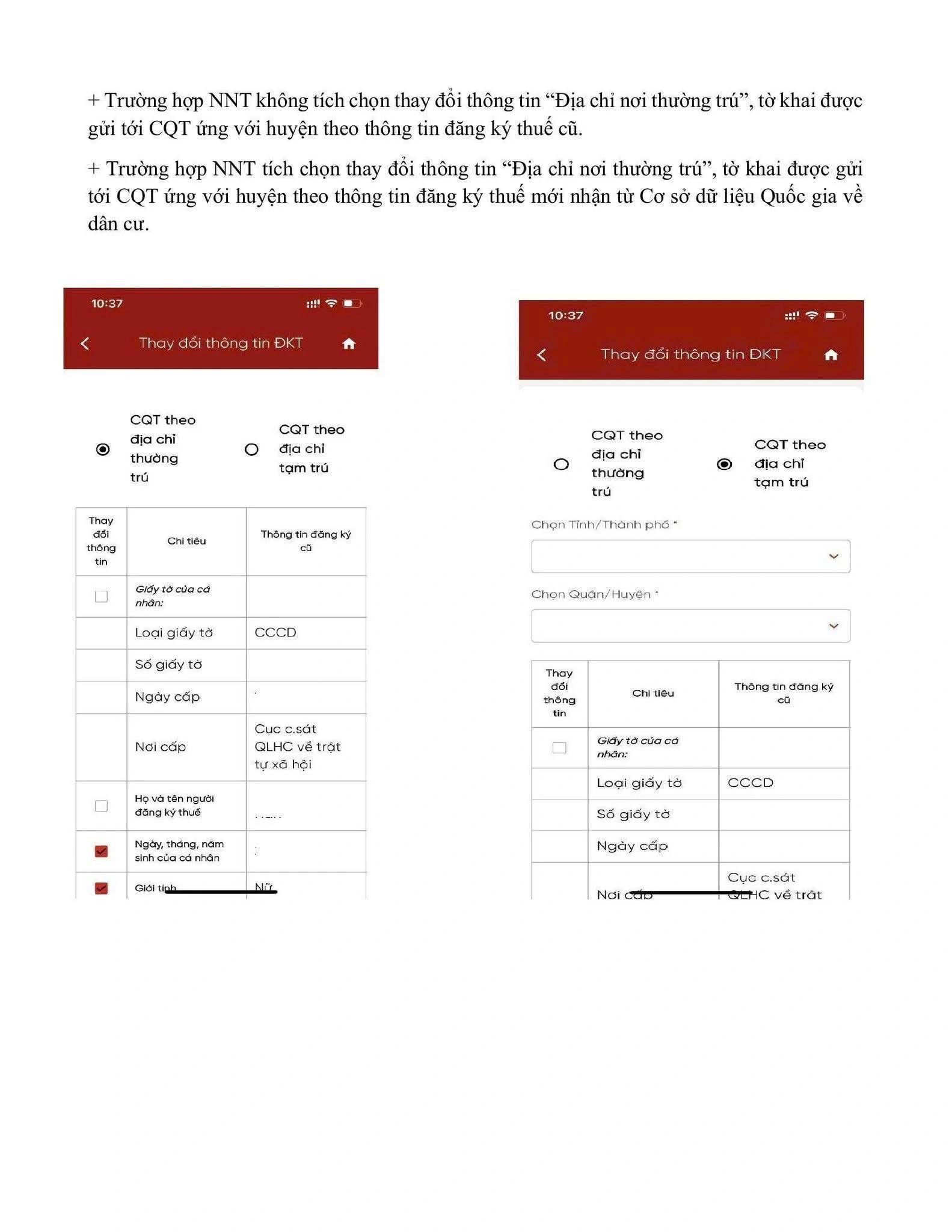

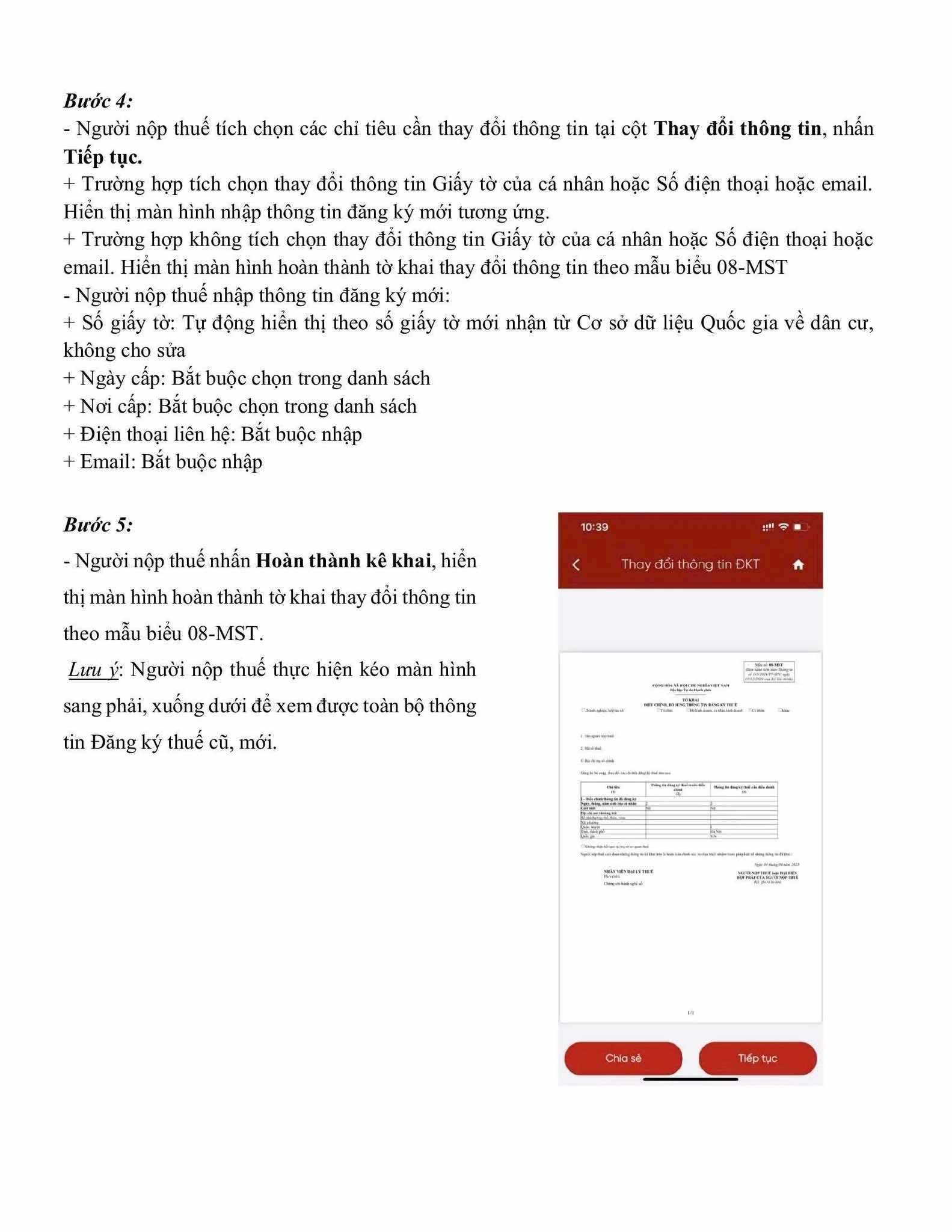

Method 1: Declare changes to tax registration information electronically:

Method 2: Declare changes in tax registration information through the income paying agency:

Method 3: Declare changes in tax registration information directly to the tax authority:

- Place of application submission: Tax team where the individual registered for permanent or temporary residence (in case the individual does not work at the income paying agency).

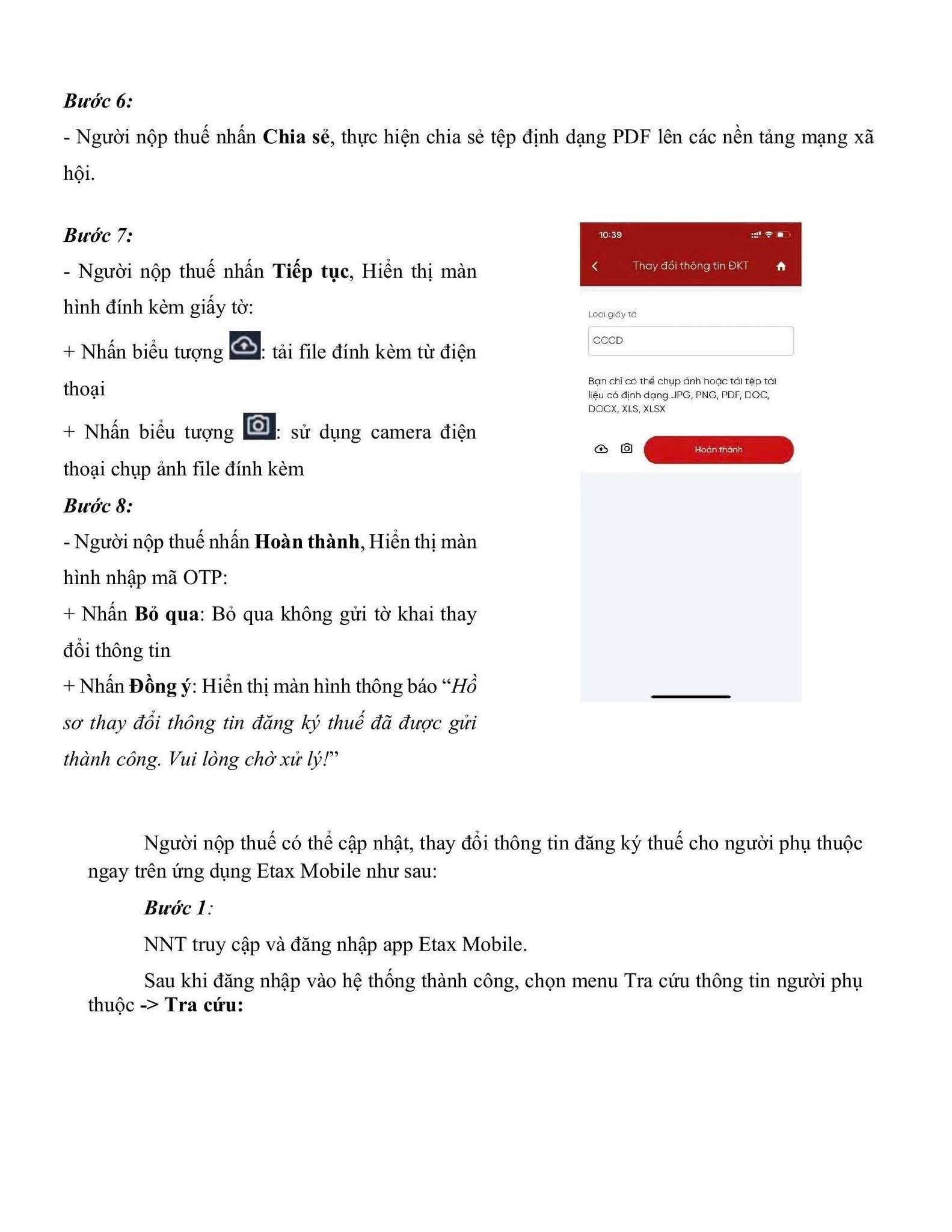

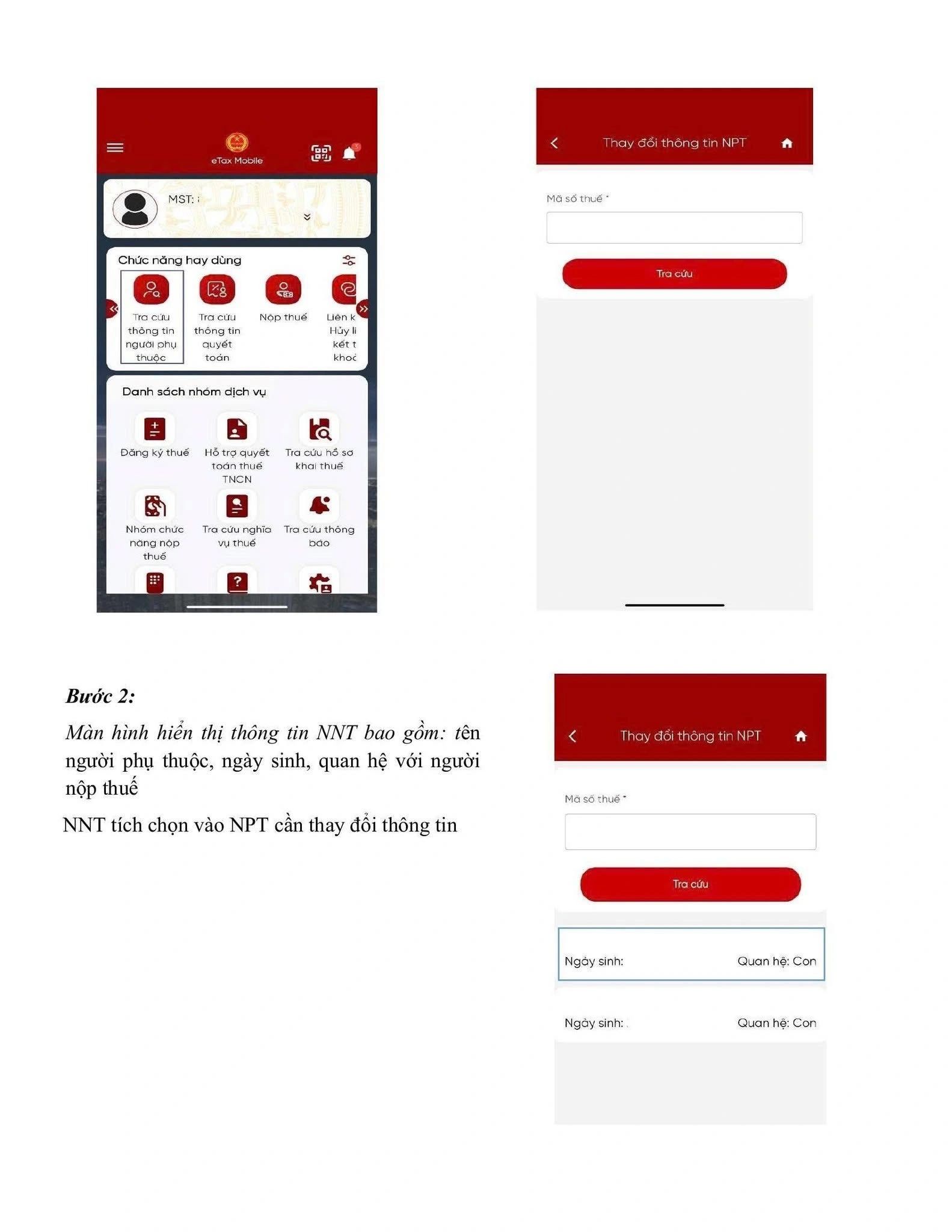

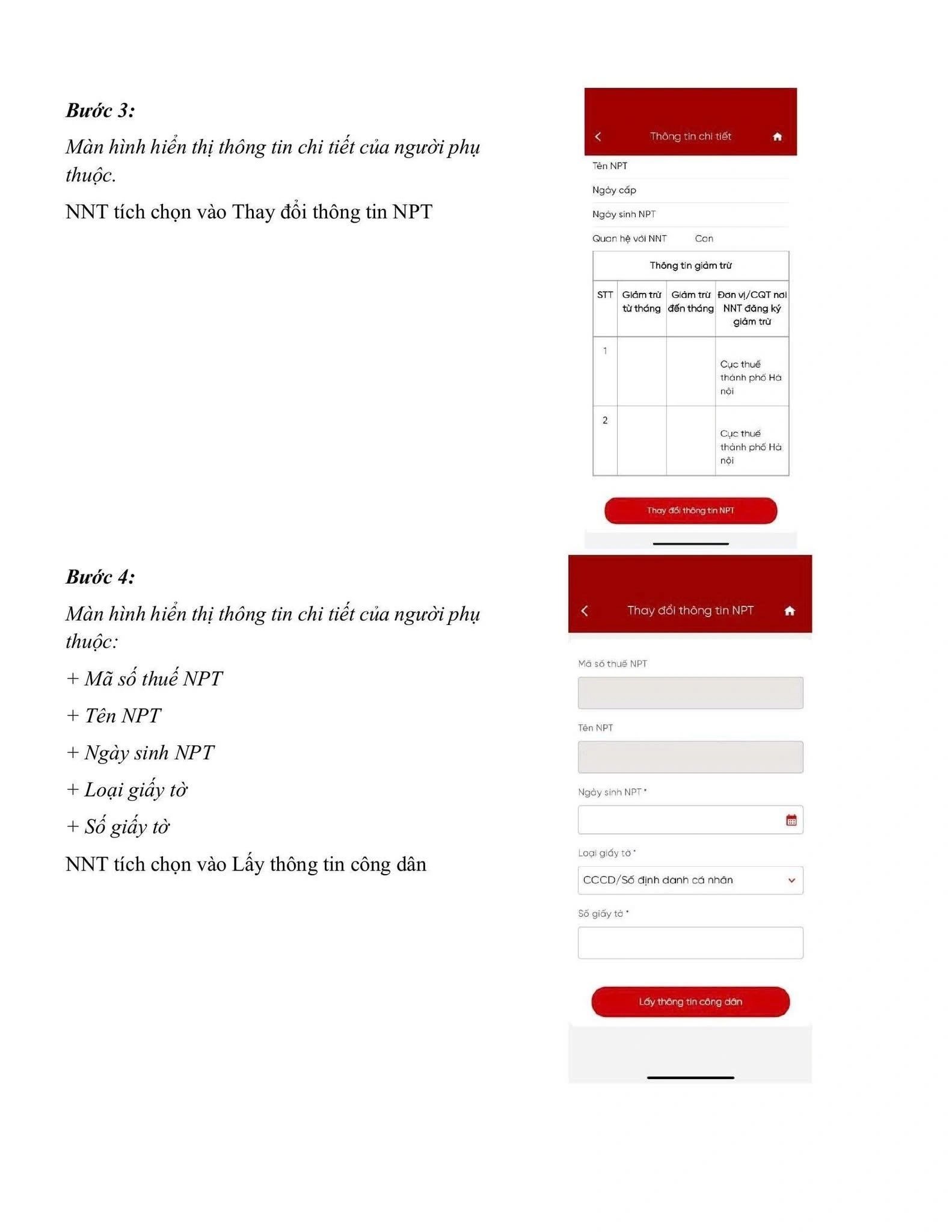

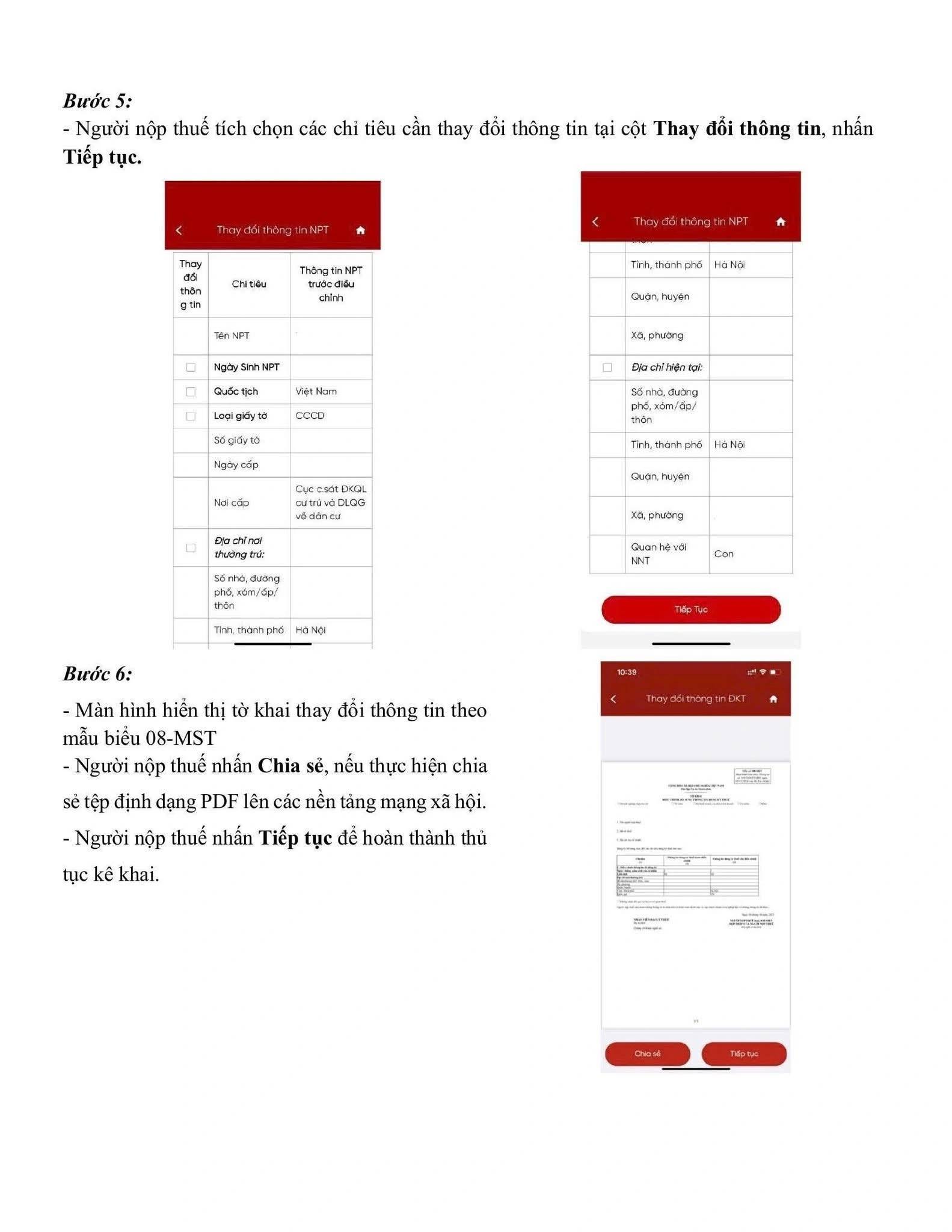

Detailed instructions on the steps to follow the 3 methods mentioned above:

The Tax Department of Region I recommends that households, business households, individuals and individuals proactively check and update information promptly to avoid tax obligations being interrupted after July 1, 2025.