Clause 8, Article 3 of the Draft Decree stipulates the principles for declaring, calculating taxes and using electronic invoices of business households and individuals with different revenue thresholds. In particular, business households and individuals with annual revenue of less than 1 billion VND are not required to use electronic invoices with codes of tax authorities or electronic invoices generated from cash registers with data connected to tax authorities.

This draft makes many business households "breathe a sigh of relief". Ms. Luu Thi Thuy - Owner of a multi-crab cake business on To Hieu Street, Cau Giay - said: "After raising the tax threshold to 500 million VND/year, I have somewhat reduced my burden even though this level is still quite low. The only thing I have problems with is the input invoice."

"My store itself is not afraid to pay taxes, but standardizing input and output invoices still makes it difficult for businesses. The source of input materials I import directly from my hometown, because my parents go fishing, so there are no invoices" - Ms. Thuy frankly shared.

For Ms. Thuy, switching to the declaration method and requesting input invoices is a barrier for many business households. Ms. Thuy herself felt: "It must be changed, but it will take time to standardize, the issuance of output invoices does not cause difficulties for us, but there are input invoices, related to many import-export relationships. When implementing, we will definitely have to pay additional costs and cannot operate as at present".

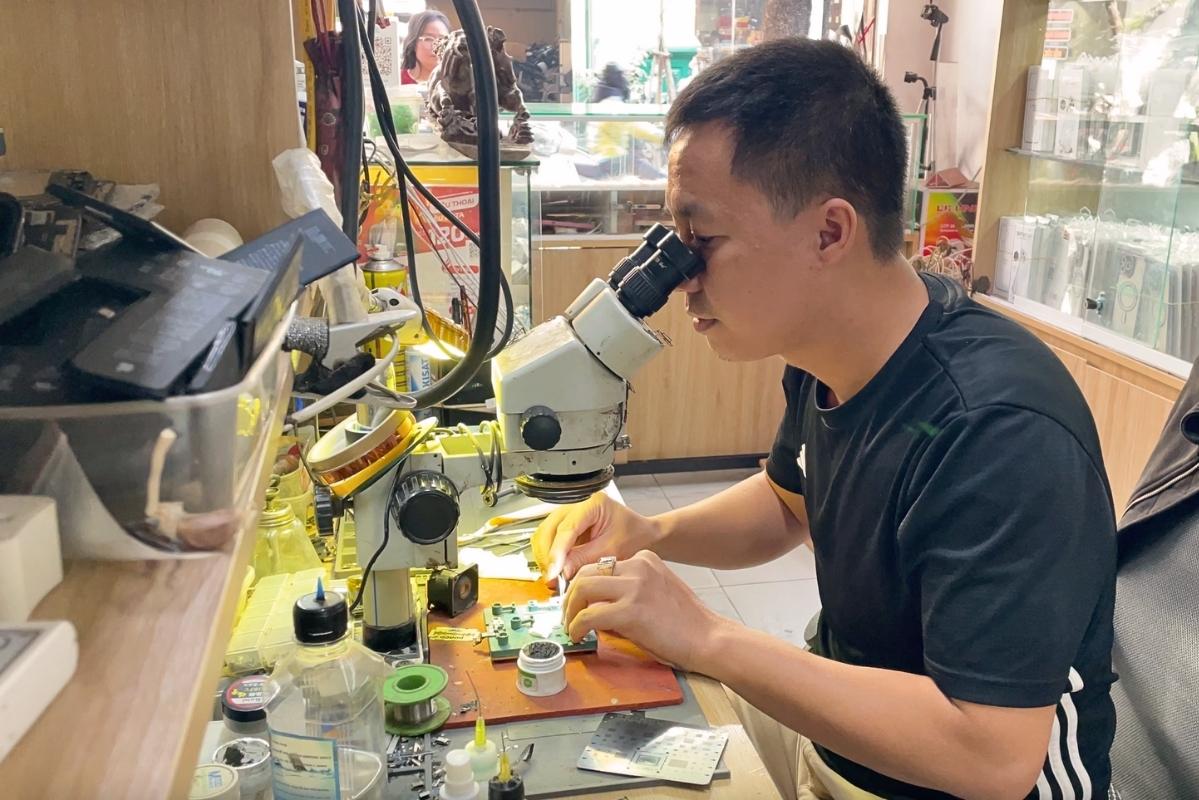

Similarly, Mr. Nguyen Van The - Business owner of a phone repair and sales business on Trung Kinh Street, Hanoi, is looking forward to the draft coming into life soon.

"If it is not necessary to create an input bill, it would be great. My business items are quite specific, with many small components. There are cases where the devices in the old device are replaced with a new one if suitable, so I don't know how to declare the invoice. Not to mention having to buy a device, install linkage software, many stages are more complicated" - Mr. The frankly shared.

According to Mr. The, business is getting more and more difficult, if there are many costs, sellers will not be able to stay strong.

The draft also clearly states that in cases where the conditions for information technology infrastructure are met and there is a need to use electronic invoices, the tax authority encourages and supports business households and individuals to register to use electronic invoices with the code of the tax authority or electronic invoices generated from cash registers with tax authorities.

In case a business household or individual does not register to use an electronic invoice and needs to use an electronic invoice, they must declare and pay the tax before the tax authority issues an electronic invoice with the tax authority's code for each time a transaction of selling goods or providing services arises.

Mr. Nguyen Dinh Van (60 years old, owner of a popular restaurant) feels "less inconvenienced" when he is not required to invest in buying equipment to create electronic invoices, issue invoices, and sign digital signatures as before.

On average, Mr. Van sells 45-50 meals a day, each meals for 25,000 VND/meal. On weekends, Mr. Van's popular restaurant has almost no customers.

Mr. Van also calculated that from now until Tet, if not stable, he would also try to change direction when the input food ingredients were from 1-1.2 million VND/month. The new draft on tax declaration, calculation and deduction, and use of electronic invoices of business households and individuals makes him somewhat more assured.

"I am old, I do not have much profit, now I have to bear the need to operate and declare taxes according to standards according to each output - input invoice, making me only want to think about quitting sales. I only hope to sell as much as I want, declare as much, and pay the corresponding tax" - Mr. Van expressed.

The general mood of many business households with revenue under 1 billion VND/year (equivalent to more than 83 million VND/month). Business households and small business individuals feel less confused when it is not mandatory to prepare sales invoices and invest in machinery and equipment to connect data with tax authorities.