HDBank interest rates today, highest at 8.1%

According to the latest interest rate table from HDBank, individual customers depositing savings can receive an attractive interest rate, the highest up to 6. 10%/year. This is the interest rate applied to Online Savings products and Deposit Certificates for a term of 18 months.

HDBank also has a special interest rate policy for very valuable deposits:

7.70%/year for a 12-month term, applied to a minimum savings of VND500 billion.

8. 10%/year for a 13-month term, applied to a minimum savings of VND500 billion.

For customers transacting at the counter, the interest rate is also very competitive. The 18-month term has an interest rate of 6.00%/year, and the 15-month term is 5. 90%/year.

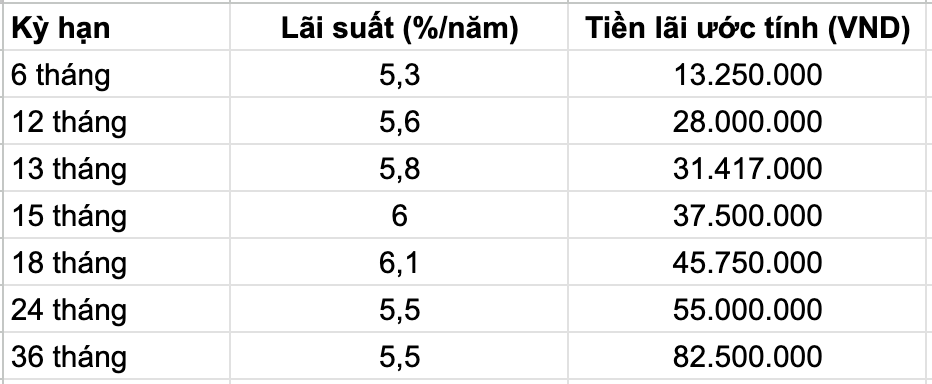

HDBank Online Savings Interest Rate Table and Interest Estimated at VND500 million

With a deposit of 500 million VND, depositors have many flexible term options. Notably, although the 18-month term has the highest interest rate, the 36-month term brings the largest total interest amount, up to 82.5 million VND.

Below is a reference interest rate table for Online Savings products and the interest amount corresponding to a deposit of 500 million VND:

The problem of "DUB- interest" and optimal term selection

A strategy that many depositors are interested in is dividing the term to take advantage of the power of double interest (reversal of both principal and interest). However, HDBank's interest rate table analysis shows that this strategy does not always bring the highest efficiency.

Because the interest rate difference between the 12-month and 6-month terms is large enough (0.3%/year), choosing to deposit for a 12-month long term brings a higher profit of nearly 1.15 million VND. This shows that depositors need to carefully consider the listed interest rates of the terms and the accumulated benefits from compound interest to make optimal decisions.

Suppose a customer deposits 500 million VND in 12 months.

Option 1: Submit 2 consecutive 6-month terms.

The interest rate for the first 6 months (interest rate 5. 30%/year) is 13,250,000 VND.

The total new capital is 513,250,000 VND.

The interest rate for the next 6 months (with new capital) is 13,600,625 VND.

Total interest received after 12 months: 26,850,625 VND.

Option 2: Submit directly for a 12-month term.

With an interest rate of 5.60%/year, the interest received is VND 28,000,000.

Note: The above interest rate table is for reference only. For the most updated and detailed information, customers please contact the nearest HDBank branch or Customer Service Center. This interest rate table takes effect from June 11, 2025.