VietinBank increases for the second time in the month

VietinBank has just continued to increase online deposit interest rates for the second time this month, with an increase of 0.3-0.6%/year for online savings interest rates for terms from 1-36 months.

Accordingly, the 1-2 month term increased sharply by 0.6%/year, up to 3%/year; the 3-5 month term increased by 0.6%/year, up to 3.4%/year; the 6-11 month term increased by 0.6%/year to 4.5%/year; the 12-month term increased by 0.5%/year to 5.2%/year; the 13-36 month term increased by 0.3%/year to 5.3%/year.

Previously, all 4 state-owned commercial banks (Big4) including Vietcombank, VietinBank, Agribank, BIDV simultaneously participated in the race to increase deposit interest rates.

However, the Big4 group is still maintaining the lowest deposit interest rate among commercial banks today, creating a premise for limiting the increase in lending interest rates.

Since the beginning of December, 26 banks have increased deposit interest rates, including: Techcombank, MB, NCB, BVBank, Saigonbank, ACB, Bac A Bank, OCB, KienlongBank, Sacombank, SHB, PGBank, VIB, Vikki Bank, VCBNeo, BIDV, VPBank, PVCombank, ABBank, LPBank, BaoViet Bank, Agribank, Vietcombank, VietinBank, SeABank and Cake by VPBank.

Of which, NCB, Techcombank, OCB, MB, ACB, Saigonbank, Sacombank, PGBank, VietinBank have adjusted interest rates twice. VPBank alone has increased interest rates for the third time this month.

Highest special interest rate 6.59%/year

The highest deposit interest rate at banks currently fluctuates around 6.59%/year, but to enjoy this interest rate, customers must meet special conditions on deposit scale.

PVcomBank applies a special interest rate of 9%/year for a term of 1213 months when depositing money at the counter, with the condition of maintaining a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with a minimum balance of VND500 billion.

Vikki Bank applies an interest rate of 8.4%/year for deposits with a term of 13 months or more, with a minimum deposit of 999 billion VND; OCB lists an interest rate of 7.1%/year for deposits over 500 million VND, with a term of 36 months.

Viet A Bank applies an interest rate of over 6%/year for Dac Tai Savings products, with interest rates ranging from 6.0%/year for a 6-month term to 6.8%/year for a 18-month term. The applicable condition is that the minimum deposit is 100 million VND, transacted at the counter and received interest at the end of the term.

For deposits over 1 billion VND at Bac A Bank, interest rates are increased to 6.4%/year for 68 month terms; 6.45%/year for 911 month terms; 6.5%/year for 12-month terms; 6.6%/year for 1315 month terms and 6.7%/year for 1836 month terms.

Nam A Bank applies an interest rate of 6.5%/year for a 24-month term and 6.3%/year for a 36-month term, with the condition that the deposit amount is from VND500 billion or more.

Many banks list interest rates above 6.5%/year without conditions

In addition to special interest rate packages, many banks are also listing interest rates above 6.5%/year for long terms without a minimum deposit requirement.

Vikki Bank applies an interest rate of 6.5%/year for a 6-month term; 6.6%/year and 6.7%/year for a 12-month and 13-month term, respectively. Cake by VPBank maintains an interest rate of 6.7%/year for terms from 636 months.

Bac A Bank listed interest rates at 6.5%/year for terms from 611 months; 6.55%/year for terms of 12 months; 6.6%/year for terms of 1315 months and 6.7%/year for terms from 1836 months.

OCB applies interest rates of 6.5%/year for 18-month terms, 6.6%/year for 21-month terms, 6.7%/year for 24-month terms, 6.9%/year for 36-month terms;

VIB applies an interest rate of 6.5%/year for a 12-month term; PVcomBank applies an interest rate of 6.8%/year for terms from 1536 months.

PGBank applies an interest rate of over 6.8%/year for 6-9 month terms; 12-13 month terms to 6.9%/year; 18-36 month terms to increase to 7%/year - the highest official listing rate on the market today.

Statistics of banks with the highest savings interest rates today:

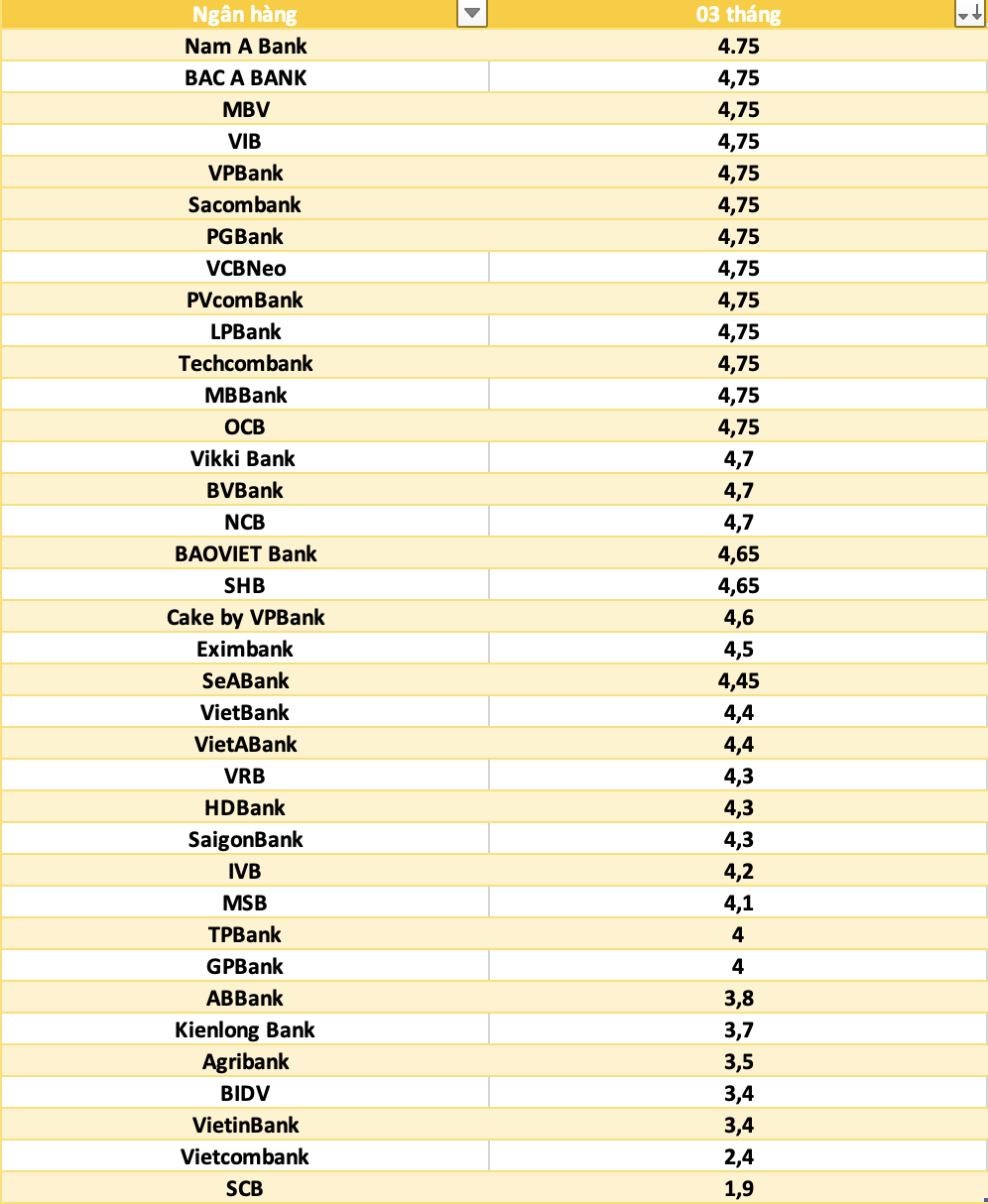

Compare the highest bank interest rates for 3-month terms

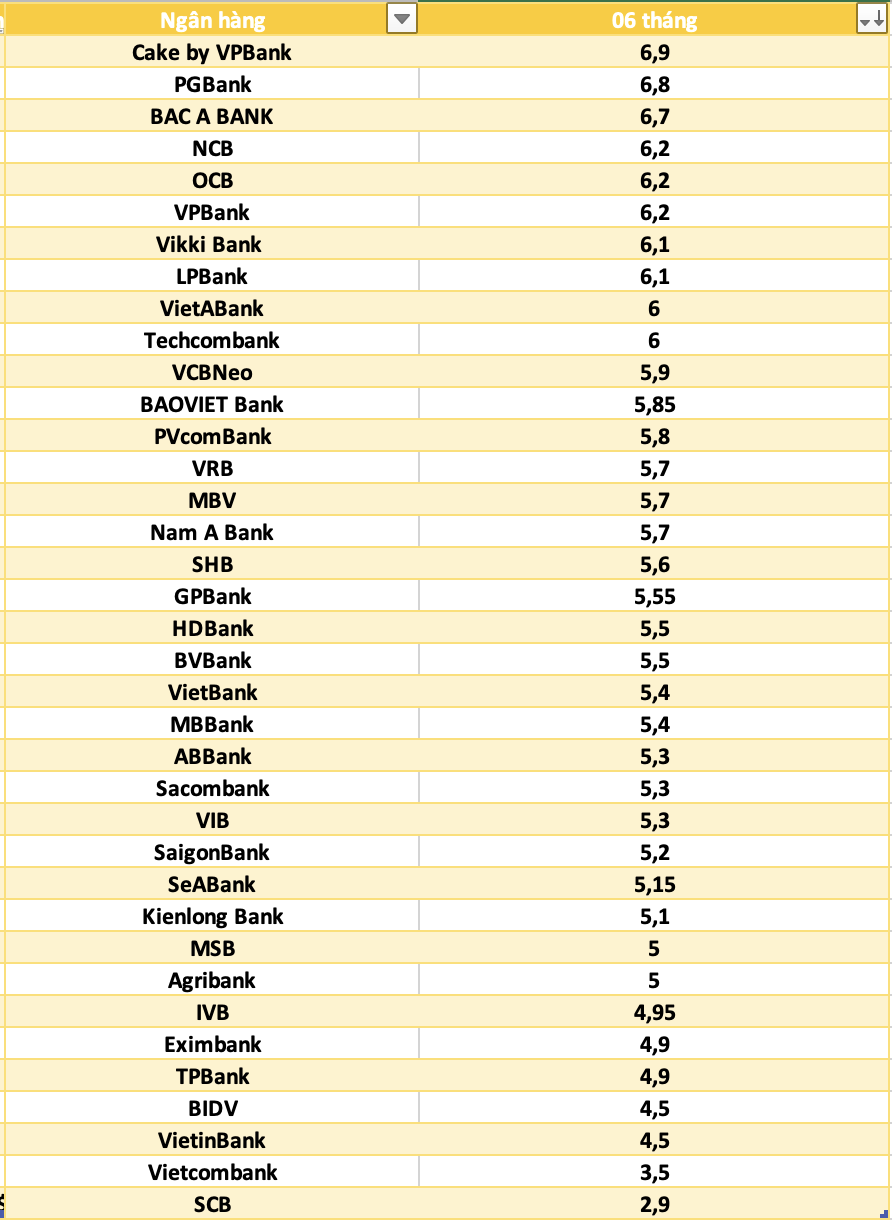

Interest rates for savings deposits at banks for 6-month terms

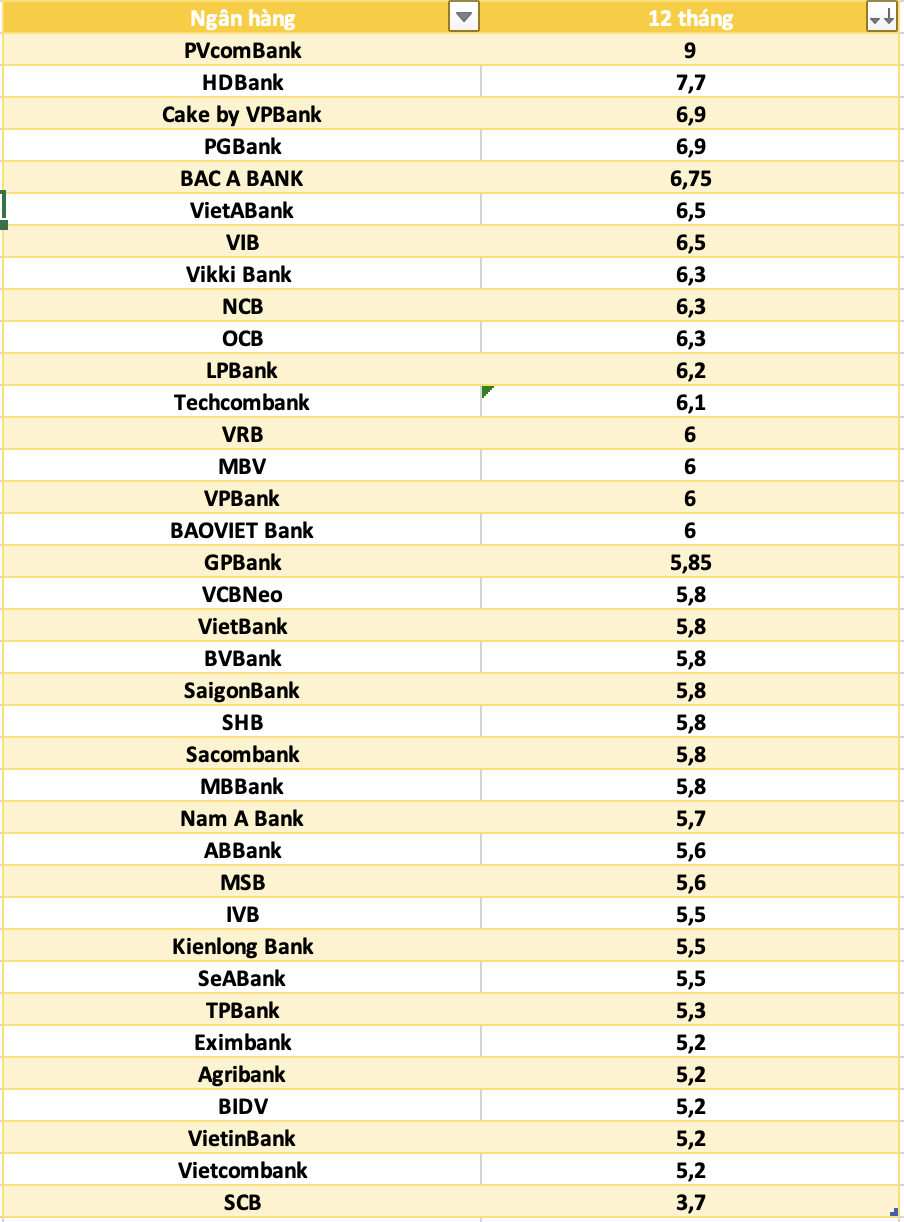

For 12-month savings, which bank has the highest interest rate?

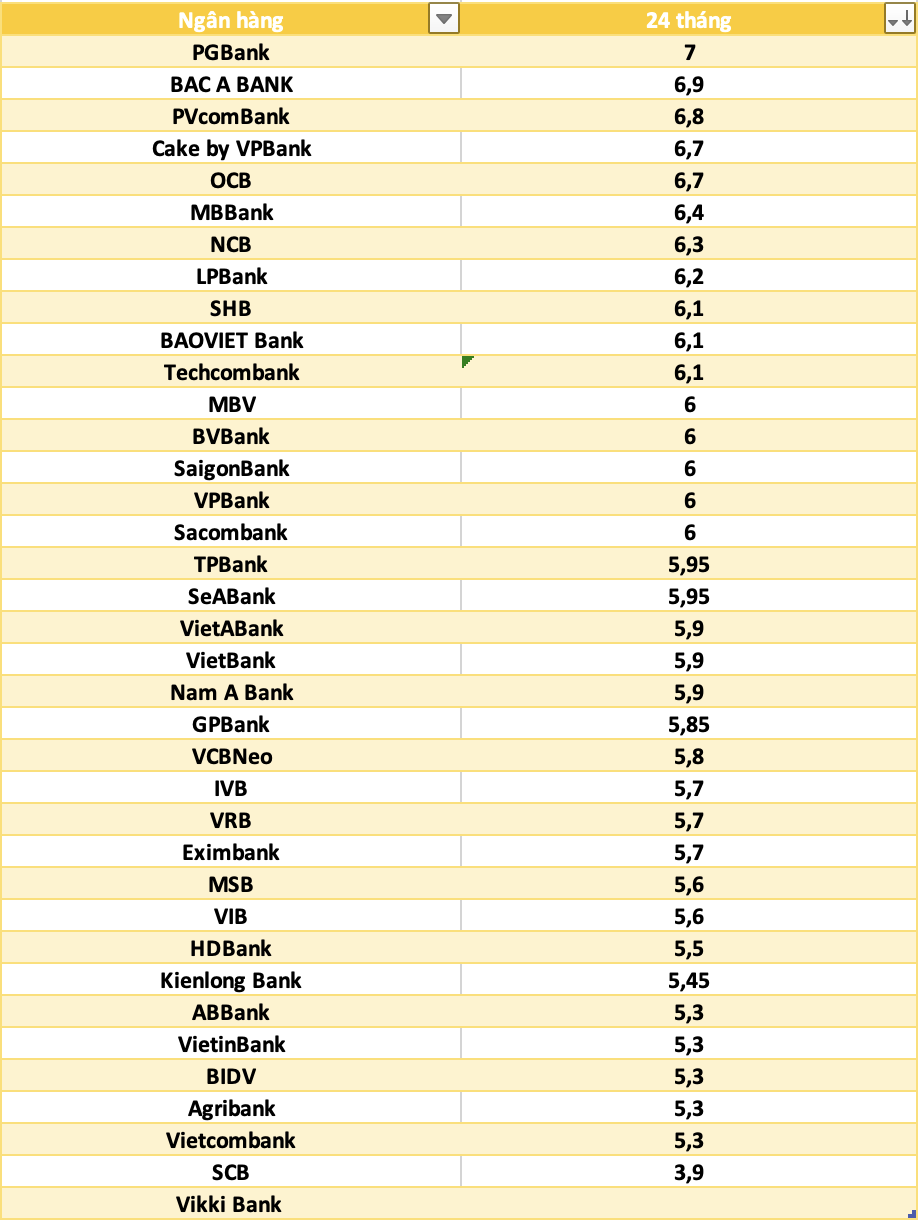

Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... are the highest for a 24-month term.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles on interest rates HERE.