Deposit interest rates continue to increase sharply

LPBank has just announced the implementation of a deposit interest rate promotion program, plus up to 1.5%/year for customers depositing savings from October 27 to November 5. The program applies to individual customers who open new savings books from 100 million VND for Tu Tien thuong thanh toan interest at the end of the term and from 1 billion VND for Tu Tien Loc Phat Thinh Vuong.

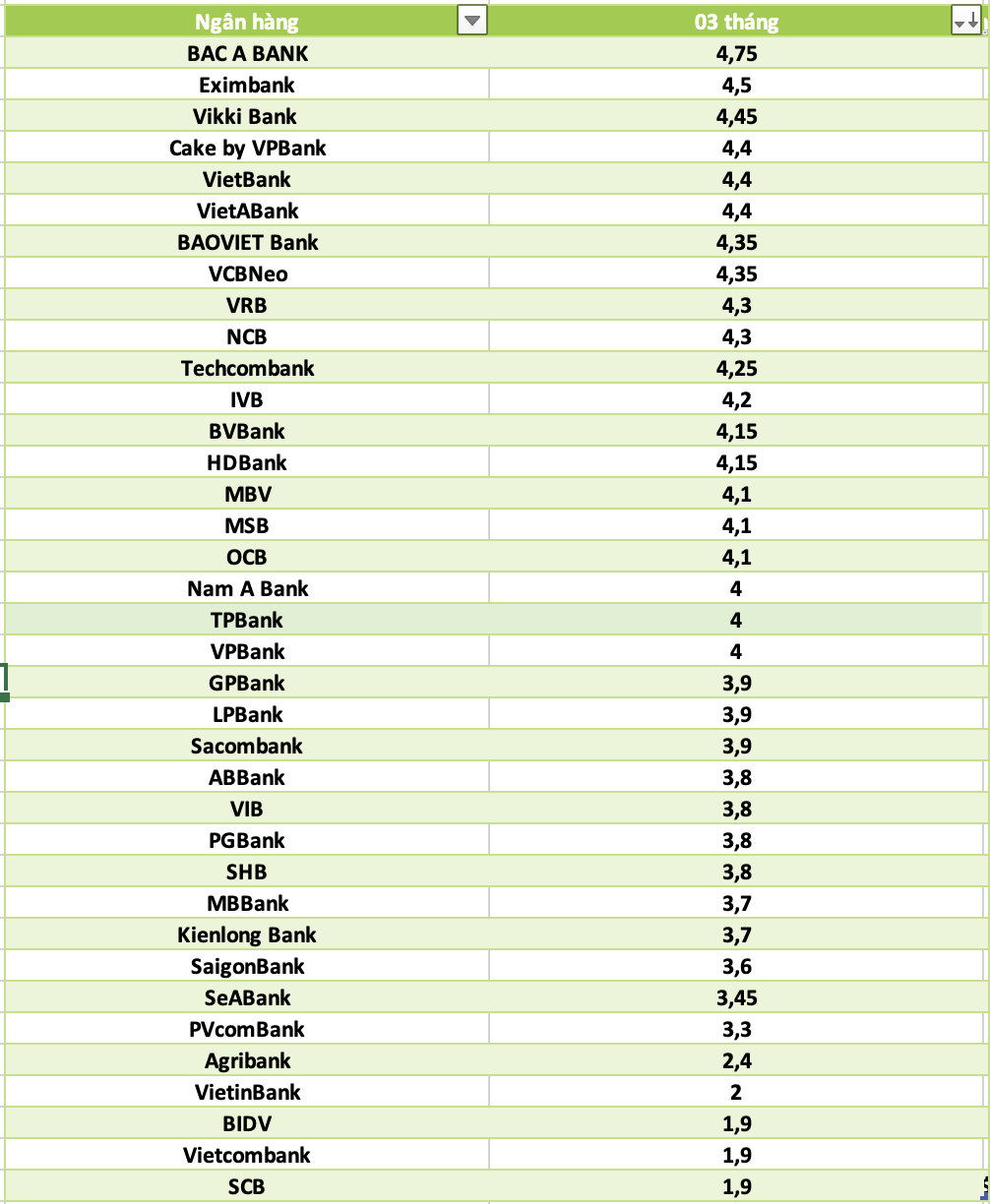

Additional interest rates are applied to terms of 3 months, 6 months, 12 months and 18 months. Accordingly, the interest rate for 3-month online savings deposits at LPBank reached 4.75%/year - the current ceiling for this term. In the market, Bac A Bank is also listed at 4.75%/year, making the two banks the leading group in the market in 3-month term interest rates.

After adding incentives, LPBank's counter savings interest rate for 6 and 12-month terms reached 6.1%/year, and for 18-month terms it was 6.2%/year. For online deposits, the interest rate for 6 and 12-month terms is at 6.2%/year, while the 18-month term is 6.3%/year.

For the Long Phat Thinh Vuong Savings product alone, the 6-month term interest rate was increased to 6.3%/year and the 18-month term reached 6.4%/year - among the highest in the market today.

Recently, deposit interest rates have shown signs of increasing again when the demand for capital mobilization of banks increased in the last months of the year.

Since the beginning of October, 6 banks have increased deposit interest rates, including: GPBank, NCB, Vikki Bank, Bac A Bank, VCBNeo, and HDBank. Of which, Bac A Bank has increased interest rates twice this month.

In addition, a series of banks have applied preferential policies to attract customers. Including: VietinBank, Vietcombank, Vikki Bank, MB, Techcombank, VietBank...

Special interest rates

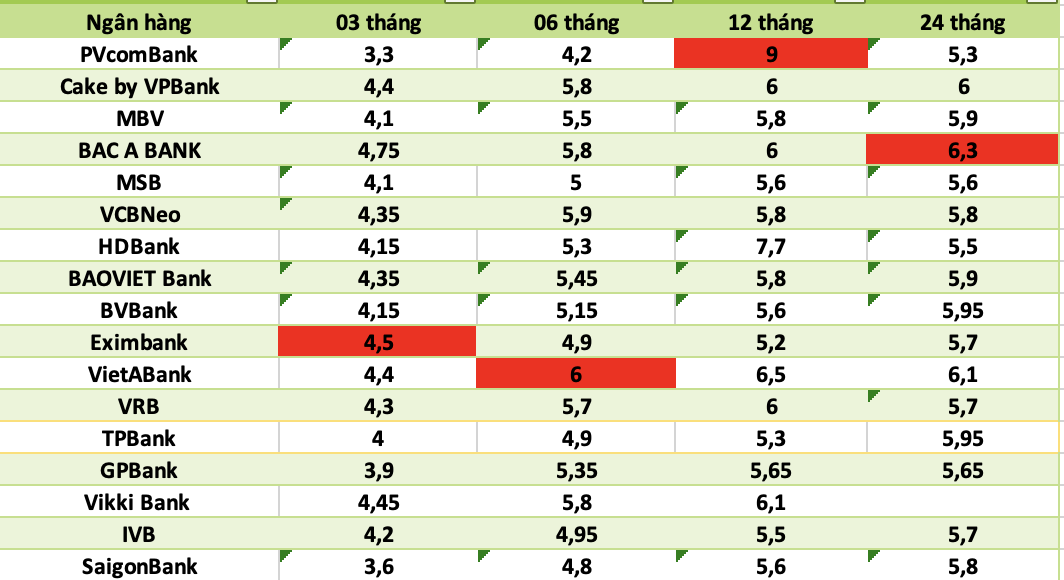

The highest deposit interest rate at banks ranges from 6-9%/year. However, to enjoy this interest rate, customers must meet special conditions.

PVcomBank applies a special interest rate of 9%/year for a term of 12-13 months when depositing money at the counter. The applicable condition is that customers must maintain a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion.

Vikki Bank applies an interest rate of 7.5%/year for term deposits of 13 months or more, with a minimum amount of 999 billion VND; Bac A Bank is applying the highest interest rate of 6.3%/year for terms from 18 to 36 months; 6.1%/year for terms of 1315 months and 6%/year for terms of 12 months for deposits of VND 1 billion or more.

IVB applies an interest rate of 6.15% for a term of 36 months, conditions applied to deposits of VND 1,500 billion or more; ACB applies an interest rate of 6%/year for a term of 13 months receiving interest at the end of the term when customers have a deposit balance of VND 200 billion or more.

At LPBank, for deposits of VND300 billion or more, the mobilization interest rate applied to customers receiving interest at the end of the term is 6.5%/year, receiving monthly interest of 6.3%/year and receiving interest at the beginning of the term is 6.07%/year.

Viet A Bank applies an interest rate of over 6%/year for Dac Tai Savings products. Of which, the 6-month term interest rate is 6.0%/year; 7 months is 6.1%/year; 12 months is 6.5%/year; 13 months is 6.6%/year; 15 months is 6.7%/year and 18 months reach the highest level of 6.8%/year. To participate, customers need to deposit at least 100 million VND and make transactions at the counter, with the form of receiving interest at the end of the term.

Banks with interest rates from 6%

Currently, interest rates above 6%/year are being listed by some banks for long-term deposits, without a minimum deposit requirement.

Vikki Bank applies an interest rate of 6%/year for a 6-month term, 6.2% for a 12-13 month term; Cake by VPBank applies an interest rate of 6%/year for a 12-18 month term and 24-36 months; HDBank applies an interest rate of 6%/year for a 15-month term and 6.1%/year for a 18-month term; BVBank also pays 6.1%/year for a 60-month term and 6.0%/year for a 48-month term. Viet A Bank maintains the only 6.0%/year for the 36-month term; Bac A Bank applies an interest rate of 6.1% for the 18-36 month term.

Statistics of banks with the highest savings interest rates today:

Compare the highest bank interest rates for 3-month terms

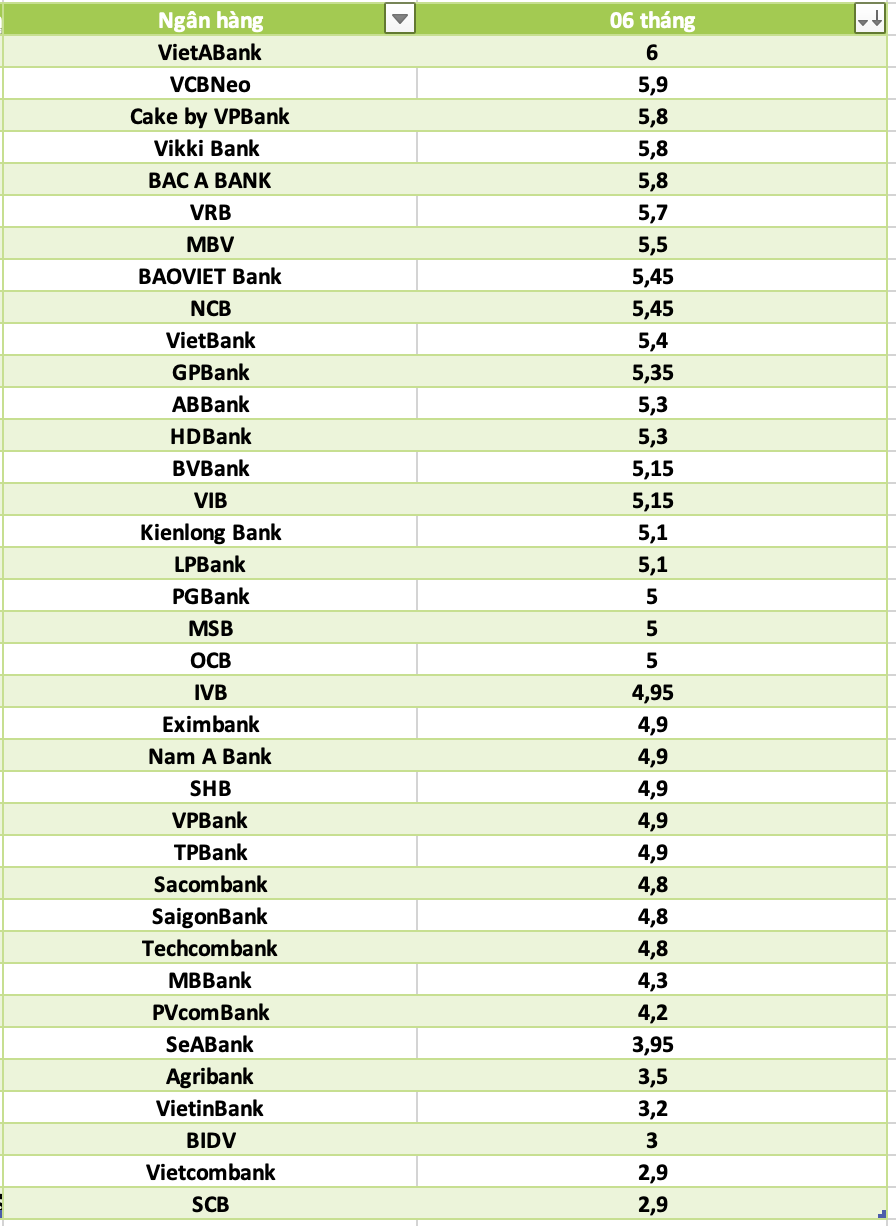

Interest rates for savings deposits at banks for 6-month terms

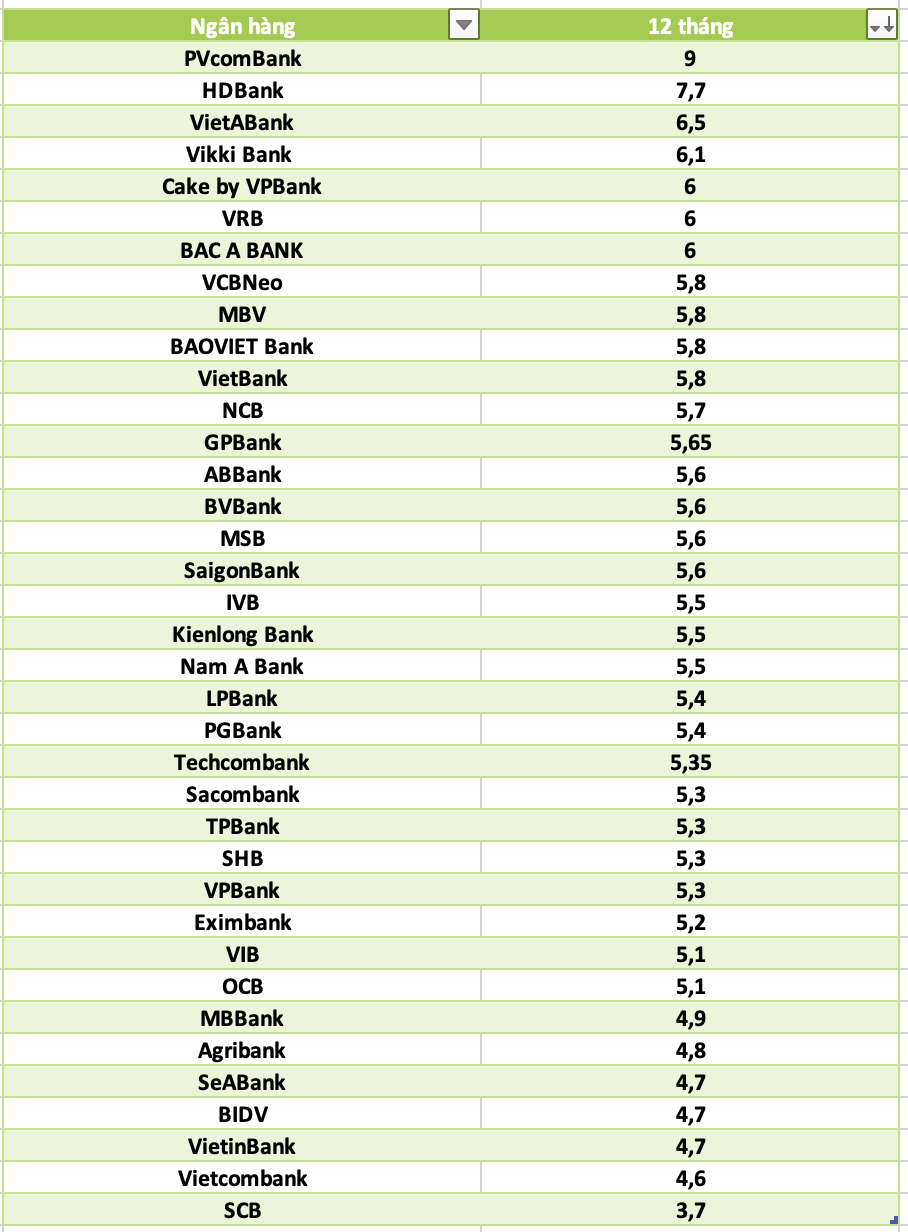

For 12-month savings, which bank has the highest interest rate?

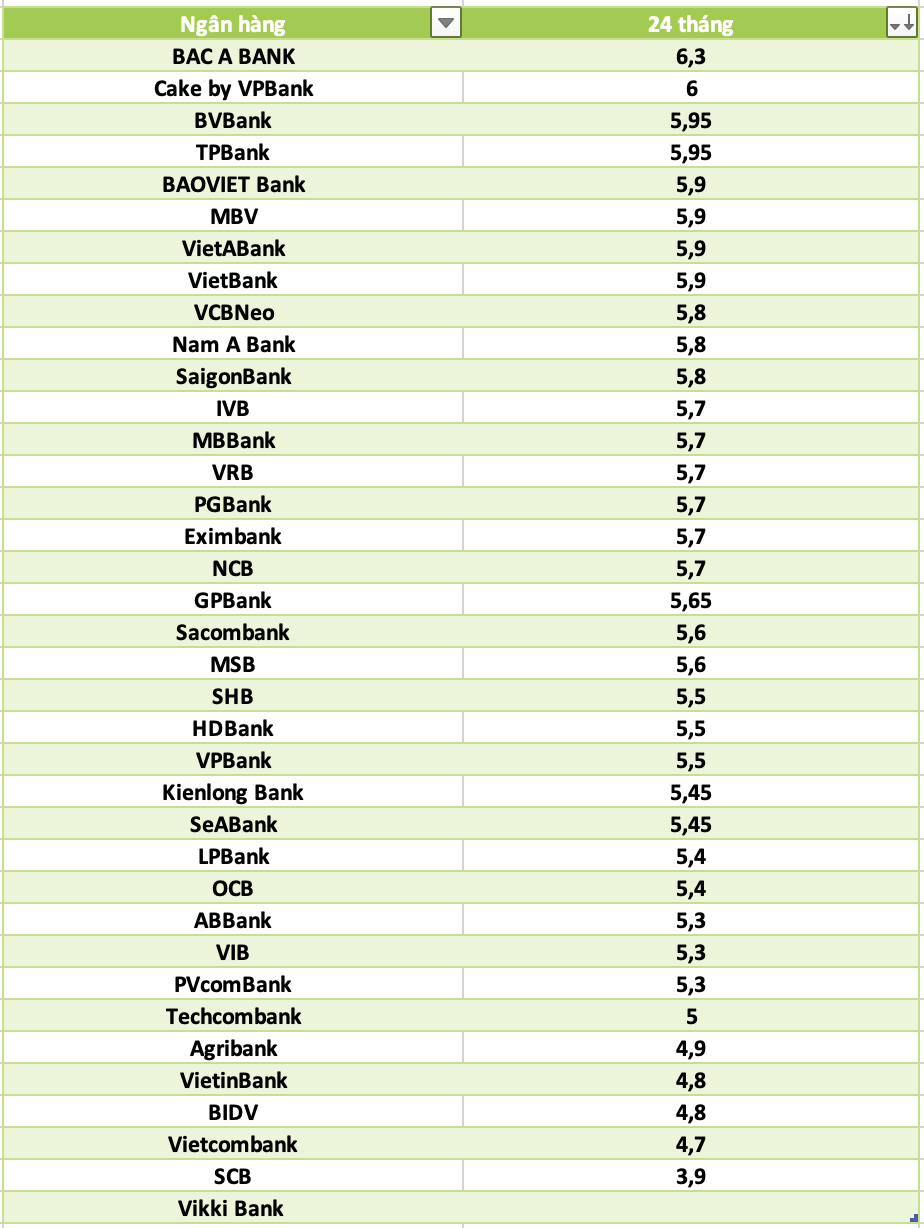

Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... are the highest for a 24-month term.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles on interest rates HERE.