Race to increase interest rates at the end of the year

The slight increase in VND savings interest rates at the end of 2024 reflects the increased capital demand from banks to support production and consumption.

In the group of state-owned commercial banks, 12-month term interest rates ranged from 4.7% - 4.8%/year, while joint-stock commercial banks recorded higher interest rates, reaching 5.4% - 6.25%/year for longer terms.

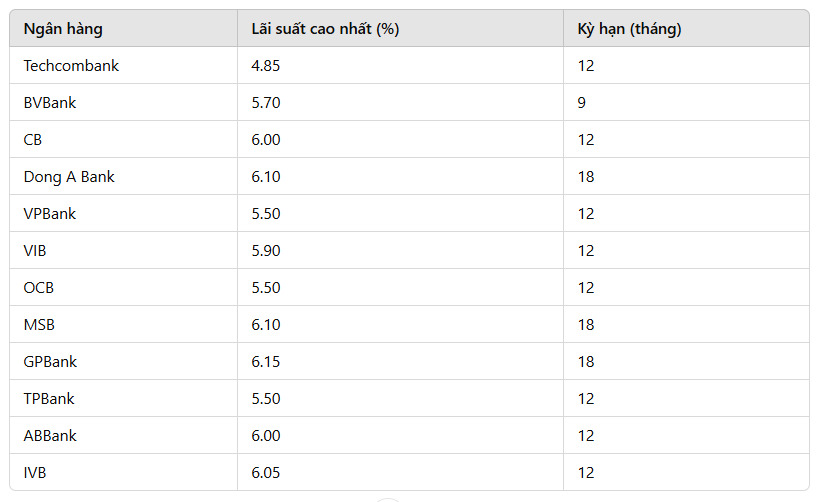

According to statistics, 12 banks have increased deposit interest rates since the beginning of December, including: Techcombank, BVBank, CB, Dong A Bank, VPBank, VIB, OCB, MSB, GPBank, TPBank, ABBank and IVB.

Although interest rates tend to increase, the State Bank still maintains the direction of controlling interest rates at a reasonable level to ensure financial market stability.

Measures such as liquidity support and money supply regulation are applied to reduce inflationary pressure and facilitate businesses and people's access to capital.

It is expected that from now until the end of the year, savings interest rates may increase by 0.5 - 1 percentage point, depending on the term and strategy of each bank.

However, high capital costs and pressure from bad debt continue to be major barriers, limiting the ability to reduce lending rates.

In this context, banks are increasingly optimizing their funding and risk management strategies to ensure long-term financial stability.

Special interest rate series from 7.5%

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.5%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term and 7.5%/year for a 12-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of interest at the beginning of the term or periodic interest.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

In addition, MSB is currently offering a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

See more daily bank interest rate updates HERE.