According to Lao Dong, on January 17, Eximbank continued to increase deposit interest rates at some terms, with the highest rate reaching 0.8%/year, leading the market at many terms under 6 months and 15-36 months.

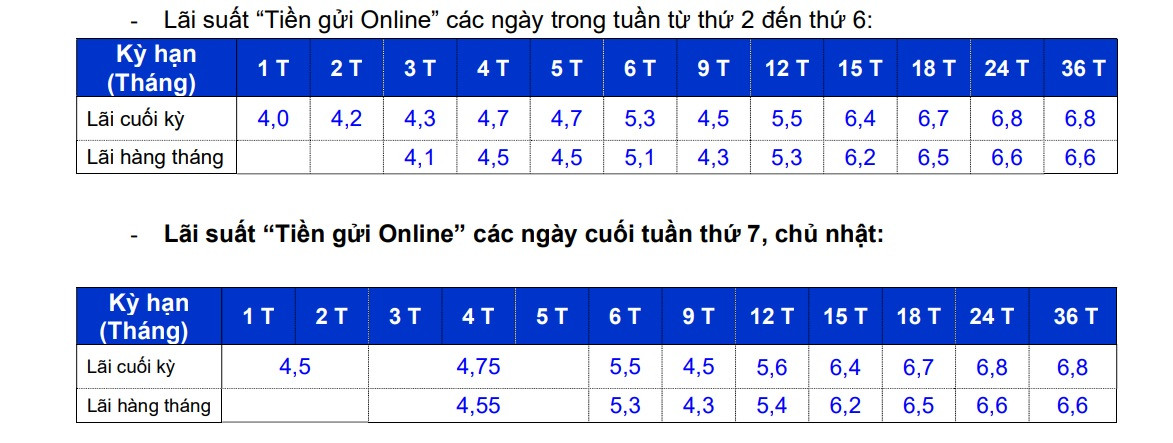

In particular, online savings interest rates for weekends are the highest in the system, with terms of 24-36 months reaching up to 6.8%/year.

Vietcombank Securities Company (VCBS) predicts that interest rates for medium and long-term deposits will increase slightly by 0.2 - 0.3 percentage points by the end of 2024, then remain stable in 2025. Lending interest rates are expected to increase by 0.5 - 0.7% as credit demand increases thanks to economic recovery, especially when businesses begin to expand production and business activities after the period affected by the pandemic.

VCBS believes that the State Bank will continue to maintain a flexible monetary policy to support economic growth while controlling inflation well. Factors such as fiscal policy, fluctuating raw material prices, and the speed of global economic recovery will be the main factors affecting interest rates in 2025.

The government also plans to adopt support policies to minimize the negative impacts of rising interest rates, especially on the manufacturing and export sectors.

Unexpected highest savings interest rate

1 month term:

Eximbank is currently leading with the highest interest rate, reaching 4.5%/year (weekend). Second place is MBV, KienLongBank with 4.3%/year. Bac A Bank and OCB are in third place, applying an interest rate of 4.0%/year.

3 month term:

Eximbank continues to lead with the highest interest rate of 4.75%/year (weekend). MBV ranks second with 4.6%/year. Bac A Bank and NCB rank third, with interest rates of 4.2%/year and 4.3%/year, respectively.

6 month term:

CBBank stands out with the highest interest rate, reaching 5.85%/year, followed by KienLongBank with an interest rate of 5.8%/year. Bac A Bank ranks third with 5.55%/year. MBV and NCB follow, both applying an interest rate of 5.5%/year.

9 month term:

CBBank continues to lead with an interest rate of 5.85%/year. MBV ranks second with 5.6%/year. Bac A Bank ranks third, with an interest rate of 5.45%/year.

12 month term:

MBV and Gpbank are in the lead with an interest rate of 6%/year. Bac A Bank is in second place with 5.8%/year. CBBank is in third place, also with 6.0%/year.

18 month term:

Eximbank leads the long-term with an interest rate of 6.6%/year. Bac A Bank follows with an interest rate of 6.2%/year. MBV, Oceanbank, and KienLongBank are ranked third, with an interest rate of 6.1%/year.