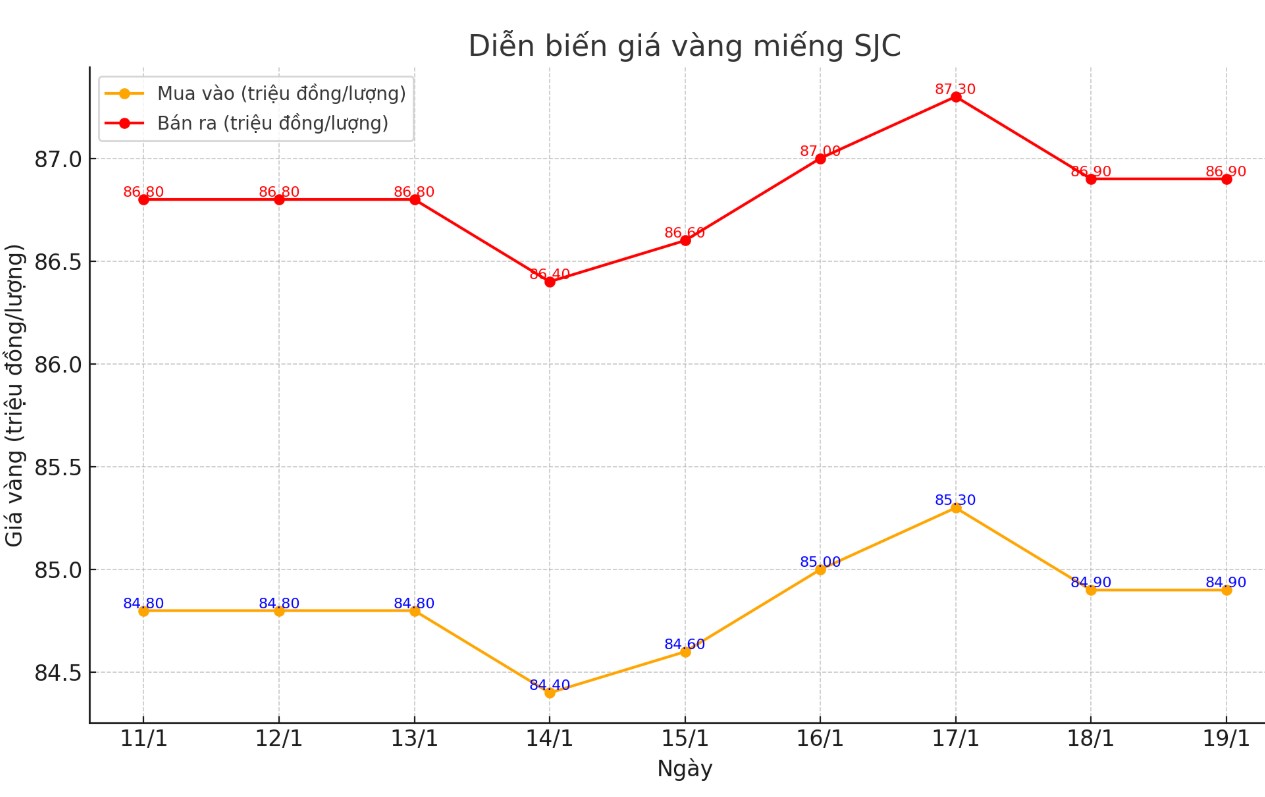

SJC gold bar price

At the end of the week's trading session, DOJI Group listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI increased by 100,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company increased by VND 100,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

If investors buy SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of January 12 and sell it in today's session (January 19), they will lose 1.9 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

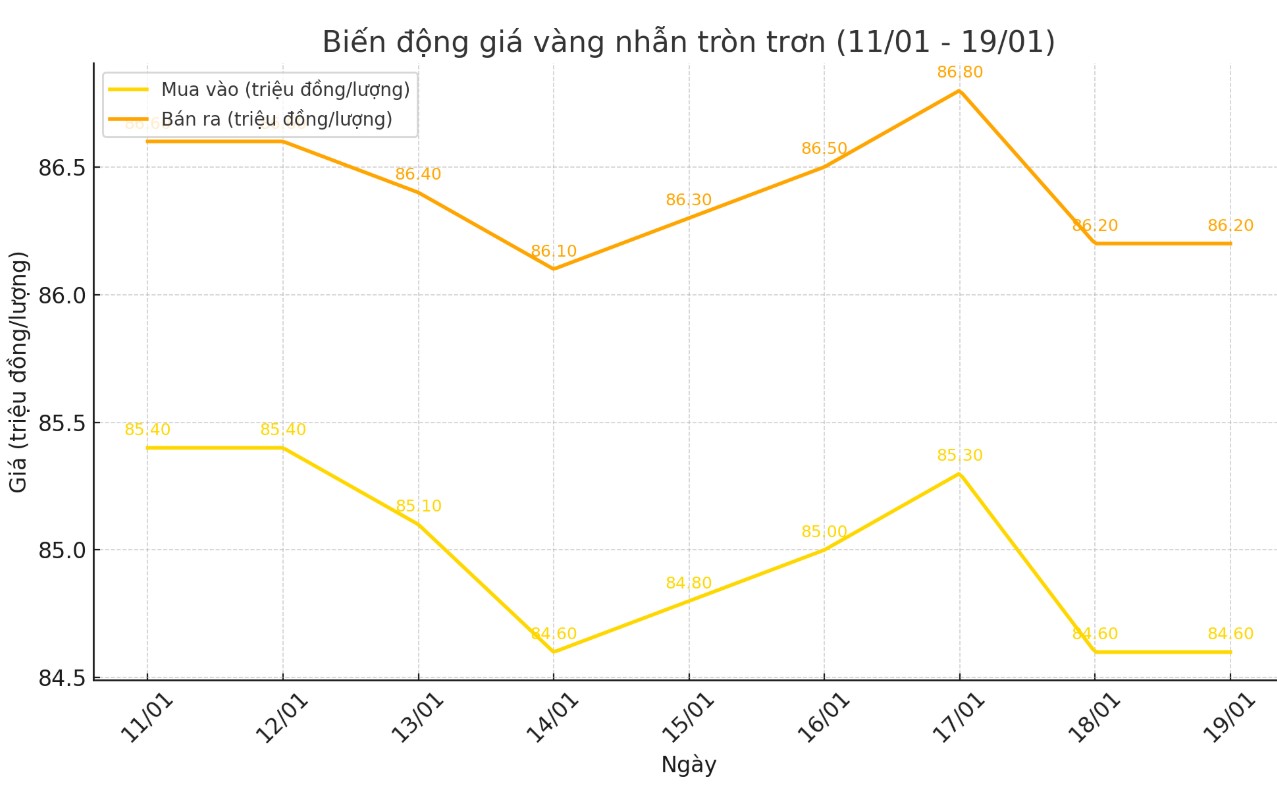

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 84.6-86.2 million VND/tael (buy - sell); down 800,000 VND/tael for buying and down 400,000 VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.9-86.85 million VND/tael (buy - sell); down 600,000 VND/tael for buying and down 50,000 VND/tael for selling compared to the closing price of last week's trading session.

If buying gold rings in session 12.1 and selling in session today (19.1), the loss investors will have to accept when buying at DOJI and Bao Tin Minh Chau is 2 million VND/tael.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

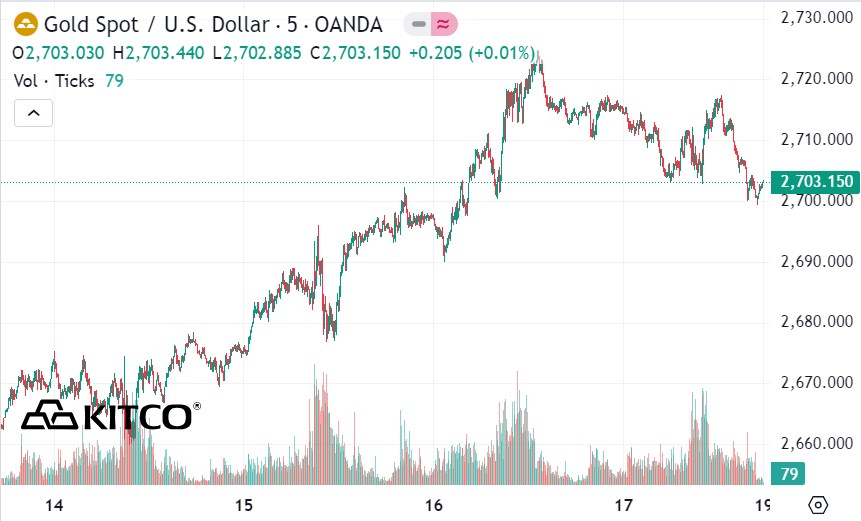

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,703.1 USD/ounce, down 13.8 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices are under pressure this weekend amid an increase in the USD index. Recorded at 7:00 a.m. on January 19, 2025, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,200 points (up 0.35%).

Many experts are giving quite positive comments about gold prices next week. Carsten Fritsch - commodity analyst at Commerzbank - said that gold prices can maintain the current high level.

“Gold prices rose to a one-month high of $2,725 an ounce last week, and are on track for their third consecutive weekly gain. However, the reasons behind the rise have changed.

Initially, the price increase was due to geopolitical uncertainties and increased demand for gold as a safe-haven asset. In recent days, this factor has been reduced as a six-week ceasefire was agreed between Israel and Hamas, which is expected to take effect at the end of the week," said Carsten Fritsch.

“Meanwhile, interest rate expectations have recently returned to the fore. Following weaker-than-expected US inflation data, markets are pricing in several more rate cuts from the US Federal Reserve. This has slowed the dollar’s rally and led to a decline in US bond yields.

However, it is worth noting that the previous appreciation of the USD and the significant increase in yields did not have much impact on the price of gold. Therefore, we can talk about a disproportionate market reaction.

Such periods are not likely to last. We are skeptical that gold prices can sustain current highs. This would require further rate cut expectations, a weaker US dollar and further declines in bond yields," Fritsch added.

“I remain optimistic,” said Michael Moor, founder of Moor Analytics.

“The rally continues into February and will likely decline thereafter,” said Mark Leibovit, publisher of VR Metals/Resource Letter.

See more news related to gold prices HERE...