According to the latest records, some banks are implementing deposit mobilization programs with attractive interest rates of up to 8%/year, attracting the attention of savings customers.

MSB is currently the bank listing an interest rate of 8%/year for a 13-month term, applied to a minimum deposit of VND500 billion from a new savings account or one that is automatically renewed from January 1, 2018. For a 12-month term, this bank applies a rate of 7%/year.

Similarly, HDBank is also implementing interest rates of 8.1%/year for 13-month terms and 7.7%/year for 12-month terms, with the condition that the deposit balance is from 500 billion VND or more.

PVcomBank currently has the highest interest rate in the market, up to 9%/year for a 12-13 month term, but only applies to customers with a deposit balance of VND 2,000 billion or more.

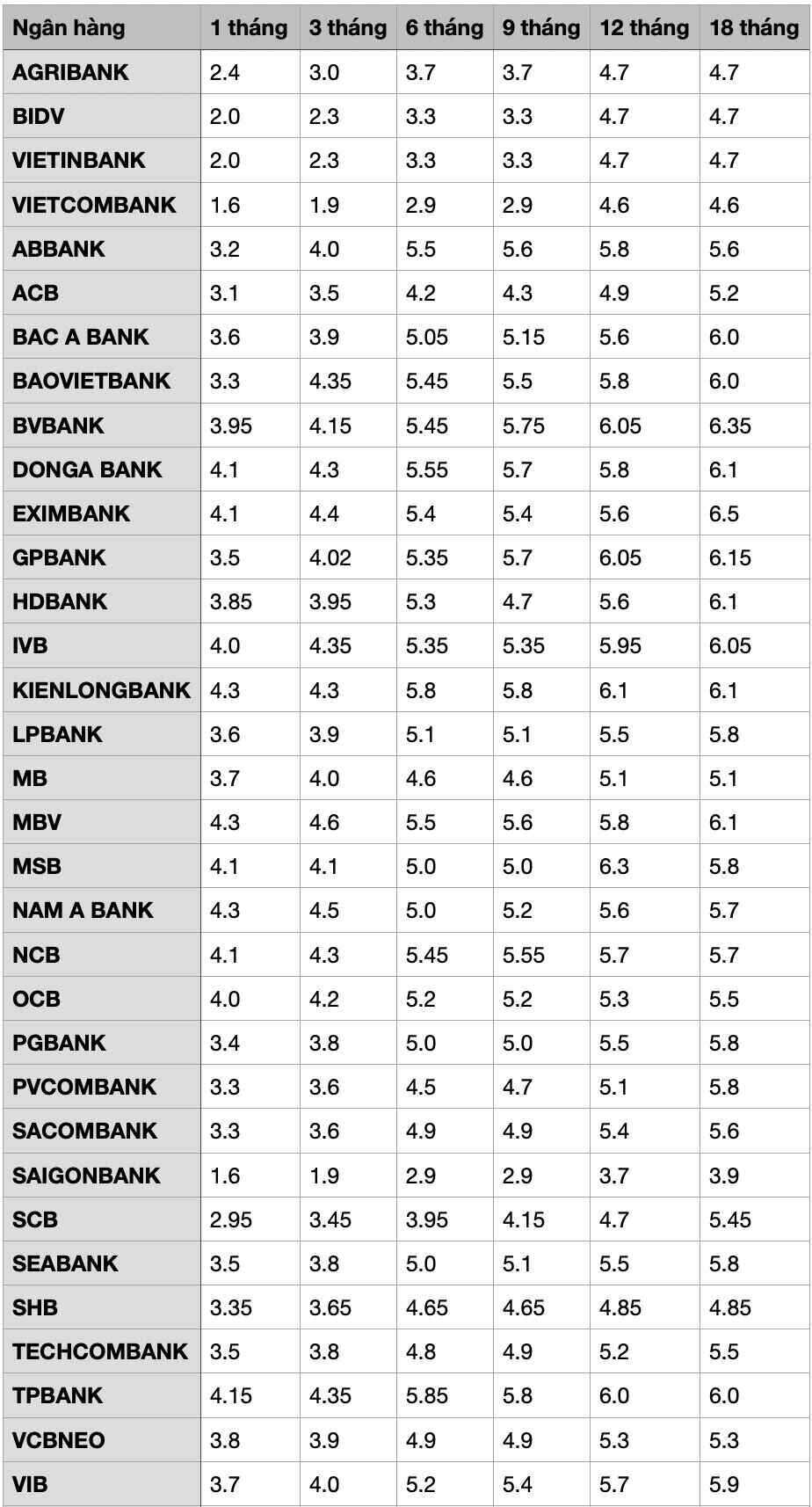

List of banks with the highest interest rates today

Eximbank: Interest rate 6.6%/year for terms of 24-36 months.

KienlongBank: Interest rate 6.4%/year for 60-month term, 6.3%/year for 36-month term, 6.1%/year for 12-24-month term.

IVB: Interest rate 6.45%/year for 5-15 year terms, 6.15%/year for 36 month terms, 6.05%/year for 12 month terms.

GPBank: Interest rate 6.05%/year for 12-month term, 6.15%/year for 13-36 month terms.

In summary, the current high interest rate of over 7%/year mainly applies to large deposits from several hundred to thousands of billions of VND. For smaller deposits, the average interest rate still fluctuates between 5-6.6%/year.

It is forecasted that in the coming time, the interest rate level may continue to fluctuate, depending on the monetary management policy and capital mobilization needs of each bank. Customers who need to deposit savings should update information regularly to choose the appropriate term and bank.