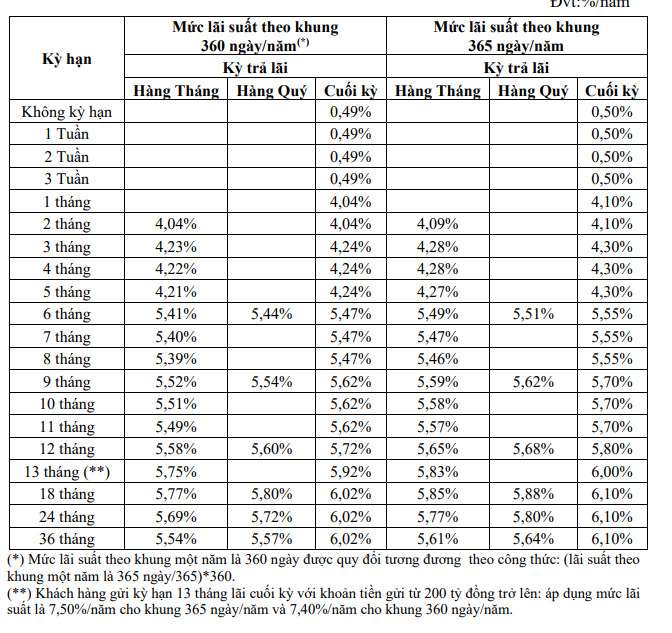

According to Lao Dong on December 9, Bac A Commercial Joint Stock Bank (Bac A Bank) has just made a strong adjustment to reduce interest rates by 0.1-0.15 percentage points for all terms.

Meanwhile, Dong A Commercial Joint Stock Bank (Dong A Bank) increased its deposit interest rate by 0.2%/year for terms of 1-5 months.

Interest rates are expected to continue to rise in the coming time.

Dr. Nguyen Tri Hieu commented that savings interest rates may continue to increase, mainly due to pressure from the USD/VND exchange rate and the need to attract idle capital from banks.

Commercial banks are currently facing liquidity pressure, so raising interest rates has become a solution to balance cash flow and ensure necessary capital. This not only reflects economic recovery but also demonstrates the banks' strategy to attract customers in the context of fierce competition.

VPBankS's research team predicts that interest rates will remain stable or increase slightly in 2025, depending on inflation developments and the State Bank's flexible monetary policy. The differentiation between large and small banks is also expected to become clearer.

Small banks often offer high interest rates to attract deposits from customers, especially in the context of interest rates at large banks not being adjusted strongly. This is an opportunity for customers to consider choosing banks with more competitive interest rates.

For savers, this is a good time to invest idle money in suitable terms, especially long terms, to take advantage of higher interest rates.

However, depositors should pay attention to the possibility of interest rate adjustments in the near future. If interest rates are expected to increase, monitoring the market further before making a decision can help optimize benefits. In addition, choosing a reputable bank that suits your needs is also an important factor to ensure the safety of this financial investment.

Where is the best place to deposit money right now?

For 1-month term, the highest interest rate is 4.1%/year applied at Dong A Bank, followed by OceanBank with 4.05%/year and Bac A Bank with 3.9%/year.

For a 3-month term, the highest interest rate is currently 4.7%/year at Nam A Bank, followed by OceanBank with 4.4%/year and Bac A Bank with 4.2%/year.

For 6-month term, GPBank leads with interest rate of 5.65%/year, followed by Dong A Bank with 5.35%/year and Bac A Bank with 5.15%/year.

For a 9-month term, the highest interest rate is 5.95%/year at IVB, GPBank holds the second position with 5.9%/year, followed by Bac A Bank with 5.25%/year and Dong A Bank with 5.45%/year.

For 12-month term, GPBank still leads with interest rate of 6.25%/year, followed by Bac A Bank with 5.8%/year, equal to Dong A Bank.

For 18-month term, the highest interest rate is 6.35%/year at GPBank. Bac A Bank follows with 6.15%/year, the same level as Dong A Bank, HDBank, and OceanBank.

See more daily bank interest rates HERE.