According to statistics, since the beginning of December, 5 banks have increased interest rates including: MSB, GPBank, TPBank, ABBank, and IVB.

Bank deposit is still a safe choice

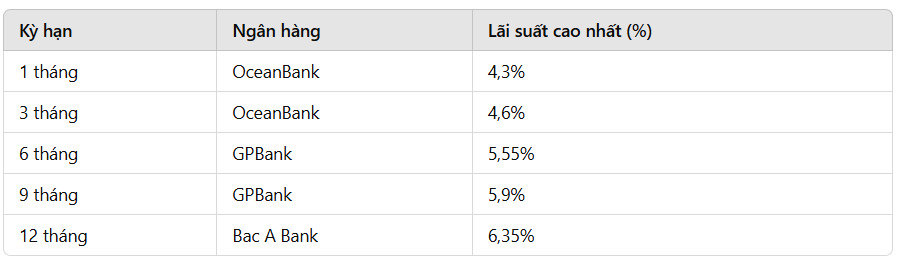

Saving money at the end of the year is a safe and stable choice in the context of many risky investment channels such as real estate or stocks not regaining their attractiveness. Currently, savings interest rates range from 4.7% to 6.5%/year, especially concentrated in long-term terms of 12 months or more, thanks to stable interest rates and consistent with the year-end credit growth trend.

As forecasted, in the second half of 2024, deposit interest rates will increase by 0.5-1% due to high credit demand from businesses expanding production. In addition, interest rate policies are also designed to strengthen the attractiveness of the dong in the context of an upward trend in the USD/VND exchange rate.

However, depositors should note that real interest rates (after deducting inflation) are still low, so the choice of term and bank should be carefully considered. If the US Federal Reserve (Fed) cuts interest rates, the pressure to increase interest rates in Vietnam will decrease, providing more flexible options for depositors.

In general, saving is a suitable option for those who have idle money, especially when prioritizing safety and stable profitability. However, factors such as inflation and exchange rate fluctuations should be considered before deciding.

Which bank has interest rate from 7.0%/year?

Many commercial banks currently list special interest rates ranging from 6.0-9.5%/year with different deposit conditions.

The highest interest rate in the market is 9.5%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed a special interest rate of 7.7%/year for a 12-month term and 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of interest at the beginning of the term or periodic interest.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

See more daily bank interest rate fluctuations HERE.