According to Lao Dong, on December 10, ABBank increased its deposit interest rates for the second time in December, raising the interest rate for 3-5 month terms to 4.45%/year and for 12 month terms to 6%/year.

OCB also adjusted interest rates for terms under 6 months to the highest level of 4.6%/year, while interest rates for the longest term of 36 months reached 5.9%/year.

VIB and VPBank slightly increased interest rates for short and medium terms, with the highest interest rates being 5.4%/year and 5.6%/year, respectively.

Meanwhile, KienLongBank has sharply reduced deposit interest rates for most terms, with the current highest rate being only 5.4%/year for a 60-month term.

Interest rates are expected to rise slightly.

Commercial banks are now facing liquidity pressure, leading to interest rate hikes becoming an important solution to maintain stable cash flow and meet capital needs. This not only reflects the economic recovery but also shows fierce competition in attracting customers.

Dr. Nguyen Tri Hieu assessed that pressure from the USD/VND exchange rate along with the need to mobilize idle capital from banks will continue to be factors pushing up savings interest rates in the coming time.

According to VPBankS's research team, the interest rate trend in 2025 will depend on the State Bank's monetary policy and inflation developments. It is expected that interest rates may stabilize or increase slightly, with a clearer differentiation between large and small banks. Small banks often apply high interest rates to attract deposits, while large banks are less likely to make drastic adjustments.

For savers, choosing long terms during this period can help take advantage of better interest rates. However, it is necessary to closely monitor the market and choose a reputable bank to ensure financial safety and optimize the benefits from the deposit.

Which term deposit and bank is the best?

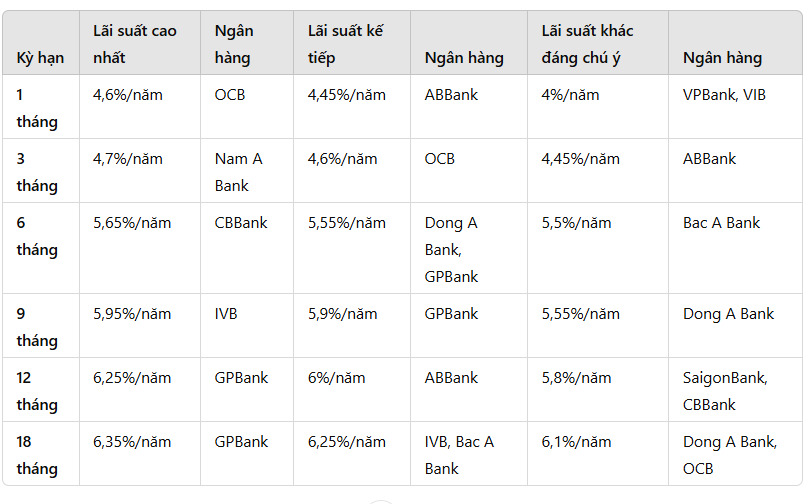

The 1-month term recorded the highest interest rate of 4.6%/year at OCB, surpassing many other banks to top the rankings. ABBank ranked second with an interest rate of 4.45%/year, followed by Nam A Bank with 4.15%/year. This shows the trend of strong competition among banks in attracting short-term deposits.

For the 3-month term, ABBank continues to lead with an interest rate of 4.45%/year. Closely followed by OCB with 4.2%/year and Bac A Bank with 4.05%/year. These interest rate adjustments not only reflect liquidity needs but also show a clear difference between large and small banks.

The 6-month term has a breakthrough when GPBank and ABBank both apply the highest interest rate of 5.8%/year. This is followed by NCB and Dong A Bank with an interest rate of 5.55%/year, while Bac A Bank maintains 5.5%/year. The stability in this medium-term term is an opportunity for depositors to optimize profits from savings.

The 12-month term continues to show GPBank at the top with an interest rate of 6.25%/year, creating a significant gap with its competitors. ABBank and Dong A Bank ranked second with 6%/year. In addition, banks such as SaigonBank, NCB and CBBank maintained the rate of 5.8%/year, showing the uniformity among mid-range banks in providing attractive interest rates.

The 18-month term affirms GPBank's leading position with the highest interest rate in the market, reaching 6.35%/year. ABBank and IVB follow with 6.25%/year. Some other banks such as Dong A Bank, HDBank and OceanBank maintain 6.1%/year.

See more daily bank interest rates HERE.