Virtual headquarters?

As reported in previous articles, SPX shareholders have had difficulty contacting the company's leadership and have not received any information about its financial activities. On December 3, 2024, a reporter from Lao Dong Newspaper and a shareholder went to the 7th floor of Charmvit Building (117 Tran Duy Hung, Hanoi) - the address registered as SPX's head office.

Here, the receptionist of the office complex said that the 7th floor is where the "virtual office" for more than 400 different businesses is located. According to the description, for just a fee of 3.5 million VND/month, businesses can register their headquarters address and if they want a company nameplate, they will have to pay an additional fee.

The reporter and shareholder Le Thi Thanh searched for the nameplate of SPX Investment Joint Stock Company in this small complex. However, after walking around the area in just a few steps, there was no sign of the company's presence.

“I suspected from the beginning that this was a virtual office,” Ms. Thanh said. “If it were a real office, the company should at least have a nameplate or a person in charge to answer shareholders’ questions.”

This is not the first time shareholders have been disappointed. On November 12, 2024, a reporter left contact information at the building’s reception area, but SPX still did not respond. This prolonged silence has made shareholders increasingly concerned about the company’s transparency and operational performance.

Journey of change and expansion

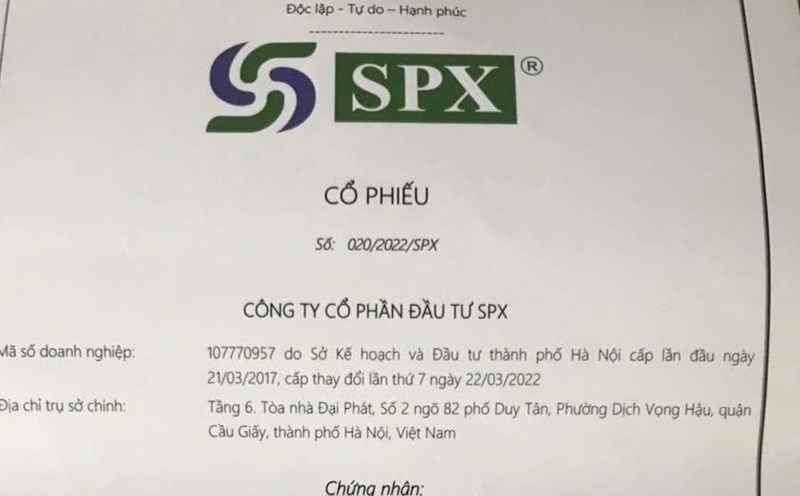

According to the investigation of Lao Dong Newspaper reporters, SPX was established on March 21, 2017 with the original name of K & K Vietnam - Japan Investment and Education Joint Stock Company. At that time, the company operated in the field of education, including foreign language teaching, public speaking skills training and tutoring services. The company's initial charter capital was 2 billion VND.

On December 13, 2021, SPX made a major change when it registered to change its company name to SPX Investment Joint Stock Company. The legal representative was also changed from Mr. Nguyen Tien Thanh (born October 22, 1984) to Mr. Do Hoang Anh (born November 16, 1984), with a permanent address in Me Linh district, Hanoi. The main business line remains education.

Not stopping there, on December 21, 2021, the company continued to register an additional real estate business code, and increased its charter capital to VND 38 billion. This capital is divided into 3.8 million common shares with a par value of VND 10,000/share. The rapid changes within a month have made SPX a company with a much more diverse business line than before.

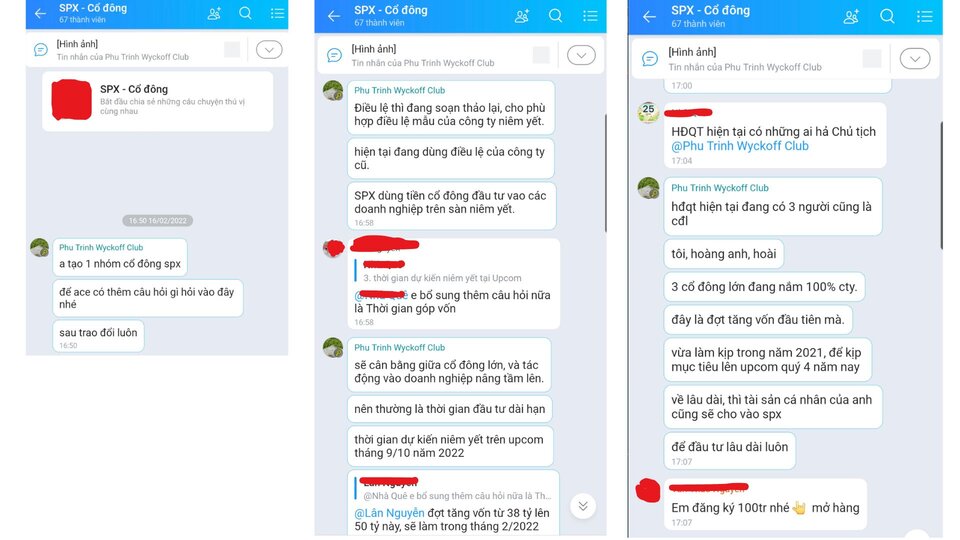

In March 2022, SPX continued to increase its capital to VND 60 billion, and added many other industry codes to expand its operations. However, this was also the time when the company began to call for capital from individual investors as reflected in previous articles. Shareholders were promised listing on the UpCOM floor, high profits and transparency in financial operations. But after nearly 2 years, these promises have not been fulfilled.

Signs that make shareholders worried

SPX has continuously changed its headquarters and legal representative. On December 28, 2023, the company moved its headquarters from No. 2, Lane 82, Duy Tan Street, Dich Vong Hau Ward, Hanoi, to the 7th floor, Charmvit Building. At the same time, the legal representative was changed from Mr. Do Hoang Anh to Mr. Nguyen Tuan Anh (born in 1984, permanent address in Nam Dong Ward, Dong Da District, Hanoi).

These constant changes raise many questions for shareholders. One shareholder expressed: “The company has continuously increased its charter capital in a short period of time, from VND2 billion to VND60 billion in just over a year. However, we have not received any financial reports or detailed explanations on the use of capital. This is something that makes me very concerned.”

In fact, changing business registration, business lines and charter capital is the right of the enterprise.

Dr. Nguyen Nhat Minh (Banking Academy) said: "Changing industries and rapidly increasing charter capital can be a sign of business expansion. However, without financial transparency and specific investment goals, investors need to ask questions to protect their rights."

Given the constant changes and silence from SPX, shareholders are now considering asking for regulatory intervention to clarify the situation.