Attractive commitment from SPX

As reflected in the previous article, Ms. Le Thi Thanh is not the only shareholder who has encountered ambiguities when investing in SPX. According to the petition sent to Lao Dong Newspaper, 11 other shareholders also said that they contributed a total of VND 3.65 billion to the company during the capital increase on March 22, 2022. This capital corresponds to 6.08% of the company's shares at the time of capital increase.

Mr. Do Hoang Anh and Mr. Trinh Duc Phu - two key figures in the SPX board of directors - were described by shareholders as the ones who directly called for capital contributions. In discussions via Zalo group, Mr. Hoang Anh and Mr. Phu continuously made attractive commitments about profits, while affirming that the company would be listed on the UpCOM stock exchange by the end of 2022.

In a text message dated February 16, 2022, Mr. Phu wrote: "Commit to buying back shares if shareholders want to divest." These assertions are reinforced by the prospect of the company operating professionally, with independently audited financial statements and expected annual profits of up to 30%.

Questions about transparency

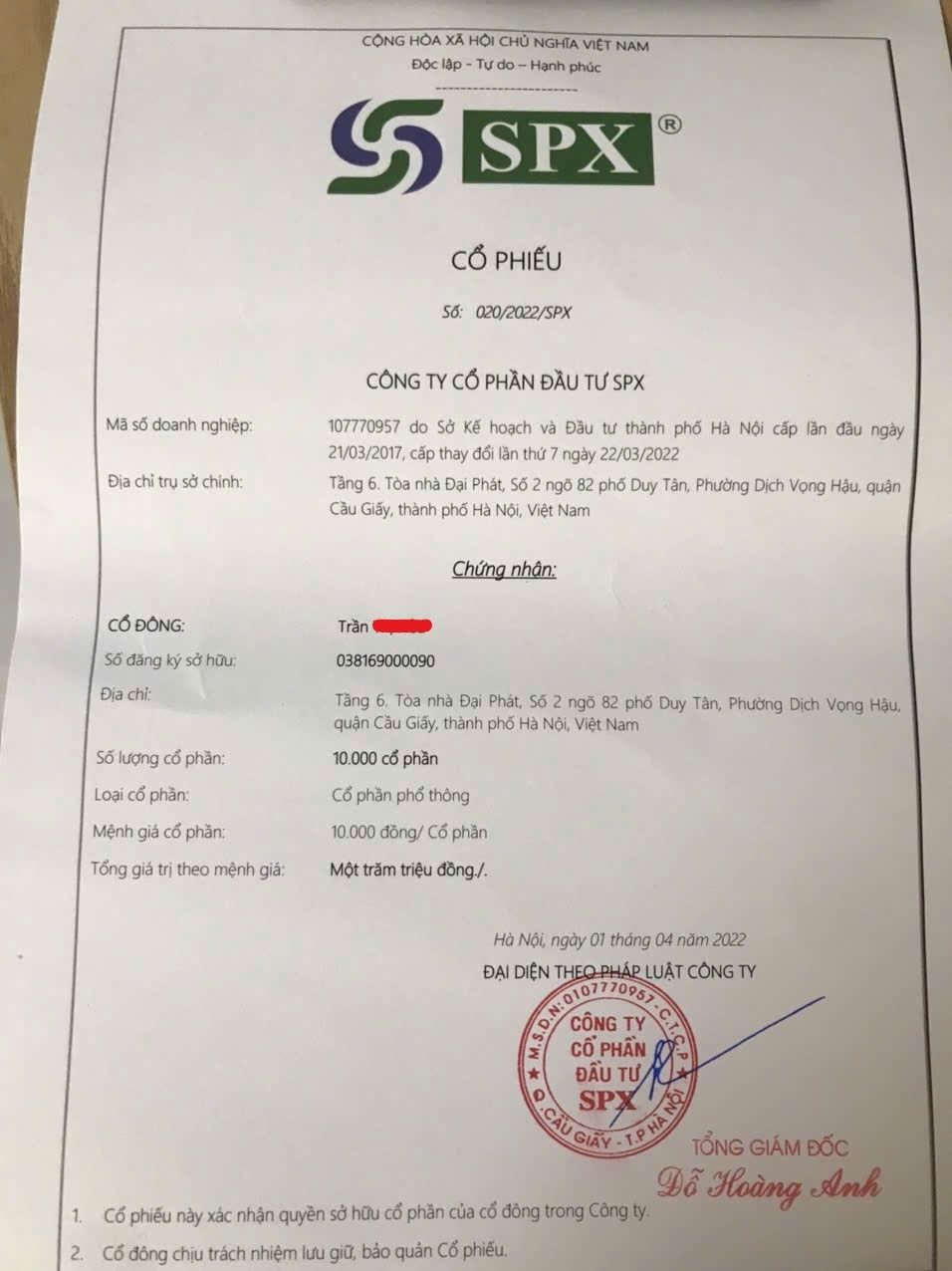

After contributing capital, shareholders, including Ms. Thanh, only received a capital contribution certificate with the company's red seal. However, when comparing with legal documents, some shareholders said that this certificate had no practical value.

“I checked and found that my name was not listed as a shareholder in the company’s business registration certificate. This made me worried about the legality of the investment,” said an anonymous shareholder.

By the end of 2022, when the listing deadline had passed, shareholders began to request information about the company’s financial performance and the organization of its general meeting of shareholders. However, neither Mr. Hoang Anh nor Mr. Phu responded to these requests, raising questions about the transparency of the company’s operations.

Sharing with Lao Dong, Lawyer Tran Van Diep - from the Hanoi Bar Association - said that avoiding, not meeting, not explaining shareholders' questions, not allowing shareholders to exercise their rights is a violation of the provisions of the Enterprise Law on the obligations of business managers.

"If it can be proven that this avoidance behavior comes from the leaders' actions of building and strengthening shareholders' trust with ghost projects, which are not real, and show signs of fraudulent behavior to appropriate the assets of capital contributors, they may also be held criminally responsible for the crime of fraud and appropriation of assets," said Mr. Diep.

Lessons from similar cases

SPX’s case is not unique. Dr. Nguyen Nhat Minh (Banking Academy) said that many businesses take advantage of investors’ lack of knowledge to call for capital contributions without providing full legal documents or transparency about operations.

He compared the SPX case to the Central Warehouse Joint Stock Company, where more than 500 investors were defrauded of more than VND38 billion. “They often use promises of high profits to lure investors, but in reality they are unable to fulfill these commitments,” said Mr. Minh.

Dr. Minh also recommends: “Investors need to request transparency of information, especially legal documents, financial reports and actual business operations. Don't let FOMO influence important decisions."

To date, SPX shareholders are still trying to contact the company to request an explanation. However, with the current information, many people have begun to question the legality and actual effectiveness of this investment.