In a letter sent to Lao Dong Newspaper, Ms. Le Thi Thanh (Hanoi) shared that, without careful research, she contributed 2 billion VND to SPX Investment Joint Stock Company based on her belief in the attractive commitments from the company's leaders.

However, after nearly 2 years, the reality is not as expected. By sending a letter to Lao Dong Newspaper, Ms. Thanh hopes that her story will be a warning to other investors.

Journey of building trust

Ms. Le Thi Thanh (Hanoi) knew Mr. Do Hoang Anh 6 years ago and became close friends through stock investment activities. In 2021, when the stock market grew strongly, Ms. Thanh joined investment groups established by Mr. Hoang Anh via the social network Zalo. The stock codes that he introduced in the group all brought significant profits, helping Ms. Thanh gain more trust.

In February 2022, Mr. Hoang Anh invited Ms. Thanh to contribute capital to SPX Investment Joint Stock Company. According to Ms. Thanh, Mr. Hoang Anh promised: "In the fourth quarter of 2022, the company will be listed on UpCOM, with long-term dividends expected to be about 20-30% per year." Putting her trust in her long-time friend made Ms. Thanh decide to participate without much hesitation.

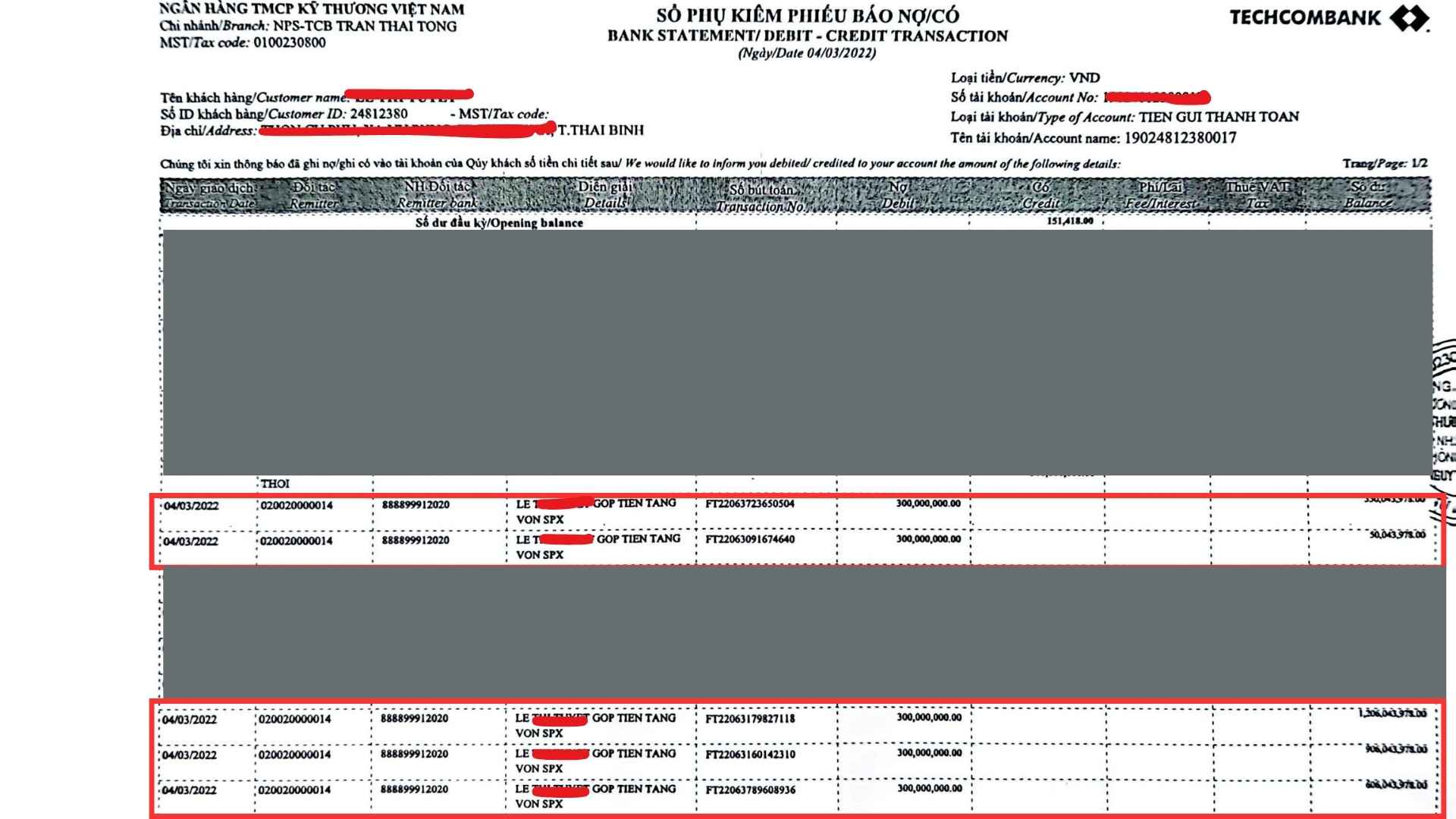

On March 4, 2022, Ms. Thanh made 7 transfers totaling VND 2 billion into SPX’s account. She was then added to the Zalo group “SPX - Shareholders,” where she began to see the appearance of major shareholders that Mr. Hoang Anh had mentioned.

Among them is Mr. Trinh Duc Phu - Chairman of the Board of Directors. Mr. Phu often sends messages in the group, affirming that SPX will become a strong investment company. "My personal assets will also be put into SPX for long-term investment. If shareholders want to sell their shares, I promise to buy them back," - said Mr. Phu.

Questions to clarify

However, by October 2022, the time when SPX was promised to be listed on the UpCOM exchange, Ms. Thanh had not received any information about the company's operations. When contacted, neither Mr. Hoang Anh nor Mr. Phu responded. Promises about profits and financial reports gradually became vague.

Shareholders also questioned the company's failure to hold a General Meeting of Shareholders or publish financial reports or business results, leading to doubts about transparency in operations.

Ms. Thanh shared: “I am very disappointed. When I authorized a lawyer to send questions to Mr. Hoang Anh, I received the answer that contributing 2 billion VND to SPX is just like the stocks I invested in with Hoang Anh, sometimes you win, sometimes you lose."

In this case, Lawyer Tran Van Diep - Hanoi Bar Association - commented: "According to Article 115 of the Enterprise Law 2020, shareholders have the right to request the company to provide financial reports, information on business activities and organize the General Meeting of Shareholders. If these rights are not exercised, the company needs to clarify the reasons to ensure the rights of investors."

Dr. Chau Dinh Linh (Banking University of Ho Chi Minh City) said: "Commitments to a 30% annual profit rate are very difficult to achieve, even for highly efficient businesses. Investors need to carefully check the legality of the business before investing."

To date, Ms. Thanh is still waiting for an answer from SPX. However, questions about the company’s operations and the legality of its initial commitments remain unanswered.

*Character names have been changed upon request