Gold prices fell sharply, marking the first plunge in nearly two weeks, amid the USD appreciating after information that US President Donald Trump's administration is preparing to nominate Kevin Warsh as Chairman of the US Federal Reserve (Fed).

In Friday's session, gold prices at one point fell by 4.8%, although they had previously increased by about 1.4%, extending a series of fierce fluctuations after the record increase was interrupted in the previous session. The USD strength index increased by a maximum of 0.5%, making the precious metal more expensive for most global buyers.

According to Bloomberg, US President Donald Trump is expected to appoint Mr. Kevin Warsh as a candidate for the Fed Chairman position. Mr. Warsh is known for his tough stance on inflation, but in recent months there has been more consensus with President Trump, when he publicly supported interest rate cuts. Mr. Trump said he would announce the nomination decision on Friday morning US time.

The developments of gold confirm the warning lesson'increasing fast, also decreasing fast'," said Christopher Wong, strategist at Oversea-Chinese Banking Corp. According to him, although information about Mr. Warsh's nomination is a direct catalyst for gold prices to fall, a real correction has come to an end. "It's like the excuse that the market is waiting for to untie the parabolic upward momentum," he said.

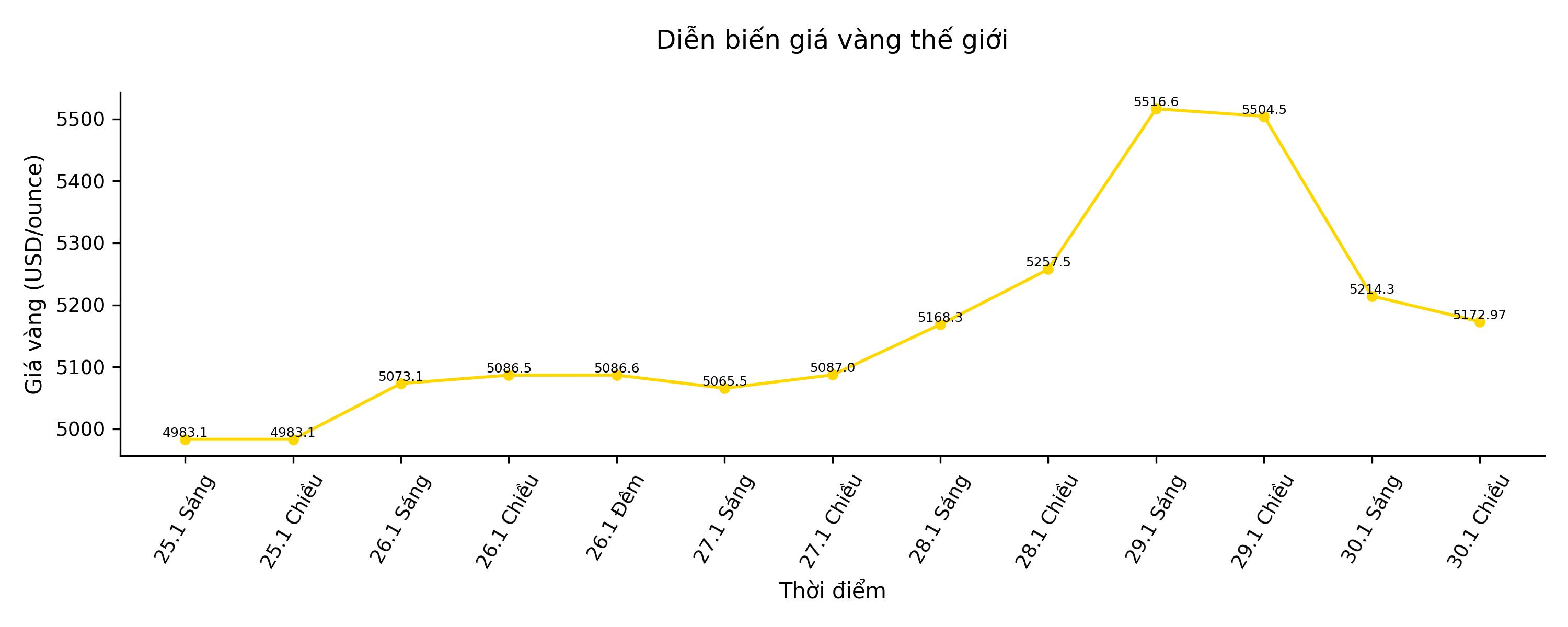

As of this afternoon's trading session, gold prices fell 3.1%, to 5,172.97 USD/ounce. Silver prices plummeted 4.9%, to 110.0425 USD/ounce. The Bloomberg Dollar Spot Index increased 0.3%, although still down about 1% throughout the week. Platinum and palladium also simultaneously declined.