Spot world gold price at 9:31 am on January 30 traded at 5,154.04 USD/ounce, down 151.21 USD, equivalent to 2.90%.

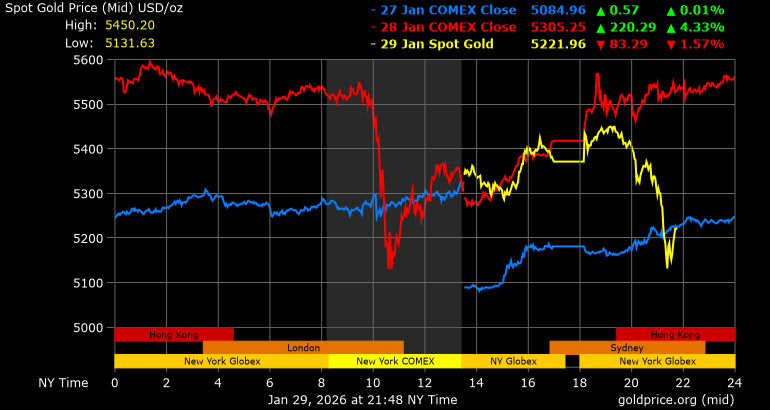

Previously, in the trading session on January 29, world gold prices suddenly plummeted sharply, falling nearly 500 USD/ounce compared to the peak, falling around 5,100 USD/ounce.

The 8.7% plunge of gold has caused the total value of the entire amount of gold estimated to be in circulation in the world to "evaporate" about 3,400 billion USD - a shocking figure even for veteran investors.

The gold price shock coincided with a strong sell-off in the US technology stock market, especially the group associated with artificial intelligence (AI).

Microsoft - the world's largest software company - lost up to 11.9% of its value as soon as the New York market opened, equivalent to hundreds of billions of USD of capitalization blown away, after financial reports showed that the Azure and AI cloud computing segments slowed down.

Oracle also fell 5.4%, while Nvidia lost 2.7% in the opening session, raising concerns that the "AI bubble" may be bursting.

In that context, gold - an asset that is considered a safe haven - cannot stand firm against the wave of fluctuations. According to experts, the reason does not lie in the physical supply and demand factors, but comes from the mutual amplification of price fluctuations and liquidity.

The problem is that volatility is feeding itself" - Mr. Ole Hansen, commodity expert at Saxo Bank, commented after gold and silver continuously peaked and then plummeted.

When prices fluctuate too strongly, market liquidity rapidly thins. Banks and market makers have difficulty managing risks, and when they hesitate to quote large volumes, liquidity weakens further, causing volatility to explode more violently.

This view is also shared by Mr. Simon Biddle, Director of Precious Metals at brokerage firm Tullet Prebon. According to him, banks "do not have an infinite balance sheet" to trade in precious metals in extreme volatility environments, forcing them to reduce risk tolerance. As a result, trading volumes have decreased, making the market even more likely to be shaken strongly with each large sell or purchase.

Trading volume of the world's largest gold ETF - SPDR Gold Trust (GLD) - has skyrocketed, reaching its highest level since the end of October last year, when gold prices first exceeded the $4,000/ounce mark.

On the derivatives market, gold futures contract trading on Comex increased on January 28, after falling from the 3-month high recorded on January 26 - showing that speculative cash flow is moving quickly, seeking opportunities in large fluctuations.

Although the fall of gold caused a shock, many analysts believe that this is not necessarily the end of the long-term upward trend of the precious metal.

Regarding domestic gold prices in the Vietnamese market, as of 9:33 am on January 30, SJC gold bar prices traded at 177.1 - 180.1 million VND/tael (buying - selling).

Bao Tin Minh Chau 9999 gold ring price traded at 177.6 - 180.6 million VND/tael (buying - selling).