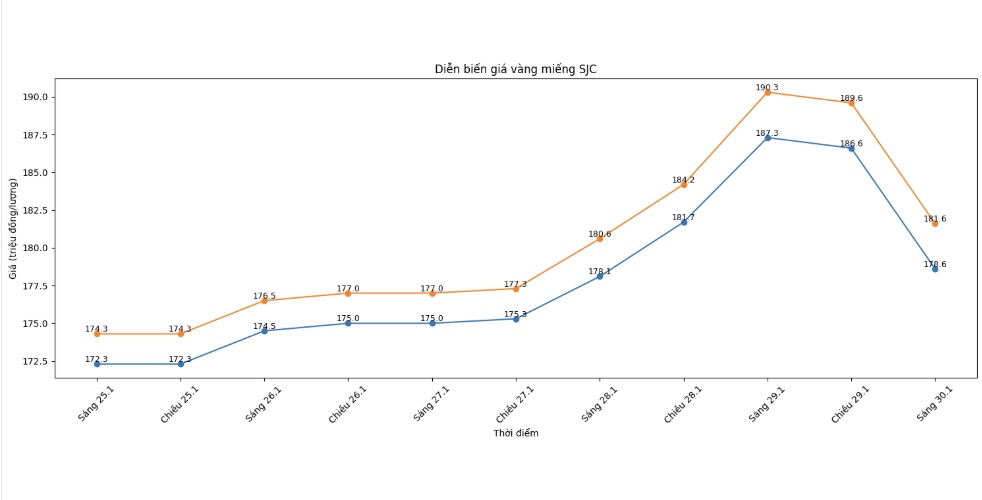

SJC gold bar price

As of 11:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 178.6-181.6 million VND/tael (buying - selling), down 8.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 178.6-181.6 million VND/tael (buying - selling), down 8.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 178.6-181.6 million VND/tael (buying - selling), down 8.7 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

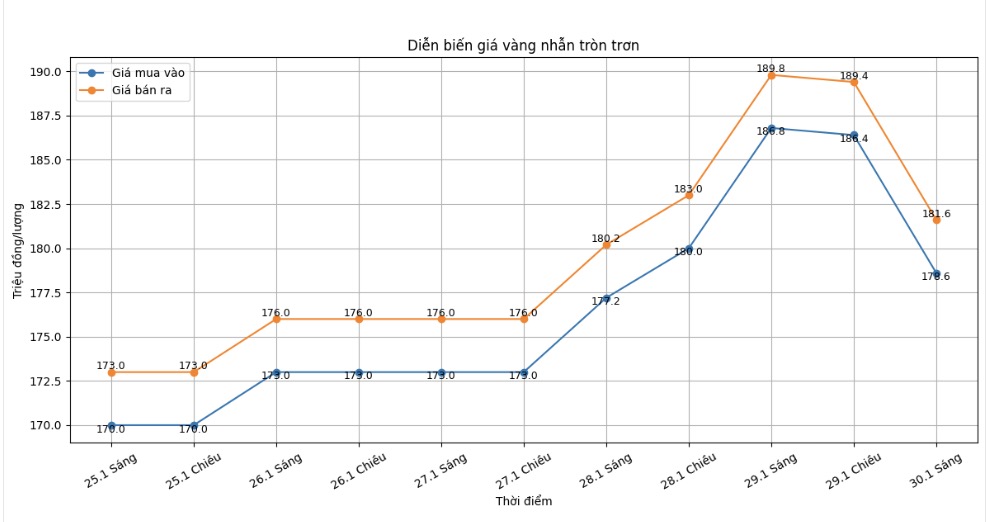

9999 gold ring price

As of 11:00 AM, DOJI Group listed the price of gold rings at the threshold of 178.6-181.6 million VND/tael (buying - selling), down 8.2 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 178.6-181.6 million VND/tael (buying - selling), down 8.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 178.1-181.1 million VND/tael (buying - selling), down 9.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

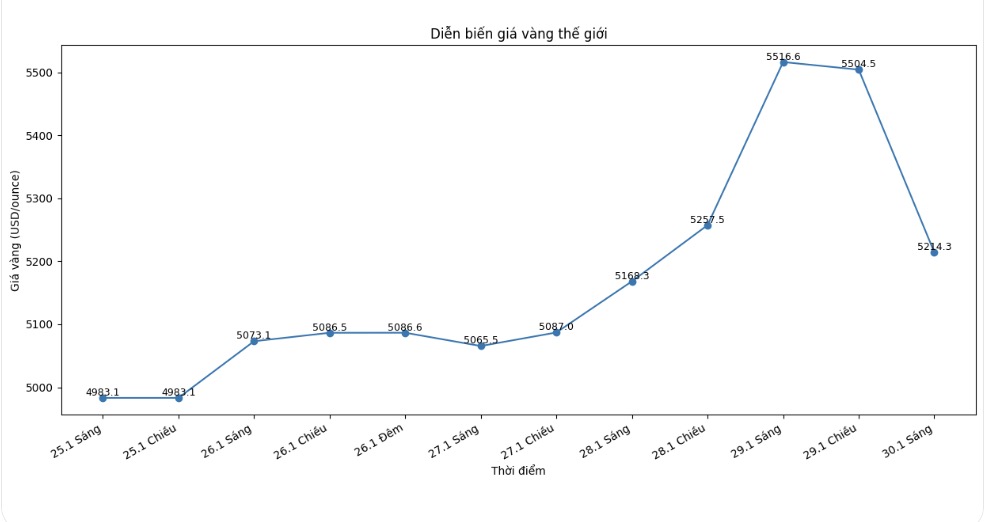

World gold price

At 11:05 AM, world gold prices were listed around the threshold of 5,214.3 USD/ounce, a shocking decrease of 302.3 USD compared to the previous day.

Gold price forecast

According to analysts, the deep decline in gold prices does not reflect the weakening of fundamental factors, but mainly comes from profit-taking activities of futures contract investors after a "hot" rally. Previously, the precious metal was strongly supported by safe-haven demand amid escalating geopolitical tensions and a weakening USD.

Mr. Jim Wyckoff - senior analyst at Kitco, said that gold is sending a technical correction signal after forming a "key reversal" pattern on the daily chart. However, he emphasized that the medium-to-long-term upward trend of gold has not been broken if selling pressure does not continue to increase in the following sessions. "The main trend is still upward, but the market needs time to absorb profit-taking supply after increasing too quickly" - Mr. Wyckoff said.

In the short term, gold prices may continue to fluctuate strongly around important support zones, as cautious sentiment covers the global financial market. Instability surrounding US monetary policy, federal budget issues, and geopolitical developments in the Middle East are still factors likely to trigger major fluctuations of precious metals.

From a broader perspective, many experts believe that the recent strong correction is not enough to reverse the long-term upward trend of gold. Mr. Simon Biddle - Director of Precious Metals at Tullet Prebon, assessed that the too rapid increase in a short time has reduced liquidity, making it easy for the market to fall into a state of "fluttering" when large buying and selling orders appear. However, this also means that gold still holds the role of a safe-haven asset in the context that macroeconomic risks have not cooled down.

In the medium term, analysts believe that gold prices will continue to be supported by concerns about currency devaluation, prolonged geopolitical tensions and expectations that the US Federal Reserve may switch to a more moderate stance. However, investors are advised to be cautious with strong fluctuations in the short term, especially when price differences and adjustment risks are still high.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...