The "cyber Security Student 2025" contest is an annual event chaired by the National Cyber Security Association (NCA), sponsored by the Ministry of Public Security and the Ministry of Education and Training, in coordination with the Department of Cyber Security and High-Tech Crime Prevention and Control (A05). After more than two months of implementation with the participation of 200 teams from domestic and international universities and colleges, the contest entered the final round taking place on November 15, 2025 in Hanoi, gathering the top 20 teams in Group A and the 56 best teams in Group B to compete in the two competitions of attack'Defense and Jeopardy.

In addition to the professional competition, many sideline activities such as Career talk show, Student Festival and Technology experience area were held in parallel at Hanoi Children's Palace, giving thousands of students the opportunity to access new trends, solutions and technologies in the field of cybersecurity.

Within the framework of the event, MoMo brought the Security with MoMo experience corner to the exhibition area. Here, students can directly learn about security solutions developed by MoMo on the AI and big data platform, helping to protect users in each digital financial transaction.

Colonel, Dr. Nguyen Hong Quan - Head of the Department of Data Security and Personal Data Protection - National Cyber Security Association - Director of the Training Center, Department of Cyber Security and High-Tech Crime Prevention (A05), Ministry of Public Security said: "In the context of increasingly sophisticated forms of cyber attacks and high-tech fraud, raising awareness of cybersecurity for students and people is a key factor to build a safe and healthy cyberspace. We appreciate the support of technology enterprises such as MoMo in developing advanced security solutions and joining hands to spread awareness of risk prevention in the digital space.

Mr. Nguyen Ba Diep, Co-founder of MoMo shared: As a digital financial platform serving tens of millions of Vietnamese users, MoMo always considers the safety and security of user information as a core factor for sustainable development.We appreciate the opportunity to accompany the Ministry of Public Security and the Department of Cyber Security & High-Tech Crime Prevention (A05) in their efforts to raise awareness of cybersecurity for students and young people - digital citizens of the future.We hope to contribute to spreading the spirit of vigilance and proactiveness in each transaction, with the community and authorities.

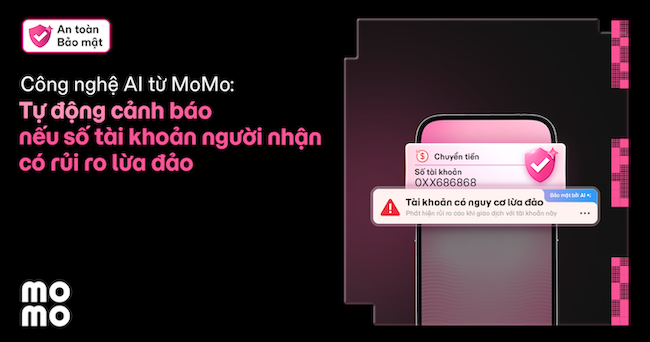

The outstanding features introduced by MoMo at the event are all security solutions that are being widely deployed on the application, demonstrating their continuous efforts in applying artificial intelligence (AI) and Big Data to protect users in the digital financial space.

● Unusual transaction warning system: Each transaction is automatically analyzed by MoMo's system according to hundreds of behavioral variables to identify the risk of users being scammed. When detecting any unusual signs, the system will temporarily block transactions immediately, at the same time send warnings and instruct users to contact the Customer Care hotline for verification.

● Identifying account security: MoMo applies an AI model to analyze transaction behavior and community feedback to assign warning labels:

○ Green leaf: Safety - Account has not recorded risks

○ Gold: Need to consider - Potential risky accounts

○ Red: Risk - Fraudulent risk account

This warning data is compiled from the official source of the state management agency, combined with the risk recipient detection system, helping users proactively assess the reliability before transferring money.

● Smart biometric authentication: In the context of increasingly sophisticated forms of deepfake fraud and identity forgery, MoMo has implemented multi-layered biometric authentication according to the State Bank's Decision 2345/QD-NHNN standard, synchronous with the national database managed by the Ministry of Public Security. In parallel, MoMo also cooperates with iProov (UK) to apply Dynamic Liveness technology, which is capable of distinguishing between real people and images, videos or AI-generated faces, ensuring "right people, right time" in all transactions.