Real estate - the main pillar of the market

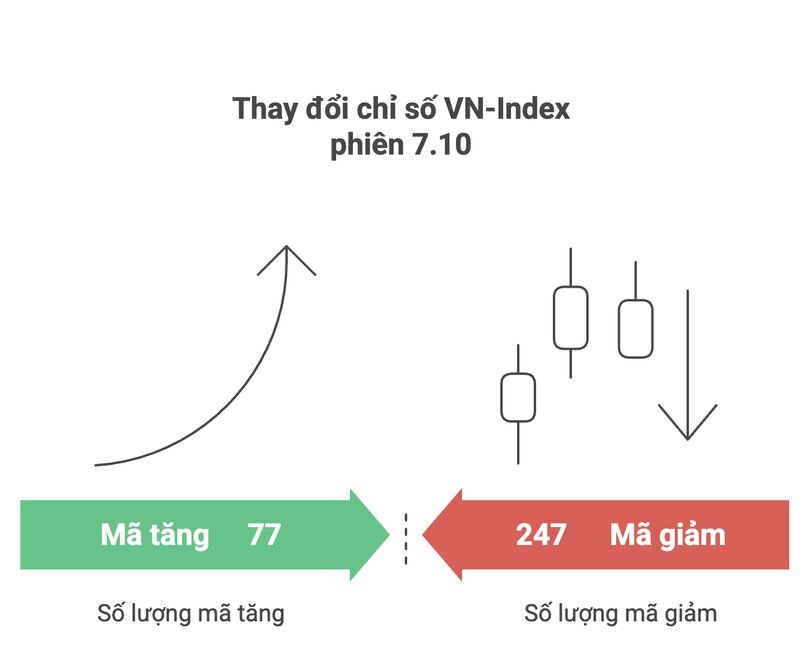

At the end of the trading session on October 7, the stock market was in the red when the VN-Index decreased by 10.20 points (-0.60%) to 1685.30 points. The market width is completely leaning towards the selling side with 247 stocks decreasing, overwhelmingly compared to only 77 stocks increasing. This development shows that selling pressure has spread, as both the banking and real estate groups have decreased in points. This creates a new context, following the deep differentiation story that took place throughout the previous September.

Looking back at September, the market can be summarized in two words "diversification". While most industry groups were in the red, especially the finance - banking group, real estate stocks had an impressive trading month, going against the general trend and becoming the main driving force to help the market not fall deeply.

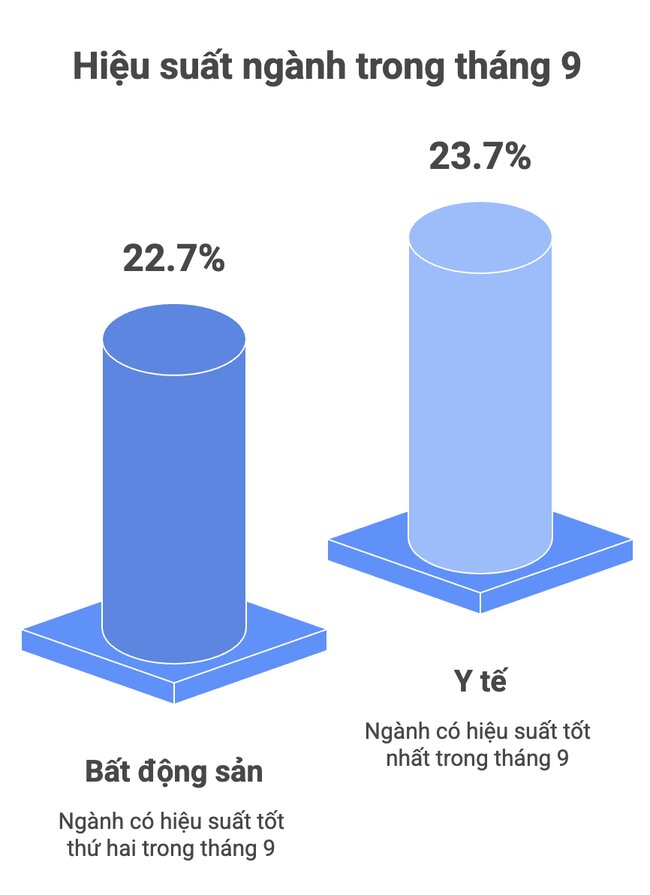

According to the analysis report of Dragon Capital Securities Company (VDSC), the real estate industry is one of the two industries with the best investment performance in September, recording a growth rate of up to 22.7%. This rebound is only behind the medical group (+23.7%).

More importantly, this impressive price increase has turned the real estate group into a solid "support" for the entire market. VDSC's analysis of its contribution to the VN-Index shows that the real estate stocks have contributed a positive 2.6 percentage point to the general index. In other words, if there were no strong rebound from this group of stocks, the decline of the VN-Index could have gone much deeper.

"achilles Heel" named after a bank and financial services

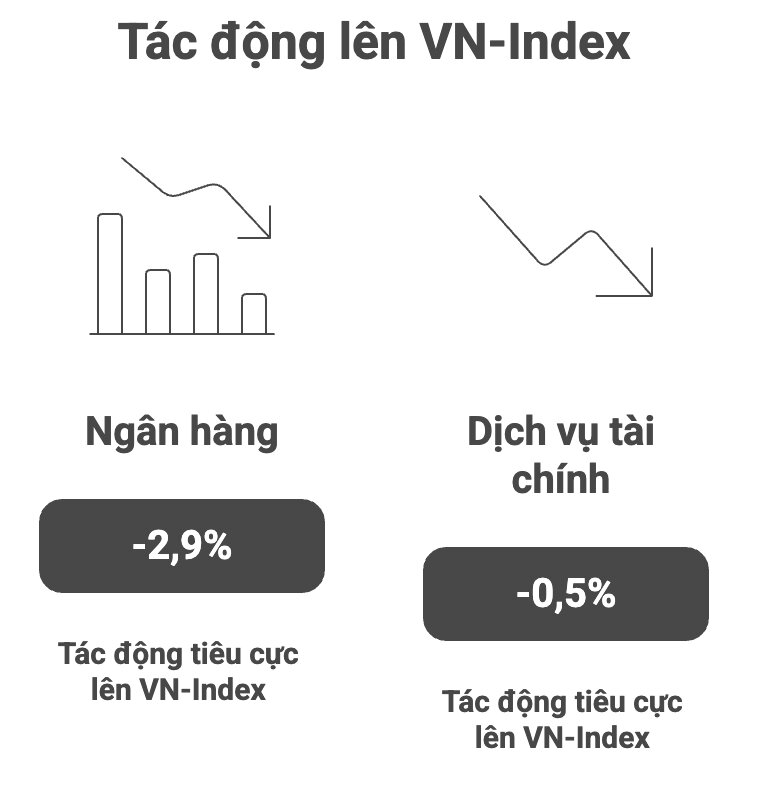

On the other hand, the group of stocks with the largest market capitalization is banks and financial services are the main obstacles. VDSC's report shows that the banking industry had a month of negative transactions with a decrease of 6.0%, while the financial services industry had the strongest decrease with 6.8%.

The decline of these two groups of "king stocks" has had a serious impact on the general index. According to VDSC, the banking group alone has taken away 2.9 percentage points from the VN-Index. The financial services group also contributed a negative 0.5 percentage point. In total, these two industry groups alone have pulled the index back by 3.4 percentage points, much larger than the actual decrease of 1.22% of the VN-Index. This once again affirms the important "carrying" role of the real estate group.

Cash flow weakens even in the group of stocks increasing in price

A noteworthy point is that despite strong price increases, the real estate group still cannot escape the general weakening liquidity trend of the entire market. The average trading value of this group decreased from VND 5,326 billion/session in August to VND 4,004 billion/session in September.

Similarly, the liquidity of the banking group also decreased significantly, from VND 14,178 billion/session to only VND 8,195 billion/session. This shows that although investors are still betting on the potential of real estate stocks, the cautious sentiment and the decline in cash flow are a reality that covered the entire market last month, according to VDSC.